Lyft Inc. (LYFT)

Lyft stock rises on bigger buyback, strong outlook for demand

Ride-hailing app Lyft Inc. on Thursday offered up a second-quarter forecast for a key demand metric that came in slightly above Wall Street's expectations, and its board approved an increase to its stock buyback plans based on what it characterized as strong demand.

Lyft shares rise as company ups buyback to $750 million

Lyft shares jumped 5% after the company lifted its share buyback plan to $750 million in its first quarter earnings report.

Will Lyft (LYFT) Beat Estimates Again in Its Next Earnings Report?

Lyft (LYFT) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

Lyft (LYFT) Earnings Expected to Grow: Should You Buy?

Lyft (LYFT) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Lyft (LYFT) Stock Sinks As Market Gains: Here's Why

In the closing of the recent trading day, Lyft (LYFT) stood at $12.40, denoting a -1.12% change from the preceding trading day.

Special Situations Fund Engine Capital Seeks Board Changes at Lyft

Engine Capital, a special situations fund that invested in Lyft in 2024 and has about a 1% stake in the company, said Tuesday (April 29) that it aims to elect two candidates to the rideshare company's board of directors and address Lyft's “governance and capital allocation shortcomings.

Lyft CEO David Risher: Surge Pricing ‘Deeply Unpopular' With Customers

Lyft found that surge pricing is “deeply unpopular” with customers, CEO David Risher said in his annual letter to shareholders, released Thursday (April 24). Surge pricing, which the rideshare company calls Prime Time or PT, balances supply and demand by raising prices when demand is high, thereby incentivizing more drivers to get online, according to the letter.

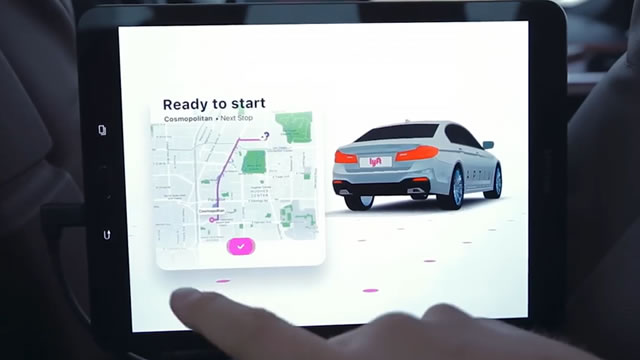

Lyft to Start Adding Licensed Taxis to Rideshare Platform

Lyft is set to start rolling out a feature that will let riders opt in to be matched with a licensed taxi when that vehicle can get there faster than a rideshare one. The company will launch this feature in St.

Lyft Scales Into Europe: Can It Take Market Share From Uber?

When you think of ride-hailing, Uber Technologies Inc. NYSE: UBER likely comes to mind, followed by the distant second player in the duopoly, Lyft Inc. NASDAQ: LYFT. The ride-hailing/rideshare market is a two-horse race.

Lyft Is Making A Comeback: Why Shares Are A Must-Buy Now

Lyft's fundamentals remain strong with U.S. ride pricing recovering and Q1 2025 DAUs growing 5% YoY, suggesting stable revenue outlook. The $200 million Freenow acquisition doubles Lyft's addressable market in Europe, adding €1 billion in annual bookings, but buybacks might have been more accretive. I project Lyft to generate $1.5 billion in free cash flow by 2027, making its current valuation of 3x 2027 FCF highly attractive.

Hitching A Bargain Ride With Lyft

Lyft stock is undervalued, trading at less than 1X P/S and around 8X P/E, despite over 20% YoY revenue growth and recent profitability. Ride-sharing isn't a winner-takes-all business; Lyft's focused, customer-centric strategy and market dynamics ensure its survival against Uber. Robotaxis will complement, not disrupt, ride-sharing; partnerships like Lyft with Mobileye highlight synergies and operational necessities.

Is Lyft Set for Huge Growth With Europe Expansion?

Lyft (LYFT 2.81%) is acquiring a taxi app in Europe. This may seem like an odd addition to the business, but Travis Hoium explains why it's a perfect strategic fit in this video.