Pinterest, Inc. Class A (PINS)

3 High Growth Revenue Stocks That Wall Street Loves

Investors looking for growth stock momentum in a challenging macroeconomic environment may want to focus on companies showing consistent revenue gains. As the broader economy presents challenges to everyday consumers, sending sentiment to multi-year lows, firms that are still winning at sales stand out.

Pinterest: Valuation Makes No Sense, Focus On International Momentum (Upgrade)

Pinterest is now valued as a value stock despite strong revenue and earnings growth, a net cash balance sheet, and aggressive share repurchases. PINS trades at just 13x forward earnings, with double-digit growth expected, and pessimism appears overdone given its profitability and ongoing buybacks. While PINS underperforms Meta Platforms, international monetization and margin expansion offer upside, with 12%-18% annual returns projected over five years.

Pinterest: Focus On User Expansion, Not Near-Term Headwinds

Pinterest presents a compelling dip-buying opportunity, as macro headwinds and weak ad demand have driven shares down sharply, despite healthy U.S. user growth. Slowing revenue is driven by cyclical macro headwinds, as brands pull back their advertising budgets. This is more of a near-term reduction rather than a structural concern. At current valuations, PINS trades well below social media peers, with a solid balance sheet and resilient EBITDA margins supporting the investment case.

Australia adds Amazon's Twitch to teen social media ban, spares Pinterest

Australia's internet watchdog on Friday said it would include Amazon.com-owned live streaming service Twitch in its upcoming teen social media ban, but will not add image-sharing platform Pinterest to the list.

Pinterest Rides on Solid ARPU Growth: Will the Uptrend Continue?

PINS' rising ARPU across regions and expanding Gen Z user base spotlight its momentum as AI-driven personalization lifts engagement.

Why Pinterest (PINS) International Revenue Trends Deserve Your Attention

Explore how Pinterest's (PINS) revenue from international markets is changing and the resulting impact on Wall Street's predictions and the stock's prospects.

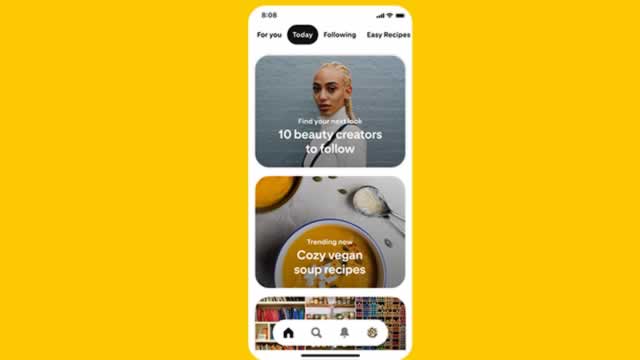

Google takes on Pinterest with a dedicated ‘inspirational' images tab in its mobile app

Google is adding a new feature to its mobile app that could potentially challenge Pinterest in becoming users' first stop for inspirational imagery: a dedicated images tab. The company announced on Wednesday it is introducing a new “Images” icon at the bottom of Google's Search app for iOS and Android devices that will display images personalized to the user's interests.

Investors Heavily Search Pinterest, Inc. (PINS): Here is What You Need to Know

Pinterest (PINS) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

Pinterest Down 16.6% in 6 Months: Should it Be in Your Portfolio?

PINS' 16.6% slide contrasts with industry gains, as rising costs, stiff competition and bearish revisions cloud its outlook.

Wall Street Analysts Think Pinterest (PINS) Is a Good Investment: Is It?

The recommendations of Wall Street analysts are often relied on by investors when deciding whether to buy, sell, or hold a stock. Media reports about these brokerage-firm-employed (or sell-side) analysts changing their ratings often affect a stock's price.

Pinterest Q3 Earnings Miss Estimates Despite Y/Y Revenue Growth

PINS' Q3 revenues climb 17% to a record $1.05B as AI-driven ad tools boosted engagement, though earnings narrowly missed estimates.

Pinterest plunges 20% after weak results as tariffs drag on ad revenue

Pinterest shares plummeted 20% on Wednesday after lackluster third-quarter earnings that fell short of Wall Street estimates and tariff-related ad headwinds. Several banks lowered their price targets following the earnings report.