Marvell Technology, Inc. (MRVL)

Marvell Technology: All Clear For EBITDA Growth To Take Off

I reiterate a buy rating for Marvell Technology (MRVL) due to expected growth acceleration and EBITDA margin expansion. The Data Center segment's revenue grew 7.9% sequentially, and with no signs of slowdown in data center investments, I expect to continue leading MRVL's growth. Margin expansion is supported by strong operating leverage, which should result in increased cash generation, enabling more capital returns to shareholders.

Marvell (MRVL): Strong Industry, Solid Earnings Estimate Revisions

Marvell (MRVL) has seen solid earnings estimate revision activity over the past month, and belongs to a strong industry as well.

Is Trending Stock Marvell Technology, Inc. (MRVL) a Buy Now?

Marvell (MRVL) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

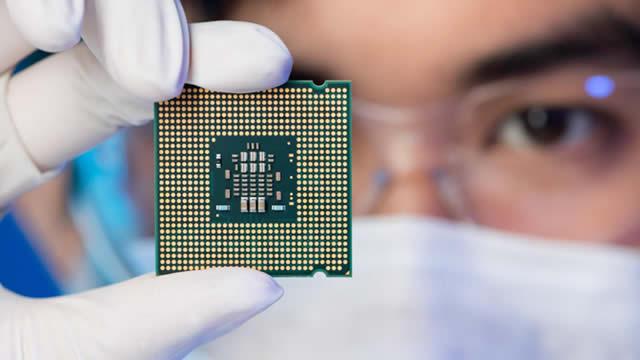

Marvell Technology's billionaire co-founder, Sehat Sutardja, has died

The Indonesia born billionaire led Marvell Technology to become one of the world's largest chipmakers before stepping down from the company he co-founded after being accused of fraud

Marvell Technology, Inc. (MRVL) Goldman Sachs Communacopia + Technology Conference (Transcript)

Marvell Technology, Inc. (NASDAQ:MRVL ) Goldman Sachs Communacopia + Technology Conference Call September 11, 2024 6:45 PM ET Company Participants Matthew Murphy - Chairman and Chief Executive Officer Conference Call Participants Toshiya Hari - Goldman Sachs Group, Inc. Toshiya Hari Okay. Great. I think we're live.

Marvell Dips 13% in a Week: Should You Buy, Sell or Hold MRVL Stock?

MRVL's improving profitability, strong pipeline and strategic positioning in the AI revolution justify holding the stock through the current volatility.

Why Analysts Are Bullish on Marvell Despite Sector Weakness

Marvell Technology MRVL is a semiconductor stock gaining hype due to its fast data center revenue growth. It has performed well over the past 52 weeks but is underperforming in its sector.

Is Most-Watched Stock Marvell Technology, Inc. (MRVL) Worth Betting on Now?

Marvell (MRVL) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

Marvell (MRVL) International Revenue Performance Explored

Explore Marvell's (MRVL) international revenue trends and how these numbers impact Wall Street's forecasts and what's ahead for the stock.

Marvell Technology AI Boom is Just Getting Started with ASIC

While semiconductor developer Marvell Technology, Inc. NASDAQ: MRVL is a benefactor in the artificial technology (AI) revolution, headline numbers for their second-quarter fiscal 2025 results don't paint the immediate upside potential. This is because the rest of the business shows weakness from the non-AI semiconductor cycle slowdown.

Marvell Technology Q2: Ramping Up Electro-Optics And Custom Silicon In H2

I reiterate a 'Buy' rating for Marvell Technology with a one-year price target of $90 per share, driven by strong growth in AI revenues from optics and custom ASIC. Marvell's data center business grew by 92% year-over-year, with significant contributions from electro-optic and custom silicon products, which are expected to continue driving growth. The company is guiding for high-teens sequential growth in Q3, with revenue projected at $1.45 billion, driven by increasing demand for high-bandwidth AI applications and interconnectivity solutions.

Marvell Technology Seeing Strong AI Chip Demand

Marvell Technology posted better-than-expected Q2 sales thanks to custom chips for AI applications. MRVL stock rose Friday.