Micron Technology Inc. (MU)

Steal These 3 Dirt-Cheap Gems Before Wall Street Wakes Up

The rise of artificial intelligence has distorted stock market valuations, pulling them far from underlying fundamentals.

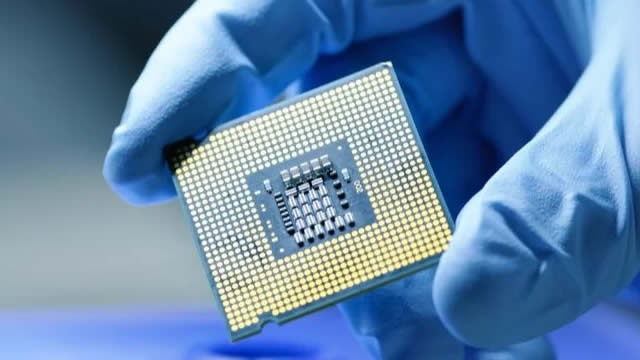

Micron In The Midst Of AI-Memory Boom

Micron Technology (MU) is rated Buy, due to strong financials, robust AI-driven growth, and a compelling risk-reward profile, despite recent volatility. MU's 1-gamma DRAM and HBM technologies drive revenue and margin expansion, with AI-related memory now the main growth engine and competitive moat. Tight supply and surging AI infrastructure demand enable price increases, supporting expectations for revenue and EPS beats in FY26.

Why the Selloff in Micron Technology Stock Never Made Sense

Micron Technology ( NASDAQ:MU ) shares soared to an all-time high of $260 earlier this month, riding the wave of AI-driven optimism in the semiconductor sector.

Best Growth Stocks to Buy for Nov. 24

SKIL, MU and SANM made it to the Zacks Rank #1 (Strong Buy) growth stocks list on Nov. 24, 2025.

Why Micron (MU) is a Top Value Stock for the Long-Term

The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

Micron Technology: From Commodity To AI Powerhouse

Micron Technology, Inc. is transforming into a growth powerhouse, driven by surging AI and data center demand for high-performance memory products. MU's record earnings, A+ growth metrics, and strategic pivot to high-value memory position it as a top play on the AI and data-center boom. Despite near-term negative free cash flow from aggressive CapEx, I view this as a strategic investment to secure future market leadership.

Micron Technology, Inc. (MU) Presents at Global Technology, Internet, Media & Telecommunications Conference 2025 Transcript

Micron Technology, Inc. ( MU ) Global Technology, Internet, Media & Telecommunications Conference 2025 November 19, 2025 8:15 AM EST Company Participants Mark Murphy - Executive VP & CFO Scott DeBoer - Executive VP and Chief Technology & Products Officer Conference Call Participants Srinivas Pajjuri - RBC Capital Markets, Research Division Presentation Operator From Micron Technologies, Executive Vice President and Chief Technology and Products Officer, Scott DeBoer; Executive Vice President and Chief Financial Officer, Mark Murphy; and your moderator from RBC Capital Markets Research Analyst, Srini Pajjuri. Srinivas Pajjuri RBC Capital Markets, Research Division Good morning, everyone.

Why Micron (MU) is a Top Momentum Stock for the Long-Term

The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

Wall Street Bulls Look Optimistic About Micron (MU): Should You Buy?

The recommendations of Wall Street analysts are often relied on by investors when deciding whether to buy, sell, or hold a stock. Media reports about these brokerage-firm-employed (or sell-side) analysts changing their ratings often affect a stock's price.

Why Micron Remains One Of The Top Momentum Stock For 2026

Micron (MU) is positioned to benefit from a DRAM supply crunch driven by surging AI demand, supporting a continued boom phase into FY26. MU's stock has more than doubled in the past year, and a significant supply shortage is expected to persist until new capacity ramps up in FY27. Despite stretched valuations, MU remains a strong momentum play, with a buy rating justified by robust revenue and margin growth forecasts through FY26.

Here's Why Micron (MU) Fell More Than Broader Market

The latest trading day saw Micron (MU) settling at $241.95, representing a -1.98% change from its previous close.

The memory boom has been great for Micron — but could hurt these other tech stocks

Morgan Stanley analysts are getting worried about potential profit pressure at Dell and HP due to surging memory prices.