Pfizer Inc. (PFE)

Here is What to Know Beyond Why Pfizer Inc. (PFE) is a Trending Stock

Zacks.com users have recently been watching Pfizer (PFE) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

PFE's Hympavzi Phase III Hemophilia Study With Inhibitors Meets Goal

Pfizer's Hympavzi meets key phase III goals, demonstrating a significant reduction in bleeding in hemophilia patients with inhibitors.

All You Need to Know About Pfizer (PFE) Rating Upgrade to Buy

Pfizer (PFE) has been upgraded to a Zacks Rank #2 (Buy), reflecting growing optimism about the company's earnings prospects. This might drive the stock higher in the near term.

Pfizer Could Be The Turnaround Story In The Pharmaceutical Space

Pfizer's post-pandemic revenue decline is temporary; new launches like Abrysvo and Adcetris, plus Seagen integration, position it for a 2025 turnaround. Valuation is compelling: Pfizer trades at deep discounts on P/E, EV/EBITDA, and P/B, with a strong 8.2% FCF yield and sector-leading 7% dividend. Risks include patent cliffs, U.S. drug price regulation, and R&D setbacks, but robust margins and pipeline support long-term growth.

Don't Sleep On Pfizer: The Turnaround Is Just Getting Started

Despite a revenue miss, Pfizer's Q1 earnings crushed estimates due to aggressive, structural cost-cutting, signaling a powerful shift towards operational and margin excellence. Management is expanding its cost-savings program to a massive $7.7 billion by 2027, aiming to create a powerful EPS growth story despite flat revenues. Pfizer's non-COVID portfolio is firing on all cylinders, with key drugs like Nurtec and Padcev showing robust double-digit growth, proving underlying business health.

Pfizer (PFE) Surpasses Market Returns: Some Facts Worth Knowing

In the closing of the recent trading day, Pfizer (PFE) stood at $24.31, denoting a +1.17% move from the preceding trading day.

Pfizer vs BMY: Which Oncology Drugmaker Is a Better Choice for Now?

Pfizer's broader portfolio and higher dividend yield give it an edge over Bristol Myers in the oncology showdown.

Is Trending Stock Pfizer Inc. (PFE) a Buy Now?

Pfizer (PFE) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

Will Pfizer Slash Its >7% Yielding Dividend? I Wouldn't Rule It Out

Pfizer's >7% dividend yield is attractive, but faces significant risk due to political, regulatory, and business headwinds impacting revenue and profitability. Major threats include U.S. healthcare policy changes, looming patent expiries, misfiring M&A, heavy debt, and over-reliance on COVID vaccine revenues. Management insists the dividend is safe barring a 'catastrophe,' but current challenges feel borderline catastrophic, making a cut plausible if pressures persist.

Pfizer: An Offensive Play For A Bear Market

The market has become overly pessimistic on Pfizer, focusing on the patent cliff while ignoring the defensive cash flows and offensive catalysts. This has created a classic value opportunity. A fortress 7% dividend yield provides a powerful downside cushion. We analyze the cash flows to show why this payout is secure and offers a compelling return. We model a 'revenue bridge' to demonstrate how Pfizer's underappreciated pipeline in oncology, vaccines, and I&I is poised to more than fill the gap left by major expirations like Eliquis.

Is It Time to Invest in Pfizer? Exploring its 7% Dividend Yield and Growth Potential

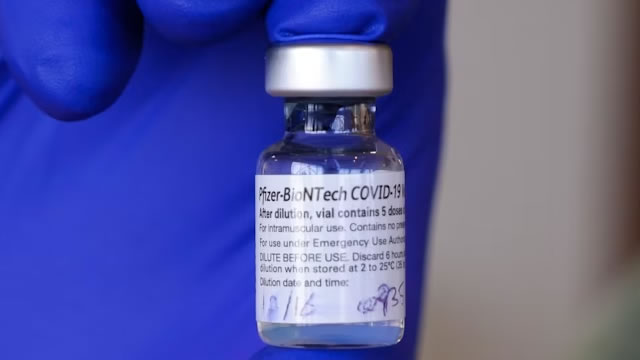

Pfizer (NYSE:PFE) stock is a biopharmaceutical firm that had a magnificent breakout in 2021 as the worst of the pandemic sent COVID vaccine demand through the roof.

Pfizer Boasts Strong Oncology Portfolio: Can it Sustain Growth?

PFE's oncology portfolio, boosted by Seagen and late-stage pipeline assets, may fuel growth amid lackluster stock performance.