Lam Research Corporation (LRCX)

3 Reasons Lam Research Is a Must-Buy for Long-Term Investors

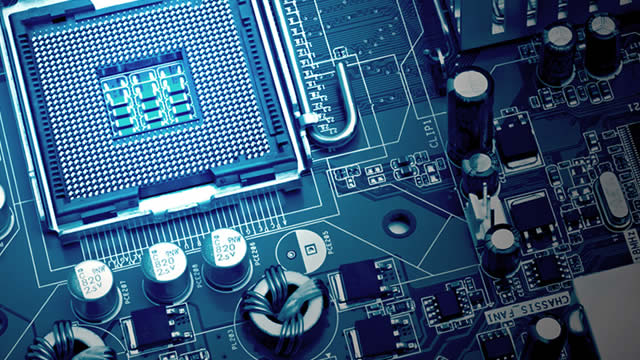

While the "Magnificent Seven" stocks often get a lion's share of attention in the tech world, semiconductor stocks outside Nvidia are often ignored by a lot of investors. And the semiconductor capital equipment ("semicap") stocks -- the makers of high-tech machines that produce semiconductors -- are ignored even more.

Lam Research: Underpriced Growth Potential Amid Industry Headwinds

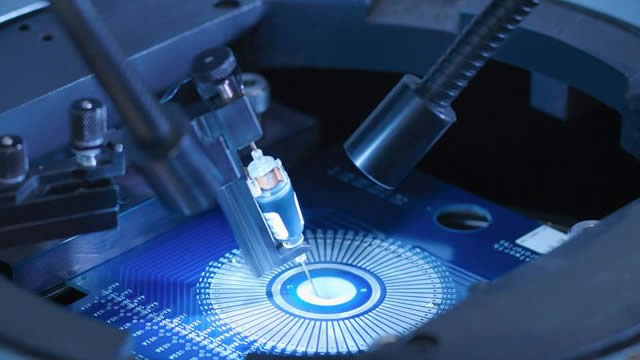

Lam Research stock has faced significant declines this year but remains operationally strong, driven by AI and semiconductor growth despite memory chip market challenges. The company's diverse revenue mix and advanced technologies in etching and deposition processes make it a key player in the semiconductor supply chain. Q1 earnings exceeded expectations, showcasing robust performance across its portfolio, with notable growth in customer support services and advanced packaging.

Lam Research: Expecting Growth To Accelerate In FY25 As Recovery Continues

Lam Research Corporation is poised for continued revenue growth in FY25 due to strong demand for DRAM, NAND technologies, and customer support services. The company's focus on factory utilization, operational efficiencies, and innovations in AI-driven technologies should drive margin growth in the coming years. LRCX stock is undervalued compared to peers, presenting a buying opportunity given its strong market position and growth prospects.

Lam Research Corporation: Undervalued And Poised For Growth

Lam Research is well-positioned for long-term growth due to its leadership in semiconductor technology and strategic focus on cost reductions and intelligent services. Despite strong fundamentals, short-term risks include supply chain challenges, rising operational costs, and geopolitical tensions, particularly with China. Lam Research appears undervalued, with a trailing P/E ratio of 23.16 and a forward P/E of 20.28.

Is Lam Research Stock a Buy, Sell or Hold at a P/E Multiple of 18.78X?

LRCX's discounted valuation and strong innovation make it a solid hold amid semiconductor market challenges and growth potential.

This Stock-Split Stock Could Crush the Market, According to Wall Street

This Stock-Split Stock Could Crush the Market, According to Wall Street

Why Lam Research (LRCX) is a Top Stock for the Long-Term

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Focus List.

Lam Research Fueled by Unyielding AI Demand Growth

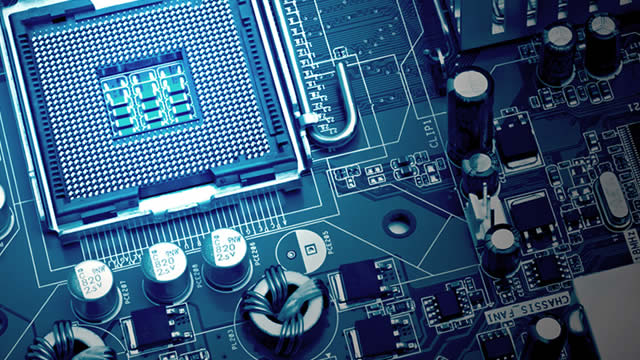

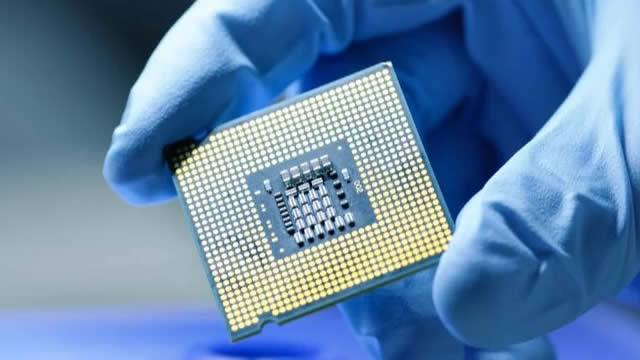

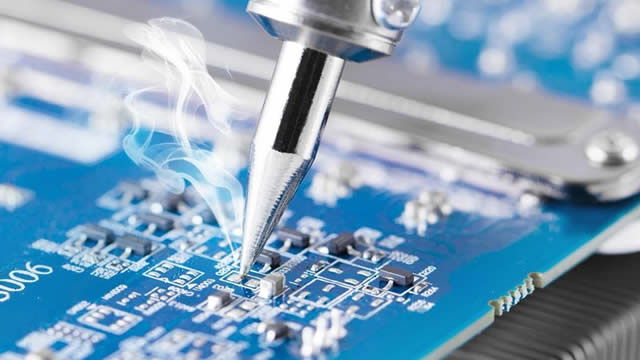

Lam Research Co. NASDAQ: LRCX is a semiconductor equipment manufacturer that makes machines that help make computer chips. Specifically, their wafer fabrication equipment (WFE) focuses on front-end wafer processing, which prepares the raw silicon wafers to be transformed into computer chips.

1 Top Artificial Intelligence (AI) Stock Down 33% to Buy Hand Over Fist Before It Skyrockets

This semiconductor equipment company recently delivered solid results and an impressive outlook.

Here is What to Know Beyond Why Lam Research Corporation (LRCX) is a Trending Stock

Lam Research (LRCX) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

Should You Buy, Sell or Hold Lam Research Stock Post Q1 Earnings?

LRCX shows post-earnings momentum and solid fundamentals, but near-term uncertainties suggest holding is the best move now.

Don't Overlook Lam Research (LRCX) International Revenue Trends While Assessing the Stock

Evaluate Lam Research's (LRCX) reliance on international revenue to better understand the company's financial stability, growth prospects and potential stock price performance.