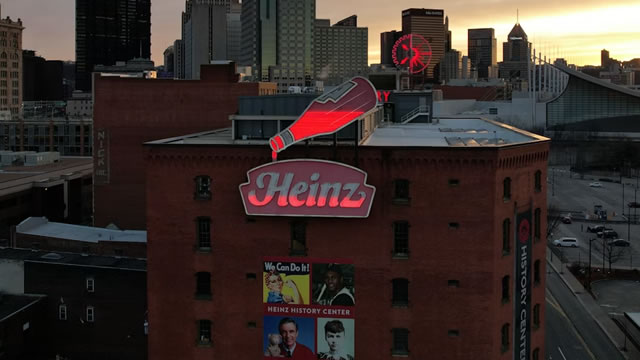

The Kraft Heinz Company (KHC)

Here's Why Kraft Heinz (KHC) Gained But Lagged the Market Today

In the latest trading session, Kraft Heinz (KHC) closed at $29.48, marking a +0.72% move from the previous day.

These Dividend Stocks Fell Between 1% and 20% in 2024. Here's Why They Are Too Cheap to Ignore and Worth Buying in 2025.

2024 was a phenomenal year for broader indexes like the S&P 500 and Nasdaq Composite. But not all stocks joined the party.

Retiree Looking For Income? Consider These 2 High Yields

Kraft Heinz and Verizon offer attractive yields of 5.3% and 6.9%, making them ideal for retirees seeking stable income amid market volatility. Both stocks are undervalued, trading at less than 10x earnings, with well-covered dividends and strong cash flows, ensuring reliability. Market reactions to tariff threats and regulatory changes have created better entry points for these stocks, enhancing their long-term investment appeal.

Kraft Heinz (KHC) Ascends But Remains Behind Market: Some Facts to Note

In the latest trading session, Kraft Heinz (KHC) closed at $28.73, marking a +0.07% move from the previous day.

Kraft Heinz Stock Hasn't Been This Cheap Since 2020: Is Now the Time to Buy?

Kraft Heinz (KHC -0.24%) is a top consumer company with many popular brands in its portfolio. In addition to Kraft and Heinz, it also has Oscar Mayer, Jell-O, Lunchables, and many other staples that people buy every month.

How to Play Kraft Heinz Stock After a 19% Decline in 3 Months?

KHC is facing challenges, including weak consumer demand, cost pressures and declining volumes, which have led to a dismal performance.

Kraft Heinz: More Berkshire-Like And Less 3G-Like Make It A Buy

We have upgraded Kraft Heinz to a buy due to an improved return on equity picture and a valuation that does not reflect the improvement. Key drivers include increasing operating margins, reduced debt, and strategic divestitures to focus on higher-return businesses. Risks include potential further asset write-downs and the possibility that increased R&D spending doesn't stimulate growth.

Could Buying Kraft Heinz Stock Today Set You Up for Life?

Every investment decision you make, even holding cash, requires making trade-offs. That's an important fact to keep in mind when looking at a company like Kraft Heinz (KHC -3.88%).

Kraft Heinz (KHC) Stock Slides as Market Rises: Facts to Know Before You Trade

The latest trading day saw Kraft Heinz (KHC) settling at $29.66, representing a -0.37% change from its previous close.

Kraft Heinz (KHC) Stock Dips While Market Gains: Key Facts

The latest trading day saw Kraft Heinz (KHC) settling at $29.66, representing a -0.37% change from its previous close.

Is 2025 the Year to Buy Warren Buffett's 3 Worst-Performing Stocks of the Past Decade?

Warren Buffett will likely go down as the greatest investor of all time -- and he recently proved just how good he is even at 94 years old. In a last-minute comeback, Buffett's company Berkshire Hathaway beat the broader benchmark S&P 500 yet again in 2024.

High-Yield Kraft Heinz Stock Was a Big Letdown in 2024. Could 2025 Be Any Better?

The biggest attraction of Kraft Heinz (KHC -0.52%) as 2025 gets underway is most likely its lofty 5.2% dividend yield. The average consumer staples company is yielding just 2.5%, less than half as much.