PG&E Corporation (PCG)

Are Investors Undervaluing PG&E (PCG) Right Now?

Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

PCG vs. NEE: Which Stock Is the Better Value Option?

Investors with an interest in Utility - Electric Power stocks have likely encountered both PG&E (PCG) and NextEra Energy (NEE). But which of these two stocks is more attractive to value investors?

Here's Why PCG Stock Deserves a Spot in Your Portfolio Right Now

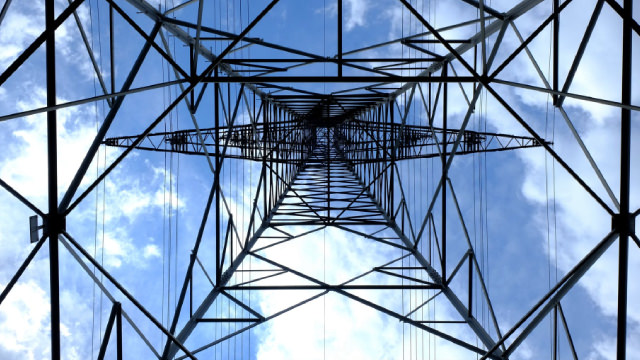

PCG has a massive $73B grid modernization plan aimed at driving long-term growth and expanding clean-energy capacity.

Is PG&E (PCG) Stock Undervalued Right Now?

Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

PCG vs. CNP: Which Stock Should Value Investors Buy Now?

Investors looking for stocks in the Utility - Electric Power sector might want to consider either PG&E (PCG) or CenterPoint Energy (CNP). But which of these two stocks presents investors with the better value opportunity right now?

Is PG&E (PCG) a Great Value Stock Right Now?

Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

PG&E Corporation (PCG) Q3 2025 Earnings Call Transcript

PG&E Corporation (NYSE:PCG ) Q3 2025 Earnings Call October 23, 2025 11:00 AM EDT Company Participants Jonathan Arnold - Vice President of Investor Relations Patricia Poppe - CEO & Director Carolyn Burke - CFO & Executive VP Conference Call Participants Steven Fleishman - Wolfe Research, LLC David Arcaro - Morgan Stanley, Research Division Julien Dumoulin-Smith - Jefferies LLC, Research Division Carly Davenport - Goldman Sachs Group, Inc., Research Division Aidan Kelly - JPMorgan Chase & Co, Research Division Gregg Orrill - UBS Investment Bank, Research Division Presentation Operator Ladies and gentlemen, thank you for standing by. My name is Christa, and I will be your conference operator today.

PG&E 2026 profit forecast beats expectations amid strong power demand

Utility firm PG&E forecast its full-year 2026 profit narrowly above Wall Street expectations on Thursday, on the back of soaring power demand.

Here's Why You Should Include PCG Stock in Your Portfolio Now

PG&E's aggressive grid upgrades, green energy push and steady returns make it a standout utility investment pick.

PG&E: Buy The Weakness

PG&E is a major California utility with a $35B market cap, now positioned as a lower-risk investment after years of wildfire challenges. PCG benefits from California's $18B wildfire fund, reduced liability share, and ongoing undergrounding of power lines to mitigate future wildfire risks. A massive capital plan targets datacenter growth and wildfire hardening, with ratepayer support and potential for significant electric bill reductions.

PG&E bets big with $70bn spending pledge

PG&E Corp (NYSE:PCG) is betting big on the power of data. The California utility said Monday it plans to invest $73 billion in transmission upgrades by 2030 as data centers fuel an unprecedented surge in electricity demand.

PG&E unveils $73 billion spending plan to meet surging data-center energy demand

U.S.-based utility PG&E Corp said on Monday it plans to spend $73 billion by 2030 for transmission upgrades to meet the data center-led surge in electricity demand.