JPMorgan Chase & Co. (JPM)

Wall Street chip stocks set for solid Q3 - JPM

JPMorgan is expecting a solid Q3 reporting season for semiconductor companies, driven by AI demand and ongoing cyclical recovery. The American investment bank, in a note, said it anticipates results to be in line or slightly ahead of expectations, with positive momentum likely to continue into year-end.

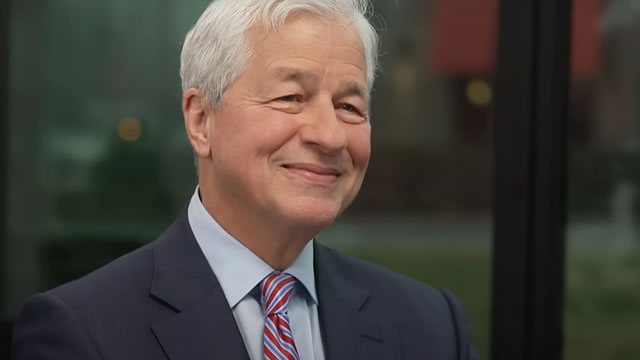

JPMorgan's Jamie Dimon is ‘far more worried' about potential stock market fall than most of Wall Street

The head of America's largest bank said he was "far more worried" about a possible stock market downturn than some of his rivals; he predicted it would come within the next six months to two years.

JPMorgan Chase & Co. (JPM) Stock Drops Despite Market Gains: Important Facts to Note

In the latest trading session, JPMorgan Chase & Co. (JPM) closed at $304.03, marking a -1.19% move from the previous day.

Jamie Dimon Says Recession ‘Could Happen in 2026'

JPMorgan Chase CEO Jamie Dimon declined to rule out the possibility of a recession in 2026, saying Tuesday (Oct. 7) that he will “hope for the best, plan for the worst.

Why JPMorgan's Rising Stock Defies Traditional Valuations And Jamie Dimon's Own Advice

“I want to make it really clear, OK? We're not going to buy back a lot of stock at these prices,” said billionaire JPMorgan Chase CEO Jamie Dimon during the bank's annual meeting in May of 2024.

JPM or MS: Which IB Stock to Buy Amid Optimistic Industry Prospects?

When it comes to Wall Street heavyweights, few names wield more influence than JPMorgan JPM and Morgan Stanley MS. These financial powerhouses stand as cornerstones of global finance, boasting deep expertise in investment banking, from advising on multibillion-dollar mergers and underwriting marquee IPOs to steering clients through the intricacies of global capital markets.

JPMorgan Chase & Co. (JPM) Stock Falls Amid Market Uptick: What Investors Need to Know

JPMorgan Chase & Co. (JPM) reached $310.71 at the closing of the latest trading day, reflecting a -1.5% change compared to its last close.

Why JPMorgan Chase & Co. (JPM) is Poised to Beat Earnings Estimates Again

JPMorgan Chase & Co. (JPM) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

JPM Shares Q3 Capital Markets Outlook: A Catalyst for Revenue Growth?

JPMorgan's capital markets fees, driven by solid IB pipelines, strong trading momentum, and rising M&A activity, are likely to fuel Q3 revenue growth.

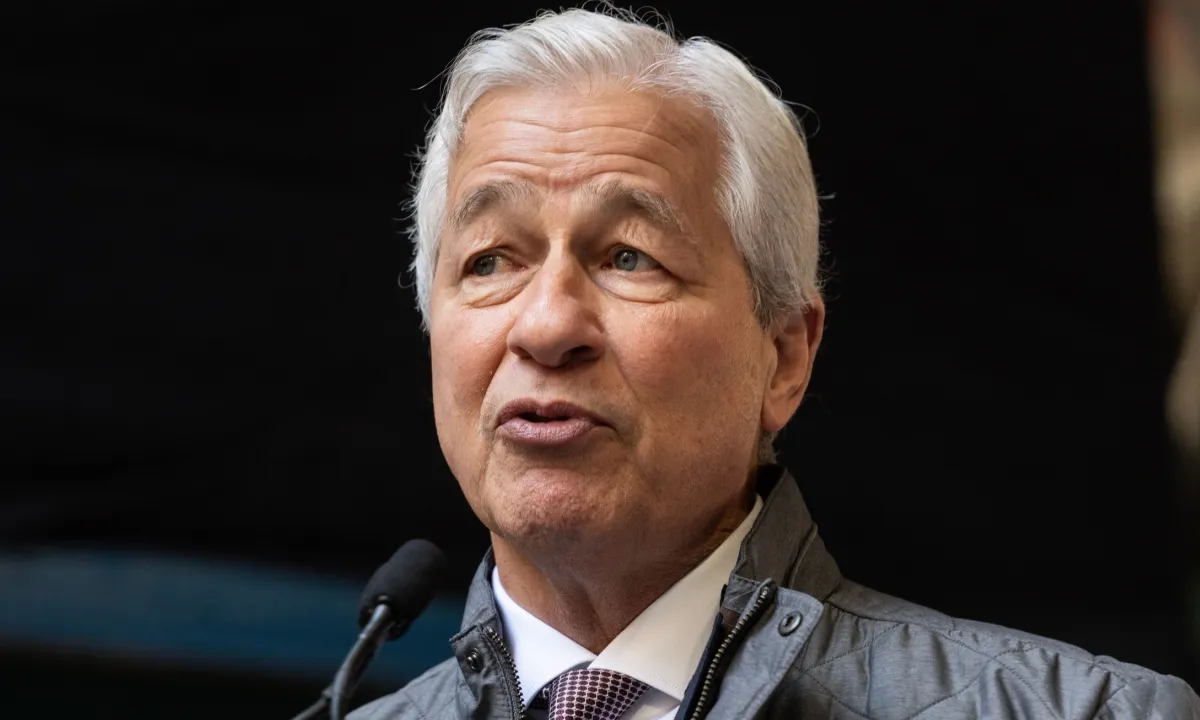

JPMorgan CEO Dimon Warns of Slowing Economy

JPMorgan Chase CEO Jamie Dimon sounded a warning on Tuesday (Sept. 9) after the latest labor market data showed the U.S. economy slowing.

JPMorgan CEO Jamie Dimon says the economy 'is weakening'

JPMorgan CEO Jamie Dimon says the economy 'is weakening'

JPM's German Digital Banking Push to Boost its Long-Term Digital Play?

JPMorgan's planned launch of a digital bank in Germany signals a bold, capital???light push to scale its European retail footprint beyond the U.K.