Kymera Therapeutics Inc. (KYMR)

Kymera's Protein Degradation Technology: A Promising Bet For Long-Term Biotech Investors

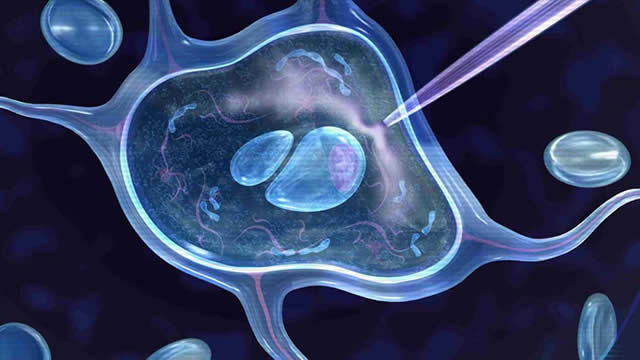

Kymera Therapeutics' innovative TPD technology degrades disease-causing proteins, with promising candidates like KT-474 and KT-621 targeting large TAMs in immunology and oncology. The company's approach leverages the body's proteasome system to degrade harmful proteins. This could lead to safer and less invasive treatments. Kymera's cash runway of approximately 4.9 years is expected to support the advancement of its pipeline until 2027.

Why Is Kymera Therapeutics (KYMR) Up 10.9% Since Last Earnings Report?

Kymera Therapeutics (KYMR) reported earnings 30 days ago. What's next for the stock?

Kymera (KYMR) to Raise $225 Million Through Offering of Shares

Kymera (KYMR) is in the process of selling approximately 2 million shares of common stock at a public offering price of $40.75 per share, along with pre-funded warrants to purchase 3,519,159 shares in the offering.

Kymera Therapeutics, Inc. (KYMR) Q2 2024 Earnings Call Transcript

Kymera Therapeutics, Inc. (NASDAQ:KYMR ) Q2 2024 Earnings Conference Call August 7, 2024 8:30 AM ET Company Participants Justine Koenigsberg - Vice President, Investor Relations Nello Mainolfi - Founder, President & CEO Jared Gollob - Chief Medical Officer Bruce Jacobs - Chief Financial Officer Conference Call Participants Eric Joseph - J.P. Morgan Jeff Jones - Oppenheimer Kelly Shi - Jefferies Vikram Purohit - Morgan Stanley Brad Canino - Stifel Nicolaus Marc Frahm - TD Cowen Kalpit Patel - B.

Kymera (KYMR) Q2 Loss Narrower Than Expected, Pipeline in Focus

Kymera (KYMR) reports a narrower-than-expected loss in the second quarter. The company expects the current cash balance to provide a runway into the first half of 2027.

Kymera Therapeutics, Inc. (KYMR) Reports Q2 Loss, Tops Revenue Estimates

Kymera Therapeutics, Inc. (KYMR) came out with a quarterly loss of $0.58 per share versus the Zacks Consensus Estimate of a loss of $0.69. This compares to loss of $0.67 per share a year ago.

Kymera Therapeutics: Solid Progress And No Change To My 'Buy' Rating

Kymera Therapeutics is a protein degradation specialist drug developer with promising Phase 1 and 2 stage protein degraders targeting various diseases. A partnership with Sanofi includes potential milestone payments of up to $1.48 billion for IRAK4 program, showing strong financial backing and support. I am expecting to see Positive data from Phase 2 studies of KT-474 expected in 1H25, with potential for significant share price increase and future M&A opportunities.

Kymera Therapeutics (KYMR) Surges 23.4%: Is This an Indication of Further Gains?

Kymera Therapeutics (KYMR) witnessed a jump in share price last session on above-average trading volume. The latest trend in earnings estimate revisions for the stock doesn't suggest further strength down the road.

Why Kymera Therapeutics Stock Is Soaring Today

Sanofi plans to expand phase 2 clinical studies evaluating Kymera's KT-474. This move could accelerate pivotal testing for the potential skin treatment.

Kymera's (KYMR) Partner SNY to Expand Ongoing HS and AD Studies

Kymera (KYMR) announces expansion plans of ongoing mid-stage studies on KT-474 (SAR444656) by partner Sanofi.