Pinterest, Inc. Class A (PINS)

Pinterest Shares Soar on Strong Outlook. Is It Too Late to Buy the Stock?

Shares of Pinterest (PINS -1.19%) soared after the social media company reported strong results and issued an upbeat forecast. This flips the script for a stock that had come under pressure its prior two quarters due to weak guidance.

Pinterest: Margins Are Supportive Of Further Upside

Pinterest's share price surged nearly 20% post-Q4 earnings, driven more by overly bearish sentiment than exceptionally strong earnings. The digital advertising market remains robust, with Pinterest showing strong ad impressions growth somewhat offset by a decline in ad pricing. Pinterest's focus on engagement and monetization is yielding results, with significant improvements in user growth, engagement, and ad performance.

Pinterest, Inc. (PINS) Is a Trending Stock: Facts to Know Before Betting on It

Recently, Zacks.com users have been paying close attention to Pinterest (PINS). This makes it worthwhile to examine what the stock has in store.

Should Investors Buy Pinterest Stock After Spectacular Earnings Results?

Pinterest (PINS -0.27%) reported excellent growth in the highly coveted North American segment of social media users.

Pinterest: From Inspiration Hub To Monetization Machine

I appreciate Pinterest, Inc.'s effort to position itself as an inspirational platform rather than just another social media app. I'm excited by the potential for PINS to reach 20% topline growth in 2025, which could reignite investor enthusiasm. I value Pinterest's debt-free balance sheet, which provides a layer of safety for this investment.

International Markets and Pinterest (PINS): A Deep Dive for Investors

Explore Pinterest's (PINS) international revenue trends and how these numbers impact Wall Street's forecasts and what's ahead for the stock.

Buy, Sell, Or Hold PINS Stock At $40?

Pinterest stock (NYSE: PINS) recently released its Q4 results, with revenue slightly above but earnings missing the street estimates. It reported sales of $1.15 billion and adjusted earnings of $0.56 per share, compared to the consensus estimates of $1.14 billion and $0.64, respectively.

Pinterest: Believe This Rally

Pinterest, Inc. stock surged after strong earnings, showing robust user growth and beating revenue guidance despite tough third-party advertiser comparisons. The company maintains a pristine balance sheet with no debt. Management guidance came sharply ahead of consensus estimates.

Pinterest CEO Bill Ready: AI helped drive recommendations to our users

CNBC's Julia Boorstin sits down with Pinterest CEO Bill Ready to discuss the company's most recent earnings, what factors will drive growth this year, and more.

Pinterest stock price: PINS shares skyrocket after the company surpasses $1 billion in quarterly sales

Pinterest shares (NYSE: PINS) are skyrocketing in premarket trading this morning after the company announced Q4 results for its fiscal 2024 yesterday. PINS stock is currently up over 22% to above $41 per share as of the time of this writing.

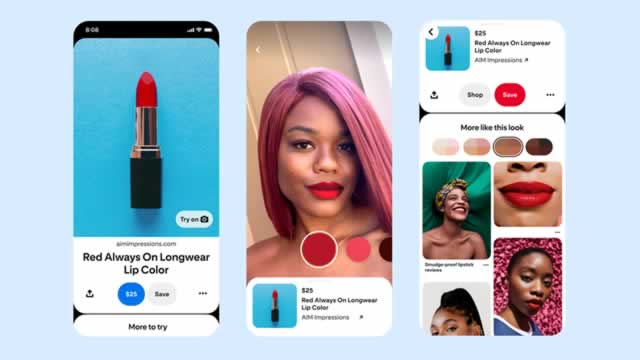

Pinterest's AI Push & Shoppable Ads Fuel Optimistic Outlook—Why Analysts Are Bullish

Pinterest, Inc. PINS shares are trading higher on Friday.

Pinterest Q4 Earnings Fall Short of Estimates, Revenues Rise Y/Y

PINS reports solid revenue growth in the fourth quarter of 2024. However, weakness in the food and beverage category remains a headwind.