NVIDIA Corp (NVDA)

Nvidia Stock: An Early Christmas Gift For Investors (Rating Upgrade)

Nvidia Corporation is upgraded to a strong buy as fundamentals strengthen and valuation contracts. NVDA's Q3 results show reaccelerating revenue growth, robust data center demand, and continued leadership in AI compute. Q4 guidance implies further NVDA top-line acceleration, gross margin expansion to 75%, and strong operating efficiency as well.

Nvidia: Traders 'Remain Bullish,' And So Do I

Nvidia Corporation offers a compelling long-term entry after a 14% pullback, with bullish sentiment and robust AI-driven growth. NVDA's data center revenue surged 66% YoY in FQ3 2026, with $500B in confirmed AI chip orders and strong partnerships fueling demand. Valuation has become attractive: NVDA's P/E dropped to 44, below its five-year average, implying 11–50% upside depending on scenario.

Nvidia (NASDAQ: NVDA) Stock Price Prediction for 2026: Where Will It Be in 1 Year (Dec 17)

Shares of Nvidia Corp. (NASDAQ: NVDA) have retreated 3.4% in the past week, as it announced the acquisition of SchedMD and a partnership with Mistral AI, and in the wake of the White House approving sales of H200 chips to certain Chinese customers.

Trading expert sets Nvidia (NVDA) stock price for Q1 2026

The past month has been a bit of a slump for Nvidia (NASDAQ: NVDA), the stock having fallen 4.76%.

MetaX IPO surge is fueled by AI enthusiam and China's push to build Nvidia alternatives: Strategist

Eugene Hsiao from Macquarie says the reason why a number of Chinese chip start-ups had very successful IPOs lately is that they're seen as future national champions. Their products may not be as good as Nvidia's, but they are good enough to drive market excitement.

Opinion | The Case for Sending Nvidia's Chips to China

‘Leadership is about controlling the platform on which others build, not hoarding end products,' writes Aaron Ginn.

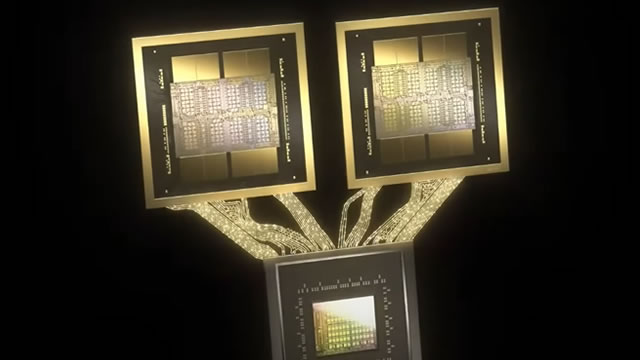

Nvidia acquires SchedMD to expand open-source AI and HPC capabilities

Nvidia Corp (NASDAQ:NVDA, XETRA:NVD) announced that it has acquired SchedMD, the company behind Slurm, a widely used open-source workload manager for high-performance computing (HPC) and AI, in a move aimed at strengthening its AI and HPC software ecosystem. The financial terms of the deal were not disclosed.

Here is What to Know Beyond Why NVIDIA Corporation (NVDA) is a Trending Stock

Nvidia (NVDA) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

Nvidia: The Law Of Large Numbers Has Been Delayed

Nvidia Corporation shattered the apparent growth fatigue narratives with a record Q3 that should extend into Q4 with its forecast of $65B in sales. Despite reports of cooling bottlenecks with the NVL72 racks, NVDA's Blackwell is sold out for the next four quarters thanks to “off the charts” demand. The Trump administration also pivoted with its transactional 25% tariff on H200 chips, reopening the Chinese market to NVDA.

NVIDIA (NASDAQ: NVDA) Price Prediction and Forecast 2025-2030 for December 16

Shares of NVIDIA Corp. (NASDAQ:NVDA) lost 4.95% over the past five trading sessions after gaining 2.08% the five prior.

Where Will Nvidia Stock Be in 5 Years?

Nvidia expects monster capital expenditure growth over the next five years. The company is currently sold out of cloud GPUs.

Wall Street's lone Nvidia bear is doubling down on his call, with high conviction

Seaport Research's negative view of Nvidia's stock hasn't panned out thus far, but analyst Jay Goldberg is emphasizing the recommendation as he looks to 2026.