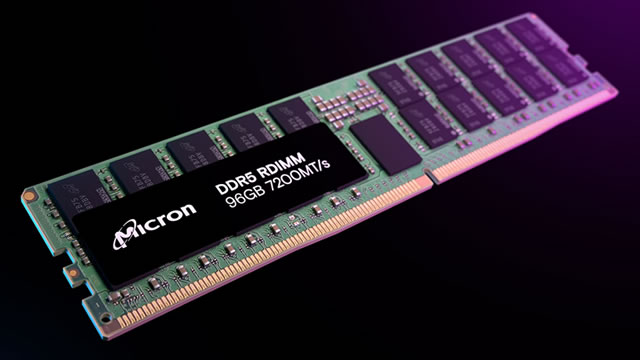

Micron Technology Inc. (MU)

Upcoming Earnings To Move Micron Technology Stock?

Memory and storage solutions leader Micron Technology (NASDAQ:MU) is scheduled to announce its earnings at the end of June. It is anticipated that revenues will increase by approximately 30% year-over-year to $8.83 billion, while earnings are expected to reach $1.59 per share, compared to $0.62 in the same period last year.

Micron Technology, Inc. (MU) is Attracting Investor Attention: Here is What You Should Know

Micron (MU) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

Micron: Share Price Movement Lags Behind Fundamentals

Micron Technology, Inc. remains a Strong Buy due to robust fundamentals, AI-driven growth, and significant undervaluation with a 38% upside potential. The company is positioned at the forefront of the AI revolution, with aggressive R&D and innovative memory solutions powering major AI smartphones and data centers. Micron's solid balance sheet and financial flexibility support ongoing innovation and growth, while forward P/E ratios indicate further undervaluation.

Micron Stock Soars 23% in a Month: Time to Hold or Book Profits?

MU shares are up 23% in a month on AI and trade relief. Solid growth ahead, but margin concerns lead to a hold recommendation.

Here's Why Micron (MU) Gained But Lagged the Market Today

In the most recent trading session, Micron (MU) closed at $95.45, indicating a +0.14% shift from the previous trading day.

Micron: A Strong Blend Of Catalysts And Deep Undervaluation

AI adoption is accelerating globally, with both private and public sectors investing heavily in data centers, directly benefiting Micron's growth prospects. The Company's fundamentals are strengthening, driven by aggressive R&D and AI momentum. MU remains massively undervalued, with my DCF model indicating an 86% upside potential based on robust EPS forecasts and strong FCF conversion.

Micron Technology, Inc. (MU) Annual JPMorgan Global Technology, Media and Communications Conference (Transcript)

Micron Technology, Inc. (NASDAQ:MU ) Annual JPMorgan Global Technology, Media and Communications Conference May 14, 2025 8:40 AM ET Company Participants Manish Batia - Executive Vice President of Global Operations Samir Patodia - Senior Director of Investor Relations Conference Call Participants Harlan Sur - JPMorgan Harlan Sur Welcome to the second day of JP Morgan's 53rd Annual Technology Media and Communications Conference. My name is Harlan Sur, I'm the semiconductor and semiconductor capital equipment analyst for the firm.

Micron (MU) Boasts Earnings & Price Momentum: Should You Buy?

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Focus List.

Why the Market Dipped But Micron (MU) Gained Today

In the closing of the recent trading day, Micron (MU) stood at $85.86, denoting a +0.83% change from the preceding trading day.

Investors Heavily Search Micron Technology, Inc. (MU): Here is What You Need to Know

Zacks.com users have recently been watching Micron (MU) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

Here's Why Micron (MU) is a Strong Momentum Stock

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

Why Micron (MU) is a Top Stock for the Long-Term

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Focus List.