PayPal Holdings Inc. (PYPL)

PayPal: Time To Buy Before It Rebounds Further

PayPal's strategic pivot towards a unified commerce platform is gaining traction, halting margin bleed and improving transaction margins despite fierce competition. Management's focus on profitable branded experiences and Venmo, rather than low-margin growth, is showing early signs of success and buying time for transformation. Valuation remains above sector peers, so continued execution is critical to avoid multiple compression, especially amid economic and trade uncertainties.

The PayPal Paradox

PayPal processed $417.2B in TPV during Q1 2025, with branded checkout growing 6% YoY on a leap-day adjusted basis. Transaction margin dollars rose 7% YoY to $3.7B, with TM margin expanding 274 basis points to 47.7%, signaling healthier economics. Venmo TPV surged over 50%, driving 20% revenue growth and 40% MAU growth in debit cards, reinforcing monetization progress.

PayPal vs. Block: Which Fintech Stock is a Stronger Buy Right Now?

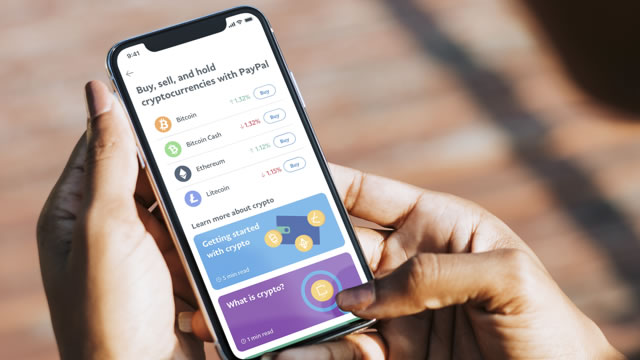

PayPal PYPL and Block XYZ are well-known providers of digital payments in the rapidly evolving fintech sector. Both offer peer-to-peer payments, Buy Now Pay Later (BNPL) solutions and a cryptocurrency buy-sell platform.

Here is What to Know Beyond Why PayPal Holdings, Inc. (PYPL) is a Trending Stock

Zacks.com users have recently been watching Paypal (PYPL) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

2 High Growth Buy Now, Pay Later Stocks Challenging PayPal

Recent earnings show that the buy now, pay later (BNPL) business model is growing rapidly. One of the most established players in the payments space with BNPL offerings is PayPal NASDAQ: PYPL.

Tariffs Calm Down, PayPal Heats Up - Initiating With A Buy

PayPal should cross into the $80s range now that tariffs are out of the picture, but fear of them coming back still looms. I think concerns over the economy, plus PayPal's checkout rebranding, should make the platform stickier for users to go with the "buy now, pay later" option. I also think that PayPal tapping into the "agentic" commerce business should boost its transaction volume.

PayPal Q1: A Nice Fit To Buffett 10x Pretax Rule

PayPal Holdings stock reported strong financials for its fiscal Q1 2025 and described multiple growth drivers. Key growth drivers include a new checkout experience, Venmo expansion, AI integration, scaling omni mode, etc. However, PYPL stock trades at only 10.8x pretax earnings based on EPS guidance, very close to the threshold in Buffett's 10x pretax rule.

PayPal: Strong Investment Setup

PayPal shares have dropped from $90 to $70 in 2025, creating a buying opportunity for a profitable Fintech. The Fintech also beat earnings estimates for Q1'25 and remained widely profitable on an operating income basis. Despite market fears, PayPal's operating income grew 16% Y/Y in Q1'25, driven by Venmo's growth and cost-cutting measures, making it an interesting Fintech play.

PayPal: The Cheapest It Has Ever Been

PayPal's Active Accounts reached an all-time high. Transaction Margin reached a 2-year high. Operating Profit reached an all-time high.

PayPal: Margins Are Improving, Strong Buy (Upgrade)

PayPal Holdings is a solid fintech investment with potential for growth, driven by increasing active accounts and improving transaction margins. The company reported $1.33 per share in non-GAAP profits for 1Q25, exceeding estimates, and reaffirmed its profit forecast for 2025. Positive trends in operating and transaction margins, coupled with a low valuation compared to peers, support a bullish outlook for PayPal.

Is Trending Stock PayPal Holdings, Inc. (PYPL) a Buy Now?

Zacks.com users have recently been watching Paypal (PYPL) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

Here's How the Coinbase-PayPal Stablecoin Deal Could Rock Crypto

Coinbase (COIN 1.77%) and PayPal (PYPL 2.81%) have teamed up to make the payment giant's stablecoin, PayPal USD (PYUSD -0.00%), easier to buy and use. Coinbase is one of the leading U.S. crypto exchanges, and PayPal is a major player in e-commerce and online payments.