Micron Technology Inc. (MU)

Is This the Best AI Stock to Buy Now (Hint: It's Not Nvidia)

Key Points in This Article: Micron Technology (MU) is emerging as a key AI stock, often overshadowed by Nvidia, AMD, and Broadcom.

Micron Technology raises fiscal Q4 guidance on strong DRAM pricing and execution

Micron Technology Inc (NASDAQ:MU) has updated its fiscal fourth quarter 2025 financial guidance, noting that its improved outlook reflects better pricing, particularly in DRAM, and strong execution. The company raised its revenue forecast to $11.2 billion plus or minus $100 million, up from the prior estimate of $10.7 billion plus or minus $300 million.

Micron's stock climbs after upbeat guidance. Here's what's driving the momentum.

One analyst says the guidance is “a clear slap in [the] face to all the bears.”

Why the Market Dipped But Micron (MU) Gained Today

Micron (MU) closed at $111.87 in the latest trading session, marking a +2.84% move from the prior day.

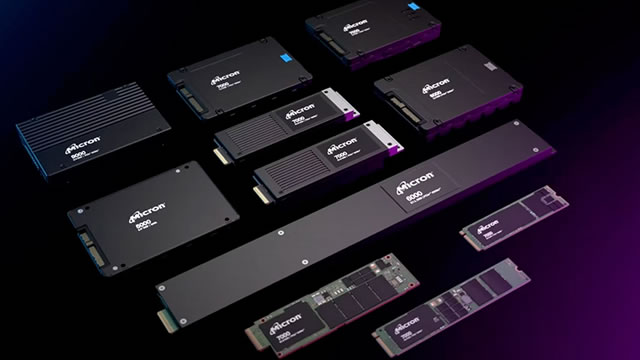

Micron: Valued As If There Is No AI

Micron is currently valued as if AI doesn't exist with a forward P/E of just 13 and Price/FCF around 7, offering significant upside potential. The new AI data center SSD product and a thriving data center market provide solid long-term growth catalysts for Micron. Despite competitive and macro risks, I reiterate a 'Strong Buy' rating for MU given its rock-solid fundamentals and attractive valuation.

Micron Technology, Inc. (MU) Is a Trending Stock: Facts to Know Before Betting on It

Recently, Zacks.com users have been paying close attention to Micron (MU). This makes it worthwhile to examine what the stock has in store.

ASML vs. Micron Technology (MU): Which Semiconductor Stock is a Better Value?

ASML (NASDAQ:ASML) and Micron (NASDAQ:MU) shares haven't been the hottest of semiconductor plays in recent years, to say the least.

Micron (MU) Registers a Bigger Fall Than the Market: Important Facts to Note

In the latest trading session, Micron (MU) closed at $109.14, marking a -4.88% move from the previous day.

Texas Instruments Is Better Positioned Than Micron In This Chip Cycle

Latest earnings reports from leading chip stocks signal that the expansion phase of the current chip cycle is ending. Micron Technology, Inc., as one of the most cyclical chip stock, faces large downsides due to its particular product mix. Memory semiconductors and storage hardware are among the most discretionary and commoditized items for the IT industry, in my view.

Investors Heavily Search Micron Technology, Inc. (MU): Here is What You Need to Know

Recently, Zacks.com users have been paying close attention to Micron (MU). This makes it worthwhile to examine what the stock has in store.

Micron: Fantastic Outlook Meets Fizzled Response

Micron delivered a strong FQ3 with better-than-expected bit shipments, pricing, and margins, signaling a somewhat surprising shift in the memory market environment, considering the prior earnings call tone. Guidance for FQ4 points to continued revenue and margin expansion, driven by tight inventories and constructive demand, especially in DRAM. The upcoming HBM4 transition and its higher pricing are set to provide tailwinds for FY26 and FY27, supporting a bullish long-term thesis and a fantastic outlook.

Micron Stock Soars 36% YTD: Still a Buy or Time to Book Profits?

MU rises 36% YTD, outpacing rivals as AI demand boosts memory chip sales, and its valuation still looks attractive.