NVIDIA Corporation (NVDA)

Nvidia hit as White House blocks sales of new AI chip to China

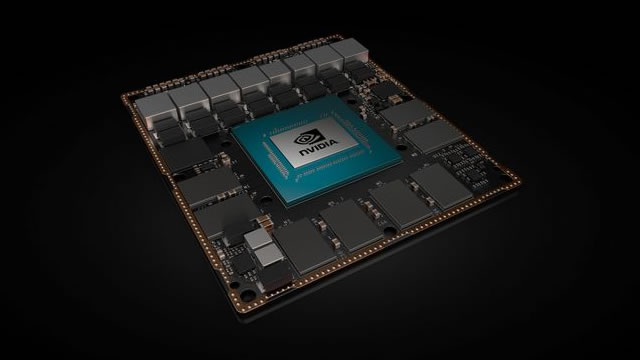

Nvidia Corp (NASDAQ:NVDA, ETR:NVD) shares dropped nearly 4% after reports that the White House has barred the company from selling its latest scaled-down AI chip, the B30A, to China. According to The Information, the chip had already been sampled by several Chinese firms and is powerful enough to train large language models when deployed in clusters, a key capability for China's tech industry.

Nvidia CEO says company not planning to ship anything to China

Nvidia CEO Jensen Huang said on Friday, upon arriving in the city of Tainan for his fourth public visit to Taiwan this year, that the U.S. AI chipmaker did not plan to ship anything to China but hoped to serve the Chinese market again in the future.

3 Small AI Stocks Ready to Explode (All Under $20)

If you've ever wished you'd caught the internet boom early—or owned shares of a company like NVIDIA NASDAQ: NVDA before it became a $5 trillion tech behemoth—this one's for you.

Nvidia: Now Is The Time To Double Down (Upgrade)

Nvidia Corporation appears expensive at first glance, but its growth prospects make it a strong value play relative to peers. NVDA's forward earnings and PEG ratios show that its high multiples are justified by exceptional growth expectations. Within the semiconductor sector, Nvidia offers far superior EBITDA growth for roughly the same valuation as competitors.

Nvidia CEO warns 'China is going to win the AI race': report

Nvidia CEO Jensen Huang warns China could win AI race due to Western cynicism and excessive regulations, citing energy subsidies and fewer hurdles as advantages for China.

Republican US lawmakers applaud Trump for holding back Nvidia chips from China

A group of eight Republican U.S. senators in a letter on Thursday applauded President Donald Trump's decision to continue denying China access to Nvidia's most advanced artificial intelligence chips.

AI Supercharger: Why Is NVDA-ORCL-DOE Deal a Bull Signal for Tech ETFs?

Nvidia and Oracle's DOE-backed AI supercomputer project fuels optimism for tech ETFs, like TRFK and XLK, poised to ride the next wave of AI growth.

Nvidia boss warns US risks losing AI lead to China

Nvidia Corp (NASDAQ:NVDA, ETR:NVD) chief executive Jensen Huang has warned that China is on the verge of overtaking the United States in the global race for artificial intelligence dominance. Speaking at the Financial Times Future of AI Summit, Huang said Beijing's heavy subsidies for energy and technology were accelerating progress by local firms, while US regulations risked stifling innovation.

AI predicts Nvidia stock price for November 30, 2025

As Nvidia (NASDAQ: NVDA) stock faces short-term bearish price movement, an artificial intelligence (AI) model is projecting the equity is likely to trade above $200 by the end of November.

Nvidia boss defends AI against claims of bubble by 'Big Short' investor

Nvidia boss Jensen Huang has told Sky News the AI sector is a "long, long away" from a Big Short-style collapse.

Nvidia chief to meet UK tech secretary as AI investment push gathers pace

Nvidia chief executive Jensen Huang is due to meet Technology Secretary Liz Kendall on Wednesday during a visit to the UK, where the chipmaker is eyeing further expansion, according to Sky News. The meeting comes as the US company, which leads the global market for artificial intelligence chips, positions Britain as a key growth territory.

NVIDIA, Qualcomm join U.S., Indian VCs to help build India's next deep tech startups

NVIDIA and Qualcomm Ventures have joined a growing coalition of U.S. and Indian investors backing India's deep tech startups. The group launched in September with more than $1 billion in commitments, timing that aligns with India's new ₹1 trillion (around $12 billion) research and development initiative.