Graniteshares 2x Long Nvidia Daily ETF (NVDL)

NVDL: A Leveraged Nvidia Bet

The GraniteShares 2x Long NVDA Daily ETF offers leveraged exposure to Nvidia, ideal for investors bullish on AI-driven gains. Nvidia's explosive growth in AI GPUs and free cash flow makes leveraged exposure attractive, but the ETF is high-risk and suitable only for highly risk-tolerant investors. NVDL has delivered strong net asset value returns since inception, but it can underperform Nvidia over time due to beta-slippage.

NVDL: How To Play An NVDA Breakout And A $220 Stock Target

I maintain my buy rating on GraniteShares 2x Long NVDA Daily ETF, as Nvidia's technicals and bullish seasonality suggest further upside despite the recent rally. NVDA stock's valuation remains reasonable given its growth trajectory, with a potential breakout above $153 targeting $220 long-term. Leveraged ETFs like NVDL are risky and best suited for knowledgeable, active traders seeking short-term opportunities in NVDA's momentum.

NVDL: Trump's Chip Restriction Is An Opportunity, NVDA Washed Out (Rating Upgrade)

The Magnificent Seven stocks have stumbled in 2025, while defensive niches like gold miners have surged, with gold miners up 55% YTD. I am upgrading the GraniteShares 2x Long NVDA Daily ETF to a buy, seeing NVDA as washed out and undervalued below $90. May has been NVDA's best month on the calendar, and earnings are on tap.

What's behind the explosion in leverage and inverse ETFs

Investors are not shying away from taking on more risk and are now turning to leveraged and inverse ETFs. Douglas Yones, Direxion CEO, and Todd Rosenbluth, VettaFi head of research, sit with CNBC's Bob Pisani to dig into the investors leading the charge, the products dominating the market and the growth of single-stock ETFs.

Top-Performing Leveraged ETFs of Last Week

These equity-based inverse/leveraged ETFs topped last week despite a downbeat market.

NVDL: Patience Required As NVIDIA Shares Fall Amid DeepSeek, Tariff Jitters

I have a hold rating on NVDL, but would upgrade if NVDA shares approach long-term support at $100. NVDA's current valuation is attractive, trading near 25-30x forward EPS, but NVDL's leveraged nature makes it a short-term play. February's historical strength and upcoming Q4 earnings report could be pivotal for NVDA and NVDL's performance.

NVDL: Pain Still Awaits

Despite a poor initial call, I believe NVDL long positions face potential pain due to NVDA's slowing growth and high valuation. NVDL is suitable for short-term trading but underperforms NVDA long-term, especially during market volatility. NVDA's revenue growth, is impressive but slowing, with valuation metrics indicating overvaluation.

Is NVDL Worth The Risk?

NVDL offers 2x daily leveraged exposure to Nvidia stock, ideal for short-term trades but risky for long-term investments due to decay and volatility. Despite impressive recent performance, NVDL's returns can be diminished by daily rebalancing and market volatility, making it unsuitable for buy-and-hold strategies. NVDA's high valuation and volatility amplify risks for NVDL investors, emphasizing the need for caution and thorough understanding of leveraged ETFs.

Tradepulse Power Inflow Alert: NVDL, Graniteshares 2X Long NVDA Daily ETF Rises 6% After Signal

GraniteShares 2x Long NDVA , (NVDL) today experienced a Power Inflow, a significant event for those who follow where smart money goes and value order flow analytics in their trading decisions.

NVDL: Pain Awaits

Leveraged ETFs, like GraniteShares 2x Long NVDA Daily ETF, are risky and should be held only during strong uptrends and for shorter periods of time. The NVDL ETF has delivered impressive returns, outperforming its 2x goal since inception, but this performance is likely an outlier due to Nvidia's exceptional bull run. Sentiment signals, technical analysis, and company valuation suggest Nvidia's growth may be priced in, indicating downside in NVDL.

NVDL: A Way To Use Nvidia's Stock Market Influence (And It Isn't 'Trading')

Nvidia Corporation's influence on the market is undeniable; monitoring it is essential for portfolio management to avoid collateral damage and capitalize on opportunities. Leveraged and inverse ETFs like GraniteShares 2x Long NVDA Daily ETF offer tactical ways to gain exposure to Nvidia, balancing risk and enhancing returns in a diversified portfolio. Tactical rotation and strategic options use are key to capturing upside while managing risk, especially with high-volatility stocks like Nvidia.

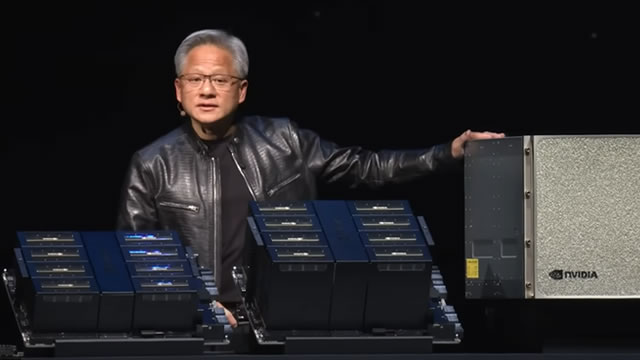

Leveraged Nvidia ETF issuers saw trading surge in bearish products ahead of earnings

Interest in leveraged exchange-traded funds that allow investors to profit when shares of Nvidia fall grew steadily ahead of the chipmaker's quarterly results, according to data from some of the companies that issued the products.