Monolithic Power Systems, Inc. (MPWR)

Monolithic Power forecasts Q1 revenue above estimates on AI demand, shares surge

Monolithic Power Systems forecast first-quarter revenue above estimates on Thursday, betting on strong demand for its power control products as generative AI drives data center expansion, sending its shares up more than 14% after the bell.

Will Higher Revenues Boost Monolithic Power's Q4 Earnings?

MPWR is expected to record top-line growth in the fourth quarter, driven by healthy demand in multiple segments. Focus on improving supply chain resiliency is a positive.

Monolithic (MPWR) Q4 Earnings on the Horizon: Analysts' Insights on Key Performance Measures

Evaluate the expected performance of Monolithic (MPWR) for the quarter ended December 2024, looking beyond the conventional Wall Street top-and-bottom-line estimates and examining some of its key metrics for better insight.

This Nvidia Supplier's Stock Is Down 30% in 3 Months—Here's Why Deutsche Bank Says It's Still a Buy

After reaching record highs last year, shares of Monolithic Power Systems (MPWR) have slumped more than 30% since the semiconductor firm's last earnings report at the end of October, but analysts have remained bullish on the stock.

Monolithic Power Systems: A Rare Buying Opportunity

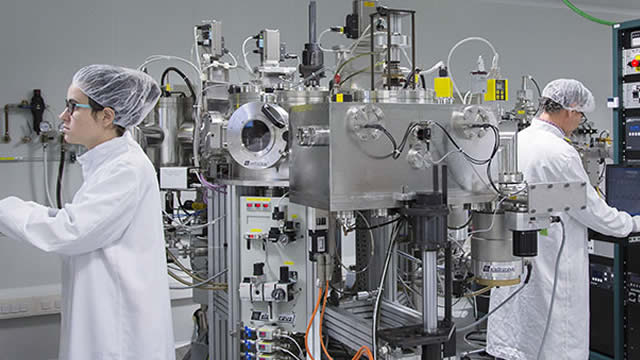

Monolithic Power Systems offers a buying opportunity after a price correction due to exaggerated share loss concerns and weak Q3 2024 results. MPWR's innovative power management solutions and fabless model drive market-share gains, particularly in the automotive and data center sectors. Despite the competition, MPWR's efficient solutions and flexible structure position it for continued growth, with the CEO confident in the 2025 outlook.

Why Monolithic Power Systems Rallied Today

Shares of Monolithic Power Systems (MPWR 4.74%) rallied hard today, up 5% as of 3:15 p.m. ET

Monolithic Power Systems: Big Growth At A Reasonable Price

I advocate for a primary risk-neutral portfolio: 50% short-term U.S. Treasuries, 10% gold, and 40% low-risk dividend equities to preserve wealth amidst geopolitical risks. Monolithic Power Systems offers a 15% CAGR opportunity over five years, driven by a robust fabless model and strong market presence but faces risks tied to TSMC and Nvidia. My valuation model reveals a 7% margin of safety and a December 2029 EV estimate of $54.34B, justifying MPWR's inclusion in growth portfolios despite macro uncertainties impacting semiconductor supply chains.

Why Is Monolithic (MPWR) Down 26.2% Since Last Earnings Report?

Monolithic (MPWR) reported earnings 30 days ago. What's next for the stock?

Power Inflow Alert: Monolithic Power Systems Inc. Receives Alert And Rises Over 22 Points

STOCK CLIMBS 3.9% AT HIGH

Is Monolithic Power Systems a Screaming Buy After Near 40% Drop?

Monolithic Power Systems NASDAQ: MPWR is a chip stock that isn't nearly as talked about as some other companies in its industry, like NVIDIA NASDAQ: NVDA or Taiwan Semiconductor Manufacturing NYSE: TSM. But that doesn't mean the company hasn't had great success over the years.

S&P 500 Gains and Losses Today: Monolithic Power Stock Drops on Risks to Nvidia Allocation

Major U.S. equities indexes were mixed and little changed on Wednesday.

Monolithic Power Got Crushed by Edgewater Report. Now It's Micron's Turn.

Shares of both companies were both suffering after reports from market-intelligence firm Edgewater Research.