Merck & Co., Inc. (MRK)

Merck (MRK) Stock Falls Amid Market Uptick: What Investors Need to Know

In the latest trading session, Merck (MRK) closed at $96.24, marking a -1.72% move from the previous day.

Merck: 3x Pipeline And Undervaluation Make It A Buy

Merck's current discounted valuation, and robust pipeline advancements, which tripled over the past 3+ years, present a compelling long-term investment opportunity. Its strong business performance with 7% YoY revenue growth, driven by Keytruda and GARDASIL expansions, supports Merck's solid financial health. Merck's 3.3% dividend yield, low net debt-to-EBITDA ratio, and promising late-stage assets enhance its appeal for value and income-oriented investors.

High-Quality Dividend Growth Stocks Near 52-Week Lows: Merck Is Magnificent

A list of high-quality dividend-growth stocks trading near 52-week lows is evaluated based on historical and future fair values. Merck's robust Phase 3 pipeline, strong financials, and sustainable dividend make it a compelling investment despite risks like Medicare negotiations and patent expirations. Merck also appears to have good potential for future growth.

Exclusive: Kennedy played key role in vaccine case against Merck

Robert F. Kennedy Jr. played an instrumental role in organizing mass litigation against drugmaker Merck over its Gardasil vaccine, a strategy that faces its first test in a Los Angeles court next week, according to two attorneys close to the case and court filings.

Merck & Co., Inc. (MRK) is Attracting Investor Attention: Here is What You Should Know

Recently, Zacks.com users have been paying close attention to Merck (MRK). This makes it worthwhile to examine what the stock has in store.

What's In Store For Merck Stock In 2025?

Merck stock (NYSE: MRK) lost about 10% in 2024, underperforming the broader S&P 500 index, which gained 23% for the year. Despite strong performances from other pharmaceutical giants like Eli Lilly stock (up 31%) and AbbVie stock(up 15%), Merck's stock performance has been muted.

Merck Falls 9% in 3 Months: Buy, Hold or Sell the Stock?

We believe investors with a long-term horizon should hold MRK stock, while short-term investors should consider selling it.

3 Magnificent S&P 500 Dividend Stocks Down 25%, 60%, and 26% to Buy and Hold Forever

If you're looking at dividend stocks as a source of income, obviously quality matters. But timing can play a role in how much income these investments generate for you, too.

Merck CEO Robert Davis goes one-on-one with Jim Cramer

Merck Chairman and CEO Robert Davis joins 'Mad Money' host Jim Cramer at the JPMorgan Healthcare Conference to talk recent acquisitions, growth in its vaccine segment, opportunities in China and more.

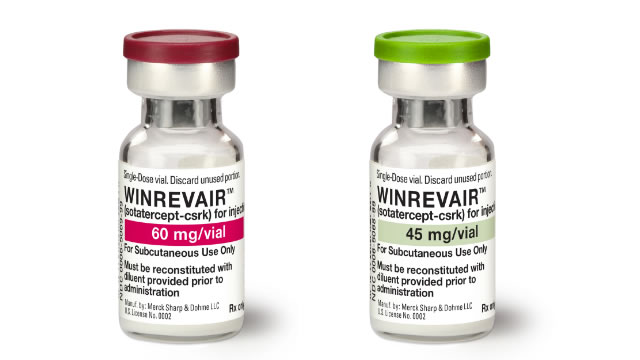

We've seen patients on transplant lists taken off of them after starting Winrevair, says Merck CEO

Merck Chairman and CEO Robert Davis joins 'Mad Money' host Jim Cramer at the JPMorgan Healthcare Conference to talk recent acquisitions, growth in its vaccine segment, opportunities in China and more.

Merck & Co. Inc. (MRK) 43rd Annual J.P. Morgan Healthcare Conference (Transcript)

Merck & Co. Inc. (NYSE:MRK ) 43rd Annual J.P. Morgan Healthcare Conference January 13, 2025 7:30 PM ET Company Participants Robert Davis - Chairman and CEO Dean Li - Executive VP & President of Merck Research Laboratories Conference Call Participants Chris Schott - JPMorgan Chris Schott Good afternoon, everybody.

Merck Just Paid Investors: How Much Did They Receive?

Merck & Co. Inc. (NYSE: MRK) is rewarding its shareholders once again with a quarterly dividend of $0.81 per share, payable on Wednesday, Jan.