Logitech International S.A. (LOGI)

What's in the Offing for Logitech (LOGI) This Earnings Season?

The improving demand for PCs, the main sales booster for its PC peripheral products, and inventory normalization at channel partners are likely to have aided Logitech's (LOGI) Q1 earnings.

Top Stocks to Buy for Growth as Earnings Approach

Investors will want to pay attention to several top-rated Zacks stocks that are set to report their quarterly results on Monday, July 22.

HEAR vs. LOGI: Which Stock Is the Better Value Option?

Investors interested in stocks from the Computer - Peripheral Equipment sector have probably already heard of Turtle Beach (HEAR) and Logitech (LOGI). But which of these two companies is the best option for those looking for undervalued stocks?

Logitech (LOGI) Earnings Expected to Grow: What to Know Ahead of Next Week's Release

Logitech (LOGI) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Logitech Stock's Gains May Fade as Uncertain Outlook Looms

Morgan Stanley analyst Erik Woodring reiterated a Sell rating on shares of computer-peripherals maker Logitech.

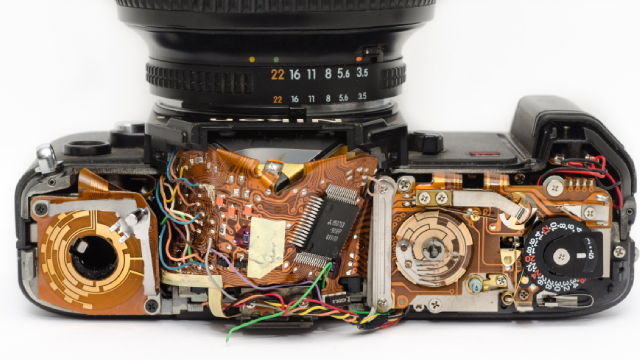

Logitech (LOGI) Expands Its Portfolio With Latest G309 Mouse

Logitech (LOGI) releases the G309 LIGHTSPEED Wireless Gaming Mouse, featuring dual-wireless connectivity, precision tracking, low latency and POWERPLAY compatibility.

Up 65% in a Year, This Pandemic Winner Could Get a Big Boost Thanks to Artificial Intelligence (AI)

A recovery in the PC market is driving a turnaround at this computer peripherals company. A potential jump in revenue and a cheap valuation make this tech stock an attractive bet even after the impressive gains it has delivered in the past year.

Logitech (LOGI) Expands Its Portfolio With Latest Speaker

Logitech (LOGI) expands its music-related device portfolio with the introduction of a portable speaker, EVERBOOM, and updates WONDERBOOM, BOOM and MEGABOOM speakers.

Logitech (LOGI) Expands Its Gaming Portfolio With New Keyboard

Logitech (LOGI) expands its gaming portfolio with the G515 LIGHTSPEED TKL Wireless Gaming Keyboard that features a low-profile design for comfort and efficiency.

Logitech (LOGI) Upgraded to Strong Buy: Here's Why

Logitech (LOGI) has been upgraded to a Zacks Rank #1 (Strong Buy), reflecting growing optimism about the company's earnings prospects. This might drive the stock higher in the near term.

Buy Logitech (LOGI) Stock to Enhance Your Portfolio Returns

Logitech's (LOGI) improving financial performance, innovative product lineup and strategic partnerships make it a compelling investment option.

Why Is Logitech (LOGI) Up 21.7% Since Last Earnings Report?

Logitech (LOGI) reported earnings 30 days ago. What's next for the stock?