M-tron Industries, Inc. (MPTI)

Summary

MPTI vs. ALFVY: Which Stock Should Value Investors Buy Now?

Investors with an interest in Engineering - R and D Services stocks have likely encountered both M-tron Industries, Inc. (MPTI) and Alfa Laval AB Unsponsored ADR (ALFVY). But which of these two companies is the best option for those looking for undervalued stocks?

M-tron Industries: Program Depth And Backlog Strength Push Me To A Buy

M-tron Industries is upgraded to buy due to strong backlog growth, program depth, and a solid balance sheet with no debt. MPTI's participation in over 40 long-term defense and space programs, with many sole-source contracts, positions it for significant multi-year revenue expansion. Gross margin pressures from tariffs and cost creep are being addressed, while new partnerships and product lines enhance MPTI's revenue potential.

M-tron Industries, Inc. (MPTI) Upgraded to Buy: Here's Why

M-tron Industries, Inc. (MPTI) has been upgraded to a Zacks Rank #2 (Buy), reflecting growing optimism about the company's earnings prospects. This might drive the stock higher in the near term.

M-tron Industries, Inc. (MPTI) FAQ

What is the stock price today?

On which exchange is it traded?

What is its stock symbol?

Does it pay dividends? What is the current yield?

What is its market cap?

Has M-tron Industries, Inc. ever had a stock split?

M-tron Industries, Inc. Profile

| Automobile Components Industry | Consumer Discretionary Sector | Cameron Pforr CEO | AMEX Exchange | 55380K109 CUSIP |

| US Country | 226 Employees | - Last Dividend | - Last Split | 3 Oct 2022 IPO Date |

Overview

M-tron Industries, Inc. is a prominent entity in the sphere of frequency and spectrum control products, engaging actively in their design, manufacturing, and marketing operations both within the United States and on a global scale. The company boasts a comprehensive portfolio of subsidiaries through which it offers a variety of specialized services and products to its diverse clientele. Since its establishment in 1965, M-tron Industries has rooted itself firmly in Orlando, Florida, from where it oversees its extensive operations spanning commercial and military aerospace, defense, space, avionics, and other critical industries.

Products and Services

M-tron Industries, Inc. offers a broad range of frequency and spectrum control products tailored to meet the demanding needs of various applications in the aerospace, defense, and other sectors. Here's a closer look at some of their key offerings:

- Radio Frequency, Microwave, and Millimeter Wave Filters: These filters are designed to enable precise signal filtering across different frequency bands, ensuring clear communication and signal integrity in various applications.

- Cavity, Crystal, Ceramic, Lumped Element, and Switched Filters: This array of filters offers customization in signal processing, catering to specific requirements for frequency tuning and signal management in complex electronic systems.

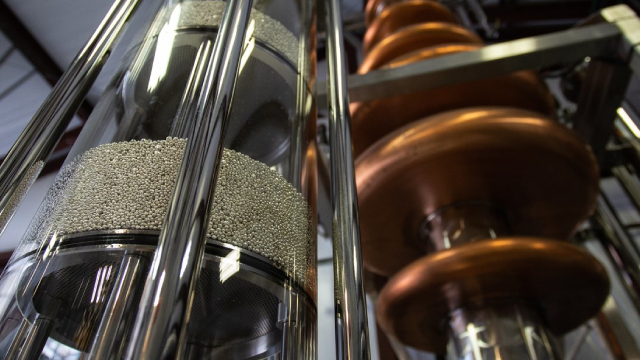

- High Frequency and Performance OCXOs (Oven-Controlled Crystal Oscillators), Integrated PLL OCXOs (Phase-Locked Loop Oven-Controlled Crystal Oscillators), TCXOs (Temperature-Compensated Crystal Oscillators), VCXOs (Voltage-Controlled Crystal Oscillators): These precision timing devices are crucial in ensuring the synchronicity and reliability of electronic systems, particularly in high-stakes applications like aerospace and defense.

- Low Jitter and Harsh Environment Oscillators: Engineered to withstand extreme conditions while maintaining optimal performance, these oscillators are vital for applications where failure is not an option.

- Crystal Resonators: These components provide stable and reliable frequency references for a wide array of electronic devices, from simple consumer electronics to complex military systems.

- Integrated Microwave Assemblies: This service involves the combining of multiple microwave components into a single, compact assembly, simplifying design and enhancing performance in radar and communication systems.

- Solid-State Power Amplifier Products: Offering high efficiency and reliability, these amplifiers are key in boosting signal strength across various applications, ensuring effective broadcasting and communication.