PayPal Holdings Inc. (PYPL)

PayPal: Opportunity To Buy A Wonderful Company At A Fire‑Sale Price

This is a rare opportunity to buy a wonderful company at a wonderful price. PayPal Holdings, Inc. stock appears fundamentally undervalued, with forward P/E ratios suggesting a potential mispricing. Current analyst projections for PYPL indicate steady 5–7% growth, which is solid for a established market leader.

PayPal Stock Ready To Surge?

PayPal (PYPL) stock has lagged in recent years amid softer growth and rising competition, but its large user base, strong brand, and solid margins keep it on investors' radar. With the market revisiting undervalued fintech names, the question is whether PayPal is finally poised for a rebound.

PayPal's Agentic Commerce: How is it Preparing for This Revolution?

PYPL teams up with Perplexity on a new agentic shopping app, letting consumers buy from 5,000+ merchants through personalized AI-powered search.

PayPal Holdings, Inc. (PYPL) Presents at Citi's 14th Annual FinTech Conference Transcript

PayPal Holdings, Inc. ( PYPL ) Citi's 14th Annual FinTech Conference November 19, 2025 9:00 AM EST Company Participants James Chriss - President, CEO & Director Conference Call Participants Bryan Keane - Citigroup Inc., Research Division Presentation Bryan Keane Citigroup Inc., Research Division Thanks for coming to the session with PayPal. My name is Bryan Keane.

PayPal: Market Is Asleep On Agentic Commerce Rebirth

PayPal remains a strong buy due to solid earnings growth, a robust balance sheet, and aggressive share repurchases. PYPL's Q3 results beat guidance, with unbranded processing showing continued recovery. Despite macroeconomic concerns and conservative guidance, PYPL's partnerships and investments in agentic commerce and AI offer potential growth catalysts.

Can PayPal Stock Rebound From $60?

PayPal (PYPL) has spent the past few years unwinding its pandemic-era excesses, leaving the stock trading at a valuation far below its historical norms. Revenue growth has slowed, competition in digital payments has intensified, and investor sentiment has shifted toward newer fintech names.

PayPal vs. Block: Which Fintech Stock is a Better Buy Right Now?

PayPal's rising profitability and platform upgrades contrast with Block's rapid Cash App-driven growth in this fintech face-off.

PayPal Holdings, Inc. (PYPL) is Attracting Investor Attention: Here is What You Should Know

Recently, Zacks.com users have been paying close attention to Paypal (PYPL). This makes it worthwhile to examine what the stock has in store.

PayPal: A Solid GARP Stock Trapped In Consolidation (Technical Analysis And Downgrade)

PayPal delivered strong Q3 results, beating expectations and raising full-year EPS guidance, yet market response remained muted. PYPL is currently in a technical consolidation phase, with key resistance around $68-69 and declining trading volume signaling limited near-term momentum. Operation risks such as user engagement and margin pressure could prolong the consolidation.

PayPal Holdings, Inc. (PYPL) Presents at KBW Fintech Payments Conference 2025 Transcript

PayPal Holdings, Inc. ( PYPL ) KBW Fintech Payments Conference 2025 November 13, 2025 9:25 AM EST Company Participants Diego Scotti - Executive VP & GM of Consumer Group Conference Call Participants Sanjay Sakhrani - Keefe, Bruyette, & Woods, Inc., Research Division Presentation Sanjay Sakhrani Keefe, Bruyette, & Woods, Inc., Research Division I want to welcome Diego Scotti. He is the General Manager of PayPal's Consumer Group.

PayPal Uses UK Relaunch to Debut Rewards Program

PayPal said it is relaunching in the UK as a “unified payment experience.” The company's new offering, announced Wednesday (Nov. 12), is designed to improve shopping for British consumers, letting them access the new PayPal+ loyalty program, along with PayPal's debit and credit cards.

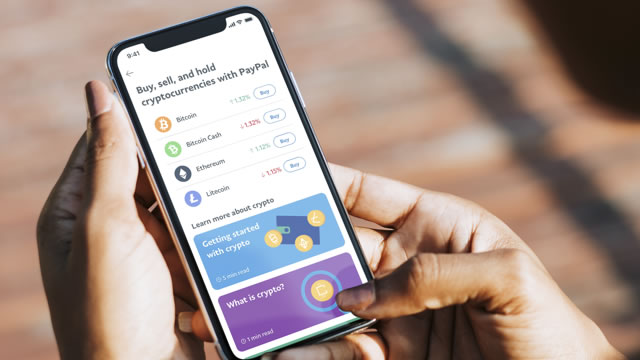

PayPal Expands Buy Now Pay Later: Can it Fuel Growth in 2025?

PYPL expands its "Pay in 4" BNPL service to Canada as global demand surges and strategic deals fuel momentum.