PayPal Holdings Inc. (PYPL)

PayPal Holdings, Inc. (PYPL) Is a Trending Stock: Facts to Know Before Betting on It

Paypal (PYPL) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

PayPal Holdings, Inc. (PYPL) Goldman Sachs Communacopia & Technology Conference 2024 (Transcript)

PayPal Holdings, Inc. (NASDAQ:PYPL ) Goldman Sachs Communacopia & Technology Conference 2024 September 9, 2024 11:50 AM ET Company Participants Alex Chriss - President, CEO Unidentified Analyst All right, everyone. Kicking off the conference today.

PayPal Launches Card Processing Partnership With Shopify

PayPal says it is expanding its partnership with eCommerce company Shopify. With this new collaboration, PayPal will become an additional online credit/debit processor for Shopify Payments via the PayPal Complete Payments solution, the company announced in a news release Monday (Sept.

Why PayPal's Latest Move Is a Big Win for Investors

PayPal struggled in recent years with slowing growth and declining margins. CEO Alex Chriss took over at the start of this year and has made it a transition year for the fintech.

Why PayPal Stock Jumped 10% in August

PayPal's new CEO is making broad changes that address consumer pain points. The results are showing up in higher revenue and improving profitability.

2 Beaten-Down Stocks to Buy and Hold

PayPal and Roku are not performing as well for investors as they were a few years ago. Still, both companies are leaders in industries ripe for growth.

Low Valuation, Strong Results, Upcoming Catalysts Make PayPal Stock A Buy

PayPal's strong Q2 results and increased Q3 guidance suggest market share concerns are overblown, making PYPL stock a buy for conservative investors. Despite competition from Apple Pay, PayPal's revenue, transaction margin dollars, and total payment volume all showed significant year-over-year growth. PayPal's relatively low valuation and the rapid growth of the digital payments market make its shares attractive, even with potential market share losses.

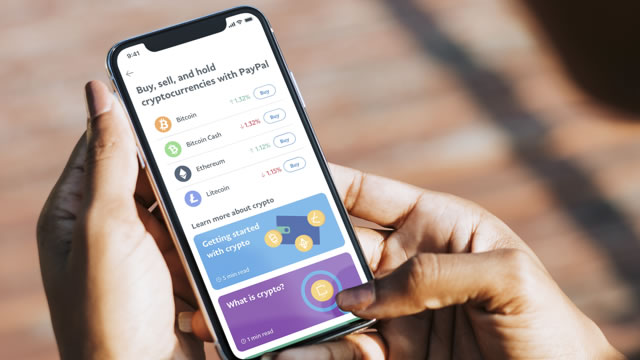

Paypal Tackles In-Store Payments With ‘PayPal Everywhere'

PayPal is integrating its debit card with Apple Wallet to enter the in-store payment arena. The company announced its omnichannel “PayPal Everywhere” solution Thursday (Sept.

PayPal pushes into in-person payments with cashback rewards, Apple integration

PayPal is expanding into U.S. point-of-sale payments by integrating its debit card with Apple's mobile wallet and offering cashback rewards, as the global online payments giant seeks direct competition with tech companies and banks.

PayPal Sweetens Rewards Program As New CEO's Overhaul Gains Momentum

PayPal upgraded its rewards program for debit card users with a 5% cash back offer for categories such as clothing, groceries and restaurants.

1 Incredibly Cheap Fintech Stock to Buy Now

Shares of this digital payments powerhouse are trading well below their all-time high. The market might be most concerned about competition.

PYPL vs. SMAR: Which Stock Should Value Investors Buy Now?

Investors looking for stocks in the Internet - Software sector might want to consider either Paypal (PYPL) or Smartsheet (SMAR). But which of these two companies is the best option for those looking for undervalued stocks?