JPMorgan Chase & Co. (JPM)

Why JPMorgan Chase & Co. (JPM) Might be Well Poised for a Surge

JPMorgan Chase & Co. (JPM) shares have started gaining and might continue moving higher in the near term, as indicated by solid earnings estimate revisions.

Here is What to Know Beyond Why JPMorgan Chase & Co. (JPM) is a Trending Stock

Recently, Zacks.com users have been paying close attention to JPMorgan Chase & Co. (JPM). This makes it worthwhile to examine what the stock has in store.

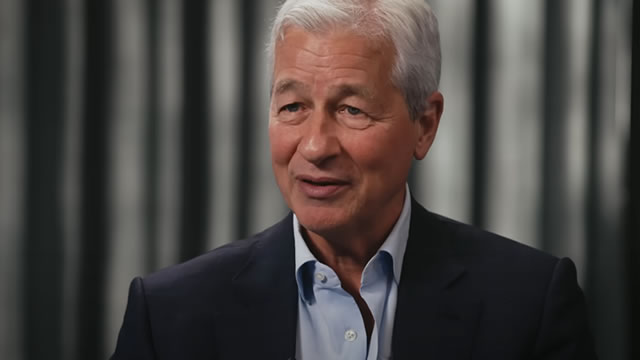

JPMorgan CEO Jamie Dimon on Elon Musk: The guy is our Einstein

JPMorgan Chase chairman and CEO Jamie Dimon joins 'Squawk Box' to discuss the second Trump administration, why he's 'cautiously pessimistic' about the U.S. economy, impact of Trump's tariff proposals and EOs, state of the global markets, impact of the strong dollar, his relationship with Elon Musk, investing landscape, future of DEI in corporate America, his thoughts on the crypto industry, succession plans at JPMorgan, and more.

JPMorgan CEO Jamie Dimon: Growth is the only real solution to reducing deficits and debt

JPMorgan Chase chairman and CEO Jamie Dimon joins 'Squawk Box' to discuss the second Trump administration, why he's 'cautiously pessimistic' about the U.S. economy, impact of Trump's tariff proposals and EOs, state of the global markets, impact of the strong dollar, his relationship with Elon Musk, investing landscape, future of DEI in corporate America, his thoughts on the crypto industry, succession plans at JPMorgan, and more.

What Makes JPMorgan Chase & Co. (JPM) a Strong Momentum Stock: Buy Now?

Does JPMorgan Chase & Co. (JPM) have what it takes to be a top stock pick for momentum investors? Let's find out.

Is JPMorgan Stock a Buy Post Q4 Earnings & Under Trump 2.0 Policies?

Is JPM stock a smart buy after its Q4 earnings report and on potential Trump 2.0 policies? Let's find out.

JPMorgan Exec: Trump Puts Banks Into ‘Go Mode'

American banks are reportedly in “go mode” with Donald Trump's return to the White House. So says Mary Erdoes, head of asset and wealth management for J.P.

Play the “Trump Bump” With These 3 Stocks

Inauguration Day is now upon us, and with a new administration taking hold, investors are placing their bets on where they see the overall market (and specific stocks and sectors) headed over the next four years.

JPMorgan: Q4 Earnings, Consolidated Environment For Loan Growth

JPMorgan Chase exceeded Q4 expectations with $1.21 billion higher revenue and GAAP EPS of $4.81, showcasing robust economic performance. The steepening yield curve and higher loan volumes led JPMorgan to provide an optimistic NII guidance of $94 billion for FY 25. Despite a slight overvaluation, JPMorgan remains a "buy" due to strong return on tangible common equity and potential regulatory easing.

JPMorgan Reports Bounce in Credit and Debit Sales on ‘Healthy' Consumer Spending

J.P. Morgan Chase's fourth-quarter earnings results showed continued momentum in consumer spending, with increased credit and debit card use. Consumers also drew down their deposit account balances.

JPMorgan Chase & Co. (JPM) Q4 2024 Earnings Call Transcript

JPMorgan Chase & Co. (NYSE:JPM ) Q4 2024 Earnings Conference Call January 15, 2025 8:30 AM ET Company Participants Jeremy Barnum - CFO Jamie Dimon - Chairman and CEO Conference Call Participants John McDonald - Truist Securities Mike Mayo - Wells Fargo Securities Jim Mitchell - Seaport Global Securities Erika Najarian - UBS Matt O'Connor - Deutsche Bank Betsy Graseck - Morgan Stanley Ebrahim Poonawala - Bank of America Merrill Lynch Gerard Cassidy - RBC Capital Markets Operator Good morning, ladies and gentlemen. Welcome to JPMorgan Chase's Fourth Quarter 2024 Earnings Call.

JPM's Q4 Earnings Beat on Solid IB & Trading, NII Down on Lower Rates

A strong rebound in IB business, robust trading performance and a fall in provisions support JPMorgan's Q4 earnings. Relatively lower interest rates hurt NII.