Kraken Robotics Inc. (KRKNF)

Kraken Robotics: The Deep Tech Defense Play Most Investors Are Missing

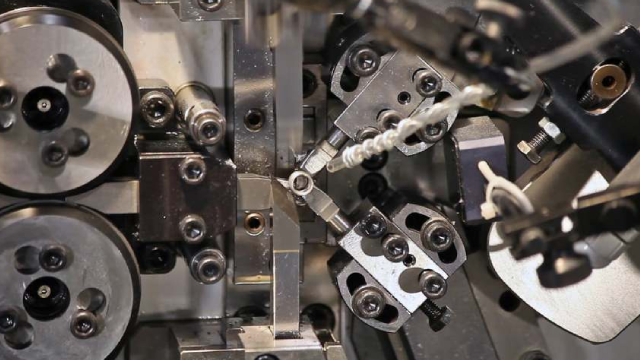

Kraken reported Q3 revenue up 60% to CA$31.3M with 59% margins, signaling accelerating defense-driven demand across NATO and Indo-Pacific regions. Anduril's US and Australian factories will produce up to 200 Dive-LD and multiple Ghost Shark units annually, embedding Kraken's batteries and sonar. Kraken's new 60,000 sq. ft. Nova Scotia facility triples battery output, supporting a record CA$31M order and 2026 full-rate production.

Kraken Robotics: The Rise Of A Subsea Titan

Kraken Robotics reported Q2 2025 revenue of $26.4 million, up 16% year-over-year, with gross margins expanding to 56%. The company reaffirmed 2025 guidance of $120–$135 million revenue and $26–$34 million EBITDA, implying strong second-half acceleration. Combined Halifax and Germany battery facilities provide $200–$250 million annual capacity, supporting rapid growth in subsea power systems.

Kraken Robotics: Riding On SAS, Which Is Revolutionizing Underwater Robotics

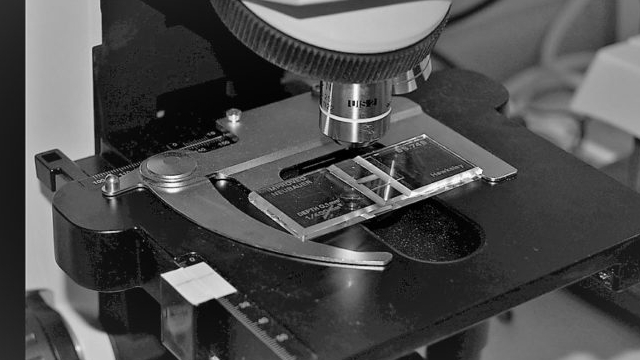

Kraken Robotics Inc. (KRKNF) is well-positioned for growth, driven by surging orders for its Synthetic Aperture Sonar (SAS) and subsea batteries. KRKNF benefits from heightened global demand for underwater security, following recent submarine cable crises and increased defense sector investment in undersea infrastructure protection. Strong revenue momentum, premium valuation, and a projected 40% FY2025 revenue growth justify a bullish outlook, despite recent profitability headwinds.

How To Profit From Underwater Warfare? - Initiating Kraken Robotics With A Buy

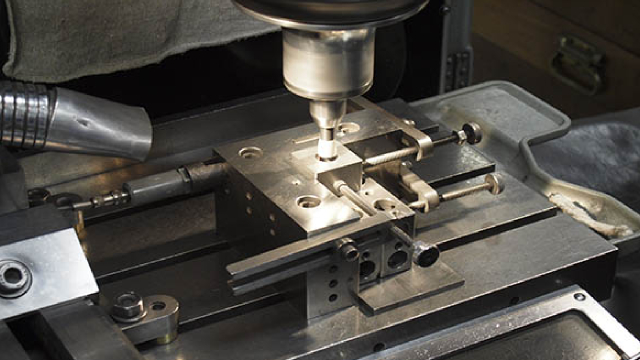

Kraken Robotics Inc. is one of the first-movers in subsea intelligence, leading the synthetic aperture sonar market and providing superior patented subsea batteries. Defense sector demand is accelerating, and that momentum is getting reflected in higher order frequency. The company just announced $13B in orders for its SAS and subsea batteries from customers in the U.S., Norway, and Turkey. We're expecting another order to follow by year's end.

