NVIDIA Corporation (NVDA)

Nvidia's Real Risk: Hardware That Ages Too Fast?

Michael Burry, the renowned investor known for predicting the 2008 housing crash, is once again placing bets against a seemingly unbeatable market. This time, he is focusing on the AI sector, particularly the valuations of Nvidia (NASDAQ:NVDA) and the hyperscalers purchasing its chips.

Nvidia's Growth Engine Is Far Bigger Than The Market Realizes

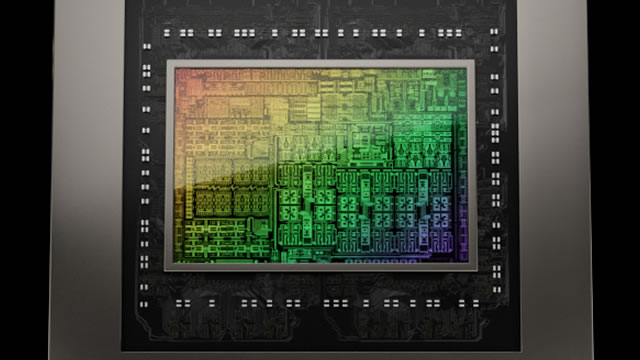

Nvidia remains a Buy, driven by unmatched AI leadership, record financials, and a deep ecosystem that competitors struggle to replicate. NVDA's data center and AI businesses are booming, with 62% sales growth, 73%+ margins, and strong partnerships fueling expansion into new markets like robotics. Valuation is high but justified by rapid profit growth, massive cash generation, and a robust buyback program; risks include inventory build and regulatory shifts.

A 'seismic' Nvidia shift, AI chip shortages and how it's threatening to hike gadget prices

The AI infrastructure buildout is creating shortages of components including various types of chips. Prices of some components like advanced memory have surged.

2 Fast-Growing AI Stocks That Could Become the Next NVIDIA

Palantir's soaring AIP demand and Micron's HBM momentum spotlight two AI players outpacing NVIDIA's stunning 2025 rally.

GOOGL "Platform Game" Against NVDA, Price "Reasonable" to A.I. Peers

John Buckingham considers Alphabet (GOOGL) "growth at a reasonable price stock" compared to its A.I. peers. While he calls Nvidia (NVDA) the "clear" leader in the space, John says Alphabet is a buy even at current levels.

Nvidia's stock is almost historically cheap — and that's a good sign for bulls

History suggests Nvidia's valuation multiple can expand meaningfully from here, according to a BofA analyst.

NVIDIA's 13F Reveals 2 Q3 Winners—And 1 Painful Miss

With a market capitalization of $4.3 trillion, semiconductor giant NVIDIA NASDAQ: NVDA is the most valuable publicly traded company in the world. NVIDIA is also viewed by many as the world's most important company.

Nvidia releases open-source software for self-driving car development

Nvidia on Monday released new open-source software aimed at speeding up the development of self-driving cars using some of the newest "reasoning" techniques in artificial intelligence.

Time to Sell Nvidia Stock as Michael Burry Takes Aim?

Nvidia (NASDAQ:NVDA) stock has been through plenty of rough patches before, but something certainly feels more ominous this time around, with shares failing to sustain a rally after a record quarter and an upbeat tone from its CEO, Jensen Huang.

Nvidia: Strong Business Momentum Offset By Broader Sector Concerns - Hold

Nvidia Corporation reported decent third quarter results with both sales and profitability coming in ahead of expectations. The data center segment remains NVDA's key growth driver, with sales up by 66.4% year-over-year and 24.6% quarter-over-quarter. NVDA provided very strong Q4 guidance well above consensus expectations, with year-over-year sales growth expected to accelerate further.

Nvidia's Latest $2 Billion Deal: Defying Short Sellers or Digging a Deeper Hole?

Nvidia ( NASDAQ:NVDA ) is facing intensifying scrutiny over allegations of circular financing in its AI chip ecosystem.

The Bull Case on Why Nvidia's Recent Results Are a Strong Buy Signal

I think we're going to be entering a very interesting period of time for a whole host of high-growth stocks in the market.