Micron Technology Inc. (MU)

Micron At $250 Isn't Peaking - It's Powering The Next AI Supercycle

Micron Technology stands at a pivotal point near $250, with strong AI-driven growth and a geopolitical moat supporting a bullish outlook. MU's recent revenue and margin outperformance, combined with robust AI demand, suggests higher highs and structurally improved cycles compared to pre-AI eras. A DCF analysis points to a fair value of ~$375, implying 50% upside, though risks from cyclicality, policy, and competition remain significant.

If You Wait for the Dip, Micron Technology Could Leave You Behind

While concerns that the AI demand outlook is overblown and players like OpenAI will struggle to meet their commitments regarding GPUs are valid, these are bricks in a Wall of Worry built on a robust demand spike and the foundations of a multi-year memory chip supercycle.

Buy This Top AI Stock Down 20% After Nvidia Confirms AI Boom

Buy chipmaker Micron stock down 20% for great value and long-term artificial intelligence (AI) growth.

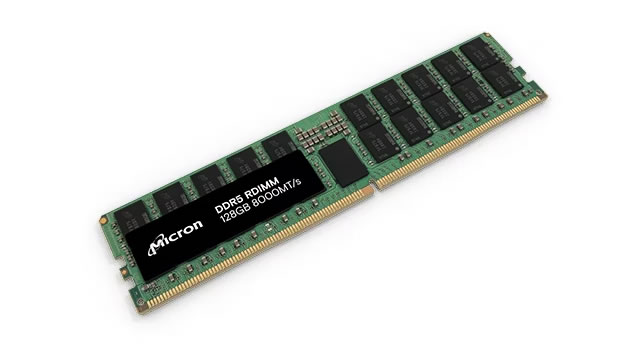

Micron: Picks And Shovels For AI

As history has shown us, during the Gold Rush, it was the sellers of picks and shovels who profited most, not the gold miners themselves. Micron Technology, Inc. reminds me of a picks and shovels seller because it provides the essential memory chips that power today's AI gold rush. Meanwhile, MU stock is significantly undervalued compared to peers like Nvidia, AMD, and Broadcom.

2 Chip Hardware Stocks Suffering From Sector Headwinds

Memory chip stocks are deep in the red today, after Japanese peer Kioxia's earnings and revenue were dismally short of estimates.

Is Top-Ranked Micron the Best AI Stock to Buy Now?

AI chip stock Micron has soared to new highs, and it's crushed the Tech sector over the last 15 years. Despite that, the Zacks Rank #1 (Strong Buy) stock offers great value and long-term upside.

Here's Why Micron (MU) is a Strong Growth Stock

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

Micron Technology, Inc. (MU) Hits Fresh High: Is There Still Room to Run?

Micron (MU) is at a 52-week high, but can investors hope for more gains in the future? We take a look at the company's fundamentals for clues.

Will Data Center AI Chip Demand Keep Aiding Micron's Sales Growth?

Surging data center demand, powered by AI-driven memory and storage solutions, positions MU for another year of robust revenue growth.

Best Growth Stocks to Buy for Nov. 11

Here is one stock with buy ranks and strong growth characteristics for investors to consider today, Nov. 11:

Memory and Data Storage Stocks Surge Amid Optimism About AI Demand

Memory and data storage stocks led the tech sector higher Monday amid optimism about growing AI-driven demand.

Is Micron's Cheap Valuation an Opportunity to Invest in the Stock?

MU's soaring stock still trades at a steep discount to tech peers, with AI-driven growth and solid fundamentals supporting further upside.