Kraken Robotics: At The Confluence Of Autonomous Systems And Subsea War

Kraken Robotics is positioned for explosive growth, driven by its patented subsea battery technology and deepening ties to defense giant Anduril. Despite recent mixed earnings, resilient guidance, and impending battery orders support a bullish long-term outlook, especially as military UUV demand surges. Anduril's new rapid manufacturing plants could add enormous annual revenue, making Kraken a potential acquisition target.

Kraken Robotics: Something Feels Right About This Small-Cap

Kraken Robotics is at a potential inflection point, with accelerating sales growth, global defense contracts, and strong customer loyalty. The company stands out as a highly profitable micro-cap, leveraging proprietary software-driven sonar tech and a cost-leadership strategy in a capital-intensive sector. Key risks include reliance on acquisitions for innovation, leadership transition after the founder's death, and potential dilution from recent capital raises.

Kraken Robotics: A Canadian Small-Cap That Shows Promise

Kraken Robotics is a niche leader in underwater robotics, with cutting-edge sonar and battery technology driving rapid revenue and stock growth. The company benefits from strong geopolitical and energy sector tailwinds, as global naval and offshore wind investments accelerate demand for its products. Kraken's technological edge and broad product applications provide a robust moat and large, expanding addressable market.

Kraken Robotics (KRKNF) Q4 2024 Earnings Call Transcript

Kraken Robotics Inc. (OTCQB:KRKNF) Q4 2024 Earnings Conference Call April 28, 2025 8:30 AM ET Company Participants Greg Reid - President, Chief Executive Officer Joseph Mackay - Chief Financial Officer Conference Call Participants Nicholas Boychuk - Cormark Securities Benoit Poirier - Desjardins Capital Markets Steven Li - Raymond James Doug Taylor - Canaccord Genuity John Shao - National Bank Financial Gabriel Leung - Beacon Securities Operator Good morning and welcome to the Kraken Robotics 2024 financial results conference call. As a reminder, all participants are in listen-only mode and the conference is being recorded.

Kraken Robotics: Expect A Strong Quarter

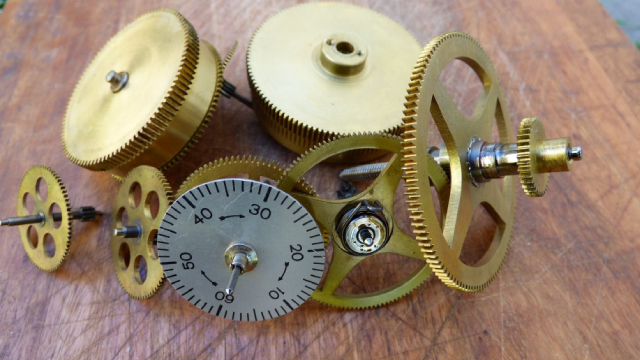

Kraken Robotics is capitalizing on the growing demand for un-crewed underwater vessels (UUVs) due to its SeaPower batteries, attracting significant orders. The company's unique encapsulation process allows its batteries to operate at extreme depths with high-energy density, making them essential for clients like Anduril Industries. Coming out of a very weak third quarter, Kraken may shock investors with the strength of its 4Q 2024 numbers, as well as its future guidance.

Kraken Robotics: OEM Partnerships Not Fully Priced In And Favorable Macro Tailwinds

Kraken Robotics' future growth is driven by strong OEM partnerships, particularly with Anduril, with growth targets not fully priced in. Multiple future positive catalysts position the stock favorably to benefit from surprises and news. Risks include heavy reliance on major partners like Anduril and HII, but specialist hardware and board relationships help de-risk some of it.

Kraken Robotics: It's A Very Good Time To Buy

Kraken Robotics Inc. offers a strong buying opportunity due to its 25% stock drop, robust revenue growth, and expanding TAM in underwater robotics and defense markets. The company specializes in advanced underwater sensors, batteries, and robotics, with significant growth in its Services segment and new defense contracts boosting future revenues. Kraken's gross margin of 49% and consistent adjusted EBITDA margin of ~21% highlight its profitability, despite increased R&D and production costs.

Kraken Robotics: Outstanding Performance, But Can It Keep It Up?

Kraken Robotics Inc. has shown impressive revenue growth and profitability, driven by high demand for its products and strategic acquisitions, leading to a 350% share price increase in the last year. The company's financial health is strong, with significant cash reserves, manageable debt, and an interest coverage ratio of 7.2x, indicating efficient capital allocation. Despite its success, I am initiating coverage with a hold rating, awaiting the next quarterly report to assess continued performance and potential guidance updates.