MP Materials Corp. (MP)

Inside look at MP Materials amid the rare earth race

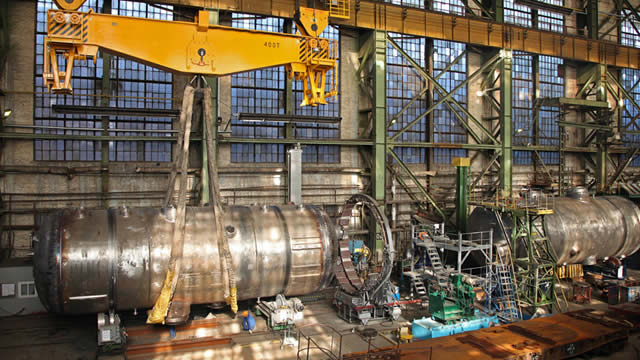

The public-private partnership between the Pentagon and MP Materials aims to triple magnet production capacity amid geopolitical tensions over rare earth supplies.

Rare Earth Stocks: The Truce That Isn't a Truce

Recent headlines celebrating a U.S.-China trade truce have lulled the market into a false sense of security, triggering a sharp sell-off in domestic rare earth stocks. But behind the headlines, a more strategic and confrontational reality is emerging.

MP Materials Corp. (MP) Presents at Morgan Stanley Virtual National Security & Critical Materials Symposium Transcript

MP Materials Corp. ( MP ) Morgan Stanley Virtual National Security & Critical Materials Symposium November 12, 2025 12:00 PM EST Company Participants Ryan Corbett - Chief Financial Officer Conference Call Participants Carlos de Alba - Morgan Stanley, Research Division Stephen Burt Presentation Carlos de Alba Morgan Stanley, Research Division Where you are. It's great to have Ryan Corbett, CFO of MP Materials with us as well as Martin Sheehan to participate in this mining symposium critical minerals and rare earths.

MP Stock Gains 13% Post Q3 Earnings Beat: Time to Buy, Sell or Hold?

MP Materials posts record NdPr output and narrower Q3 loss as shares soar 12.8%, but high costs are likely to weigh on full-year results.

Rare Earths Stock Lands Much-Needed Upgrade

MP Materials (NYSE:MP) is 7% higher to trade at $62.75 this morning, after the rare earths stock landed an upgrade to "buy" from "hold," as well as a price target hike to $71 from $68 at Deutsche Bank.

2 Rare Earth Stocks the U.S. Government Doesn't Want to Fail

China continues to leverage its near-monopoly on processing through export controls, even as it signals a temporary pause on new restrictions. Now a second rival has joined the field: Russia, with President Vladimir Putin ordering a national strategy to develop the country's vast reserves.

MP Materials Stock Dives After Earnings. Why the Market 'Has It Wrong' on Rare Earths.

Shares of rare earth companies are down again after MP and USA Rare Earth reported third quarter numbers.

MP Materials Corp. (MP) Q3 2025 Earnings Call Transcript

MP Materials Corp. ( MP ) Q3 2025 Earnings Call November 6, 2025 5:00 PM EST Company Participants Martin Sheehan - Senior Vice President of Investor Relations James Litinsky - Co-Founder, Chairman, President & CEO Ryan Corbett - Chief Financial Officer Michael Rosenthal - Co-Founder & COO Conference Call Participants William Peterson - JPMorgan Chase & Co, Research Division Lawson Winder - BofA Securities, Research Division David Deckelbaum - TD Cowen, Research Division Carlos de Alba - Morgan Stanley, Research Division Ben Kallo - Robert W. Baird & Co. Incorporated, Research Division Max Yerrill - BMO Capital Markets Equity Research Laurence Alexander - Jefferies LLC, Research Division Presentation Operator Hello, and welcome to the MP Materials Q3 Earnings Call.

MP Materials Corp. (MP) Reports Q3 Loss, Tops Revenue Estimates

MP Materials Corp. (MP) came out with a quarterly loss of $0.1 per share versus the Zacks Consensus Estimate of a loss of $0.14. This compares to a loss of $0.12 per share a year ago.

Should You Buy, Hold or Sell MP Materials Stock Ahead of Q3 Earnings?

MP's Q3 results are due Nov. 6, with revenues expected to fall 15.56% and earnings seen at a $0.14 loss per share.

MP Materials Corp. (MP) Presents at 49th Annual Automotive Symposium Transcript

MP Materials Corp. ( MP ) 49th Annual Automotive Symposium November 4, 2025 11:00 AM EST Company Participants Ryan Corbett - Chief Financial Officer Conference Call Participants Brian Sponheimer - Gabelli Funds, LLC Presentation Brian Sponheimer Gabelli Funds, LLC Terrific. As I mentioned, it's going to be a great day.

Is This Nevada-Based Company a Strong Play for Growth-Oriented Portfolios?

Good news for China-U.S. trade policy has been bad news for MP Materials. The stock is down about 35% from recent highs, despite no change in its fundamental business.