Qualcomm Inc. (QCOM)

Qualcomm Beats Quarterly Estimates, Guides Higher. Stock Jumps.

Wireless-chip leader Qualcomm beat analyst estimates for its fiscal fourth quarter and guided above views for the current period. The post Qualcomm Beats Quarterly Estimates, Guides Higher.

China Android Sales Behind Qualcomm's Rosy Forecast, CFRA's Zino Says

Angelo Zino, CFRA senior equity analyst, discusses the factors driving Qualcomm's bullish sales forecast. Speaking on "Bloomberg The Close," Zino also comments on the possibility of Qualcomm acquiring Intel.

Qualcomm Stock Pops on Better-Than-Expected Earnings, $15B Buyback

Qualcomm (QCOM) posted fiscal fourth-quarter earnings that exceeded analysts' expectations and announced a $15 billion stock buyback, driving shares higher after the closing bell Wednesday.

QCOM Rallies & ARM Slips After Hours, TSLA Drives Trump Rally

Donald Trump's second presidential win opened the market dams to a massive rally, led by a near 6% gain in the Russell 2000. Tesla (TSLA) and several crypto-related stocks surged as leaders during the trading day.

Qualcomm shares spike following quarterly beat on earnings and revenue

CNBC's Seema Mody joins 'Closing Bell Overtime' to talk Qualcomm earnings.

EARNINGS ALERT: QCOM, ARM

Qualcomm (QCOM) shares surge after better-than-expected 4Q numbers. The company announced a new $15B share buyback plan, along with guidance above street estimates.

Qualcomm's rosy forecast sends stock surging, and more buybacks may be on deck

Qualcomm is upping its buyback program by $15 billion after repurchasing more than $4 billion in stock last fiscal year.

Qualcomm pops 10% on chipmaker's earnings and revenue beat

Qualcomm reported fourth-quarter earnings on Wednesday that beat Wall Street expectations for earnings and revenue, and guided to a strong December quarter. The stock popped in extended trading.

Qualcomm forecasts sales, profits above Wall Street estimates

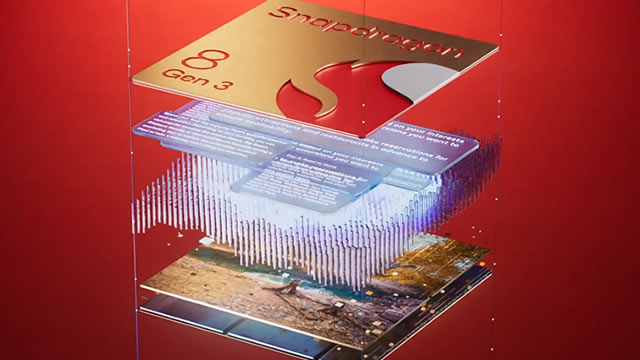

Chip designer Qualcomm on Wednesday forecast sales and profit in the current quarter to come in above Wall Street estimates as the company tries to break into the personal computer market while it vies against rivals for a piece of a recovering smartphone market.

What Analysts Think of Qualcomm's Stock Ahead of Earnings

Qualcomm (QCOM) will report its fourth quarter earnings after the market closes Wednesday, and analysts expect rising revenue and profits compared to the same time last year. However, they see revenue growth slowing over the next year amid slow smartphone and PC sales.

Diversification "Value Play" for QCOM, ARM's Long-Term Promise

Angelo Zino with CFRA looks into the earnings potential for Qualcomm (QCOM) and Arm Holdings (ARM). He believes Qualcomm is more of a "value play" but relies on the company's diversification strategy.

Is Qualcomm facing tough Q4 earnings outlook? Here's what you need to know

On November 5th, 2024, JP Morgan cut its price target for Qualcomm Inc (NASDAQ: QCOM) from $210 to $195, citing ongoing challenges in the smartphone market. Analyst Samik Chatterjee expressed concerns over fading inventory replenishments by Chinese smartphone OEMs, along with Qualcomm's lost revenue from Huawei and Apple's shift towards in-house modem chips.