Palo Alto Networks, Inc. (PANW)

Palo Alto Networks: Cybersecurity Standout in a Turbulent Market

In a year dominated by fear and risk-off sentiment in the markets, not all sectors and industries are performing equally. While the overall market has declined 7.5% from its 52-week high, the technology sector has fared worse, with the QQQ ETF dropping nearly 11% from its peak.

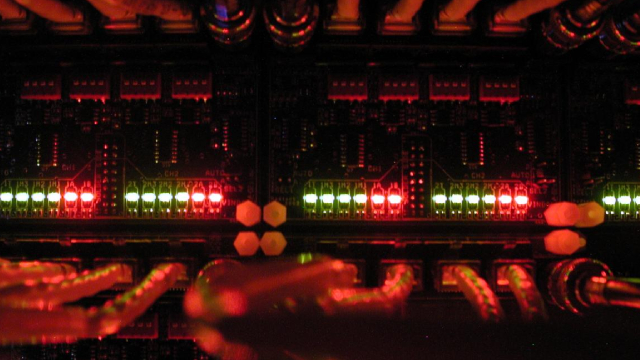

PANW Expands Cloud Infrastructure in Asia-Pacific Region

Palo Alto Networks expands its cloud infrastructure across Australia, India, Indonesia, Japan and Singapore.

Should You Buy Palo Alto Stock at Current Prices?

Palo Alto's (PANW 1.02%) unique approach to customer acquisition is showing promising early results.

3 Growth Stocks That Could Help Make You a Fortune

Over the past year, many growth stocks retreated from their all-time highs amid concerns of unpredictable tariffs and elevated interest rates. Many of those investors flocked back toward conservative blue chip stocks and other safe haven investments.

Here is What to Know Beyond Why Palo Alto Networks, Inc. (PANW) is a Trending Stock

Recently, Zacks.com users have been paying close attention to Palo Alto (PANW). This makes it worthwhile to examine what the stock has in store.

Palo Alto Networks, Inc. (PANW) Morgan Stanley Technology, Media & Telecom Conference (Transcript)

Palo Alto Networks, Inc. (NASDAQ:PANW ) Morgan Stanley Technology, Media & Telecom Conference March 5, 2025 6:20 PM ET Company Participants Nikesh Arora - CEO Conference Call Participants Keith Weiss - Morgan Stanley Keith Weiss Excellent. Thank you, everyone, for joining us.

Is Trending Stock Palo Alto Networks, Inc. (PANW) a Buy Now?

Palo Alto (PANW) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

AI, Platform Consolidation, Big Money Lift Palo Alto

AI-driven security offerings, platform consolidation, Big Money have shares of cybersecurity leader Palo Alto Networks, Inc. (PANW) rising.

This Recent Stock-Split Just Hit a New All-Time High. Should You Buy This AI Cybersecurity Leader?

Palo Alto Networks (PANW -3.91%) has a ton going for it right now. It enacted a 2-for-1 stock split in December and recently notched a new all-time high after reporting strong Q2 FY 2025 (ending Jan. 31) results.

Is Palo Alto Networks Stock a Buy Now?

Palo Alto Networks (PANW -3.91%) released its fiscal 2025 second-quarter results (for the three months ended Jan. 31, 2025) on Feb. 13. Investors' initial reaction to the report was a negative one as the company's earnings outlook fell below expectations.

Palo Alto's Platformization Strategy Delivers - Expensive Valuation Remains A Headwind

PANW's platformization strategy has delivered the new growth opportunity as intended, thanks to the free extended rollout period. These have already been accretive to its top/ bottom-lines and multi-year remaining performance obligations, providing great insights to its long-term prospects. Combined with the generative AI boom, multi-year cloud super cycle, and the growing enterprise need for cybersecurity offerings, we can understand the stocks' recent outperformance.

Palo Alto Networks: Share Price And Fundamentals Continue To Diverge

Palo Alto Networks' growth has reaccelerated in recent quarters, supported by improved hardware demand and continued strength from its next-gen portfolio. While growth is likely to improve again in the third quarter, I expect Palo Alto's growth to stabilize in the mid-teens. This growth must also be viewed in light of Palo Alto's platformization strategy and heavy use of incentives to create growth, which is impacting the company's profitability and cash flows.