NXP Semiconductors N.V. (NXPI)

NXP Semiconductors (NXPI) Beats Stock Market Upswing: What Investors Need to Know

NXP Semiconductors (NXPI) closed the most recent trading day at $219.84, moving +0.87% from the previous trading session.

Why Is NXP (NXPI) Up 1.7% Since Last Earnings Report?

NXP (NXPI) reported earnings 30 days ago. What's next for the stock?

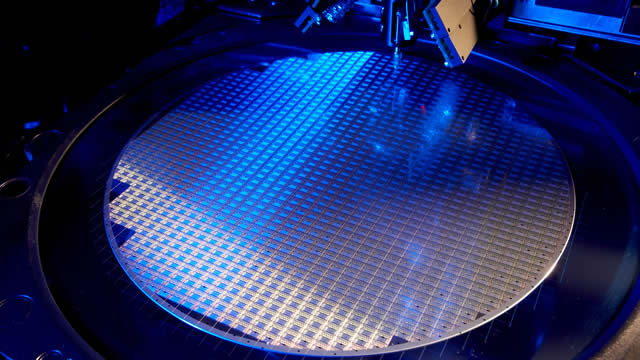

VSMC Celebrates Breaking Ground on 300mm Fab in Singapore

Initial production slated for 2027, expected output of 55,000 300mm wafers per month in 2029 Initial production slated for 2027, expected output of 55,000 300mm wafers per month in 2029

NXPI Sets "Cautious Tone" of A.I.'s "Uncertain Picture"

Uneven earnings and forecasts are why Kim Forrest isn't entirely buying the A.I. craze. Disappointing outlook from NXP Semiconductors (NXPI) proved as the latest example.

NXPI Q3 Earnings Beat, Revenues Miss, Shares Down on Weak Q4 View

NXP Semiconductor's Q3 2024 results suffer from weakness in the Automotive and Communication Infrastructure segments.

NXP Semiconductors N.V. (NXPI) Q3 2024 Earnings Call Transcript

NXP Semiconductors N.V. (NASDAQ:NXPI ) Q3 2024 Earnings Conference Call November 5, 2024 8:00 AM ET Company Participants Jeff Palmer - SVP, IR Kurt Sievers - Executive Director, President, and CEO Bill Betz - EVP and CFO Conference Call Participants Ross Seymore - Deutsche Bank Christopher Caso - Wolfe Research Vivek Arya - Bank of America Christopher Muse - Cantor Fitzgerald Stacy Rasgon - Sanford C.

NXPI Short-Circuits, WYNN Miss, Investors Bite QSR & Feed YUM

NXP Semiconductors (NXPI) sold off after reporting soft guidance, as did Wynn Resorts (WYNN) for a miss on its top and bottom line. On the food front, investors weren't impressed with Restaurant Brands (QSR) but backed Yum!

NXP (NXPI) Q3 Earnings: Taking a Look at Key Metrics Versus Estimates

The headline numbers for NXP (NXPI) give insight into how the company performed in the quarter ended September 2024, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

NXP Semiconductors (NXPI) Beats Q3 Earnings Estimates

NXP Semiconductors (NXPI) came out with quarterly earnings of $3.45 per share, beating the Zacks Consensus Estimate of $3.43 per share. This compares to earnings of $3.70 per share a year ago.

NXPI Set to Report Q3 Earnings: What's in Store for the Stock?

NXP Semiconductors' Q3 results are likely to reflect benefits from an expanding portfolio despite ongoing inventory corrections in the Automobile end market.

Ahead of NXP (NXPI) Q3 Earnings: Get Ready With Wall Street Estimates for Key Metrics

Beyond analysts' top -and-bottom-line estimates for NXP (NXPI), evaluate projections for some of its key metrics to gain a better insight into how the business might have performed for the quarter ended September 2024.

Can NXPI's Expanding Portfolio & Clientele Push the Stock Higher?

NXP Semiconductors' inventory corrections and macroeconomic uncertainties keep investors on the sidelines, despite an expanding portfolio.