Qualcomm Inc. (QCOM)

Do Rising Earnings Estimates Strengthen the Case for Qualcomm Stock?

QCOM's earnings estimates are rising on Snapdragon and auto strength, but China risks and margin pressure loom.

The Bulls Are Back—Why Qualcomm Stock Is Gaining Strength Again

Qualcomm Inc. NASDAQ: QCOM shares are back on firm footing in recent sessions after a dodgy run last month. The stock closed just above $168 on Monday, extending its bounce from last month's low around $160.

QUALCOMM Incorporated (QCOM) Presents at UBS Global Technology and AI Conference 2025 Transcript

QUALCOMM Incorporated (QCOM) Presents at UBS Global Technology and AI Conference 2025 Transcript

Here is What to Know Beyond Why QUALCOMM Incorporated (QCOM) is a Trending Stock

Qualcomm (QCOM) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

QCOM's Robust Portfolio Drives Revenue Growth: Will the Trend Persist?

Qualcomm's revenue climbs on surging automotive, IoT and premium handset demand, fueled by its expanding Snapdragon lineup and innovation push.

Is Trending Stock QUALCOMM Incorporated (QCOM) a Buy Now?

Recently, Zacks.com users have been paying close attention to Qualcomm (QCOM). This makes it worthwhile to examine what the stock has in store.

Qualcomm's Bulls Are Running Out of Room to Be Wrong

Shares of Qualcomm Inc. NASDAQ: QCOM were down another 2% early on Tuesday, Nov. 18, sliding below $163 as the broader market sell-off began to gain momentum. The move meant they had now erased all post-earnings gains from last month's breakout, leaving the stock down more than 20% from its highs.

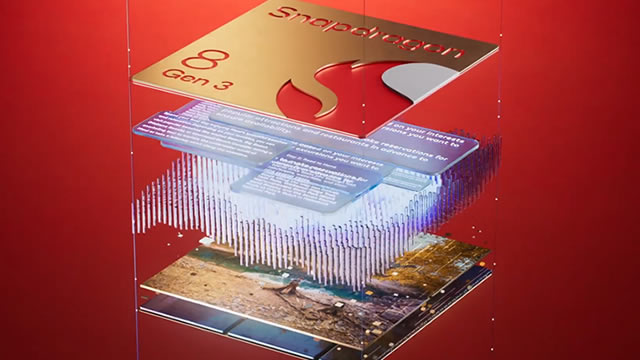

QCOM Expands Portfolio for Industrial PCs: Will It Boost Prospects?

QCOM rolls out its first industrial-grade PC processor, aiming to power smart manufacturing with high AI performance, durability and flexibility.

Is Qualcomm Up 40% or Down 20%? 2 Contrarian Takes

Qualcomm Inc.'s NASDAQ: QCOM chart captures 2025's market tension perfectly. The semiconductor giant spent much of the past six months climbing steadily on optimism around AI, automotive chips, and diversification beyond smartphones.

Qualcomm to pay dividends on December 18; Here's how much 100 QCOM shares will earn

Qualcomm (NASDAQ: QCOM) will distribute its next quarterly dividend on December 18, 2025, with the ex-dividend date set for December 4.

Should QCOM Stock Be Part of Your Portfolio Post Robust Q4 Earnings?

QCOM's Q4 earnings beat estimates as record automotive revenues and strong Snapdragon demand fuel growth, but China tensions and high R&D costs weigh.

QUALCOMM Incorporated (QCOM) is Attracting Investor Attention: Here is What You Should Know

Qualcomm (QCOM) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.