PepsiCo, Inc. (PEP)

PepsiCo CEO's Tall Order: Win Over Investor Calling for Strategy Reset

Ramon Laguarta is contending with Elliott Investment Management's push to reverse a soda-sales slump and refranchise bottling operations.

Elliott's plan for PepsiCo includes investing in some of its iconic brands, shedding others

Elliott Investment Management says PepsiCo neglected its core soda brands and is selling way too many products.

Pepsi Has Lost Its Bubbles. Elliott Wants to Make It Pop Again.

A recovery in Pepsi's valuation could lift shares by more than 50%, one activist investor says.

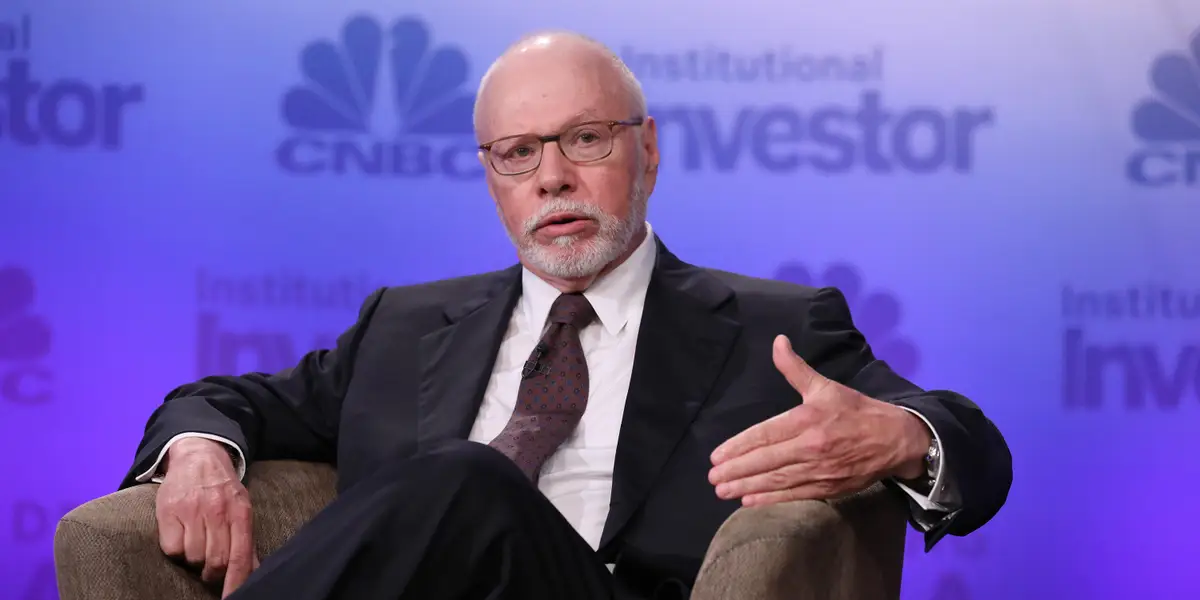

Feared activist investor Elliott Management took a $4 billion stake in Pepsi. That shouldn't scare the CEO.

Billionaire Paul Singer's Elliott Management took a $4 billion stake in conglomerate Pepsi. The feared activist investor believes the company's stock could rise by more than 50%, Elliott wrote in a letter to Pepsi.

Activist Elliott wants PepsiCo to emulate Coke's playbook. This is why.

Activist Elliott Investment Management has amassed a $4 billion stake in PepsiCo and wants the consumer-goods giant to take a leaf out of Coca-Cola's book.

PepsiCo Eyes Efficiency Gains: Can It Protect Margins Amid Inflation?

PEP posts a Q2 EPS beat and turns to AI, integration and global centers to drive efficiency and protect margins.

PepsiCo's Q3 Test: Can PBNA Gains Outweigh Frito-Lay Struggles?

PEP heads into Q3 with strong PBNA momentum, but Frito-Lay's volume struggles may test its balanced growth outlook.

PepsiCo: Dividend Supported Buy Amid Valuation Lows And Product Transitions

PepsiCo faces headwinds from commodity volatility, tariffs, and health trends, but current multi-year low valuations offer a value Buy for income-focused investors. Growth is challenged by stagnating North American sales and rising competition, but international segments and institutional support provide some offsetting strength. Margins are pressured by input costs and investment in healthier products, with execution and productivity initiatives key to future improvement.

PepsiCo: Continued Share Losses Mandate A Downgrade

Downgrading PepsiCo to 'Hold', as my expectations for a 2025 growth recovery have not materialized with continued volume and earnings declines. Staple sector faces structural headwinds: minimal population growth, rising competition, health trends, and supply chain pressures are weighing on profitability and growth. PepsiCo is underperforming peers like Coca-Cola and Mondelez in both revenue and market share growth, with disappointing recent results and guidance.

PepsiCo (PEP) Suffers a Larger Drop Than the General Market: Key Insights

PepsiCo (PEP) closed at $148.98 in the latest trading session, marking a -1.16% move from the prior day.

PepsiCo vs. Keurig: Which Beverage Giant Is a Refreshing Pick?

PEP and KDP take different paths to growth, which are global scale versus regional focus, shaping their rivalry in the evolving beverage market.

Is PepsiCo's Frito-Lay Snacks Unit Still the Star Performer?

PEP beats Q2 expectations with pricing power. However, soft volumes and long-term growth questions loom.