The Kraft Heinz Company (KHC)

Warren Buffett Makes Another Chess Move

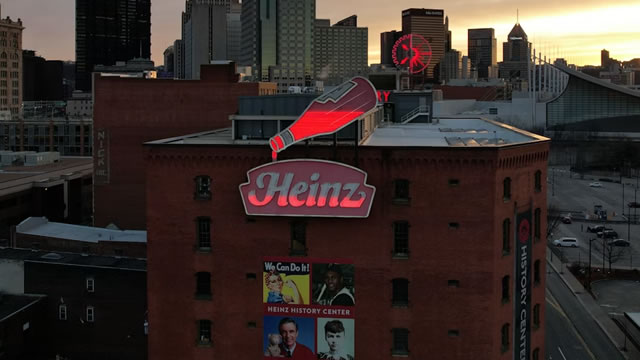

Kraft Heinz (NASDAQ: KHC) is reportedly preparing to split into two or possibly three businesses, separating high-margin consumer staples like condiments and mac & cheese from lower-margin grocery and meat segments.

Will Kraft Heinz (KHC) Beat Estimates Again in Its Next Earnings Report?

Kraft Heinz (KHC) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

Kraft Heinz Evaluating Potential Spin-Off Of A Grocery Business

Deal OverviewAccording to media publications on July 11, 2025, The Kraft Heinz Company (NASDAQ: KHC, $27.58, Market Capitalization: $32.64 billion), a leading global packaged food company, is contemplating spinning-off its grocery business while retaining its high growth condiments and sauces segment. As per market estimates, the spin-off entity would command a valuation $20 billion, on favorable turnaround of business prospects.

Kraft Heinz (KHC) Rises Higher Than Market: Key Facts

Kraft Heinz (KHC) closed at $27.58 in the latest trading session, marking a +1.7% move from the prior day.

As Kraft Heinz reportedly weighs split, analysts say more food companies need to break up

TD Cowen analysts say food-industry megamergers haven't worked.

Kraft Heinz could be splitting up in a deal worth nearly $20 billion

Kraft Heinz is studying a potential spin off of a large chunk of its grocery business, including many Kraft products, into a new entity that could be valued at as much as $20 billion on its own, a source familiar with the matter said on Friday.

Kraft Heinz (KHC) Ascends While Market Falls: Some Facts to Note

Kraft Heinz (KHC) closed the most recent trading day at $27.14, moving +2.53% from the previous trading session.

Kraft Heinz considers breakup amid sluggish sales, changing consumer preferences: report

The company is said to be mulling the creation of a new entity that would include many Kraft products and could be valued at as much as $20 billion.

Kraft-Heinz's stock jumps after report of breakup plan

Kraft Heinz's stock jumps after a WSJ report that the packaged food giant is planning a breakup, 10 years after the Kraft-Heinz megamerger.

Kraft Heinz Stock Rises After Report of a Possible Break-Up

Kraft Heinz is planning a break-up, according to a report, a move that could undo a massive merger just a decade old.

Kraft Heinz Is Eyeing a Big Breakup

Kraft Heinz shares have underperformed since its megamerger a decade ago and changing consumer tastes have hampered results.

Warren Buffett Owns 4 of Our Favorite 4th of July Dividend Stocks

If there is any holiday celebrated in the United States that is among the favorites of all citizens, it must be the 4th of July.