Lam Research Corporation (LRCX)

Lam Research (LRCX) Q4 Earnings Beat, Revenues Increase Y/Y

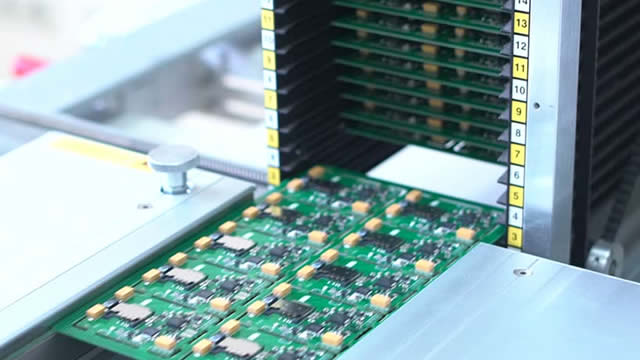

Lam Research's (LRCX) fiscal fourth-quarter results benefit from solid momentum in the Customer Support Business Group and the improving System business.

Lam Research Corporation (LRCX) Q4 2024 Earnings Call Transcript

Lam Research Corporation (NASDAQ:LRCX ) Q4 2024 Earnings Conference Call July 31, 2024 5:00 PM ET Company Participants Ram Ganesh - Investor Relations Timothy Archer - President and Chief Executive Officer Douglas Bettinger - Executive Vice President and Chief Financial Officer Conference Call Participants Timothy Arcuri - UBS Krish Sankar - TD Cowen Srinivas Pajjuri - Raymond James & Associates CJ Muse - Cantor Fitzgerald & Co. Stacy Rasgon - Sanford C. Bernstein & Co. Harlan Sur - JPMorgan Chase & Co. Atif Malik - Citigroup Toshiya Hari - Goldman Sachs Joseph Moore - Morgan Stanley Blayne Curtis - Jefferies Joseph Quatrochi - Wells Fargo Melissa Weathers - Deutsche Bank Operator Good evening, and welcome to the Lam Research June Quarterly Earnings Call.

Lam Research forecasts quarterly revenue above estimates fueled by AI boom

Chip-making tools supplier Lam Research forecast September quarter revenue above Wall Street estimates on Wednesday, anticipating a surge in orders from chip firms amid the AI boom.

Lam Research (LRCX) Beats Q4 Earnings and Revenue Estimates

Lam Research (LRCX) came out with quarterly earnings of $8.14 per share, beating the Zacks Consensus Estimate of $7.52 per share. This compares to earnings of $5.98 per share a year ago.

Pre-Q4 Earnings: How Should You Play Lam Research (LRCX)?

Lam Research's (LRCX) fiscal fourth-quarter results are expected to reflect its prospects, driven by a rebound in the semiconductor industry and improving memory spending.

Lam Research Corporation (LRCX) Is a Trending Stock: Facts to Know Before Betting on It

Lam Research (LRCX) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

Lam Research (LRCX) Gains 22.7% YTD: What's Next for Investors?

Lam Research's (LRCX) long-term prospects are expected to benefit from the growing proliferation of AI.

Here's Why Lam Research (LRCX) Fell More Than Broader Market

The latest trading day saw Lam Research (LRCX) settling at $959.69, representing a -1.78% change from its previous close.

Is Lam Research (LRCX) a Buy as Wall Street Analysts Look Optimistic?

When deciding whether to buy, sell, or hold a stock, investors often rely on analyst recommendations. Media reports about rating changes by these brokerage-firm-employed (or sell-side) analysts often influence a stock's price, but are they really important?

Lam Research (LRCX) Stock Drops Despite Market Gains: Important Facts to Note

The latest trading day saw Lam Research (LRCX) settling at $1,069.11, representing a -0.07% change from its previous close.

Up 42% in 2024, This Artificial Intelligence (AI) Stock Could Get a Big Boost in July

Artificial intelligence is driving solid demand for memory chips, as was evident from Micron Technology's recent earnings report. There's another memory industry participant that is set to report solid earnings thanks to a potential jump in memory equipment spending.

Lam Research Corporation (LRCX) Hit a 52 Week High, Can the Run Continue?

Lam Research (LRCX) is at a 52-week high, but can investors hope for more gains in the future? We take a look at the company's fundamentals for clues.