Qualcomm Inc. (QCOM)

Is Most-Watched Stock QUALCOMM Incorporated (QCOM) Worth Betting on Now?

Zacks.com users have recently been watching Qualcomm (QCOM) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

Qualcomm's Q4 Outlook: Big Moves Ahead

QCOM trades at $175 with the potential to reach $196, supported by bullish RSI and VPT trends but a caution for short-term pullbacks. Qualcomm posted Q3 2024 revenue of $9.4 billion (+11% YoY) with EPS of $2.33 (+25%), beating guidance. IoT and automotive revenues reached $1.4 billion and $811 million, with automotive growing 87% YoY.

Why Qualcomm (QCOM) is a Top Momentum Stock for the Long-Term

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

Qualcomm Shares Gain 52% in the Past Year: Reason to Buy QCOM Stock?

QCOM appears to be treading in the middle of the road and investors could be better off if they trade with caution.

Qualcomm: Strong Tailwinds Can Prove Naysayers Wrong

Qualcomm is showing strong tailwinds in many segments including automotive, notebooks, and new devices like smart glasses. We are already seeing significant up revisions in the revenue and earnings which should have a positive impact on the stock in the near term. Qualcomm stock is one of the cheapest chip stocks with good forward EPS growth projections.

Why Is Qualcomm (QCOM) Up 3.4% Since Last Earnings Report?

Qualcomm (QCOM) reported earnings 30 days ago. What's next for the stock?

QUALCOMM Incorporated (QCOM) Deutsche Bank 2024 Technology (Transcript)

QUALCOMM Incorporated (NASDAQ:QCOM ) Deutsche Bank 2024 Technology Conference August 29, 2024 2:00 PM ET Company Participants Akash Palkhiwala - CFO & COO Conference Call Participants Ross Seymore - Deutsche Bank Ross Seymore All right everyone, let's get started with the next fireside chat. We're very pleased to have Akash Palkhiwala, the CFO and COO.

QUALCOMM Incorporated (QCOM) is Attracting Investor Attention: Here is What You Should Know

Qualcomm (QCOM) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

Missed Out on Nvidia Stock? 1 Spectacular Artificial Intelligence Stock to Buy Instead

Nvidia stock has risen so significantly that many investors are upset about missing out on the upside.

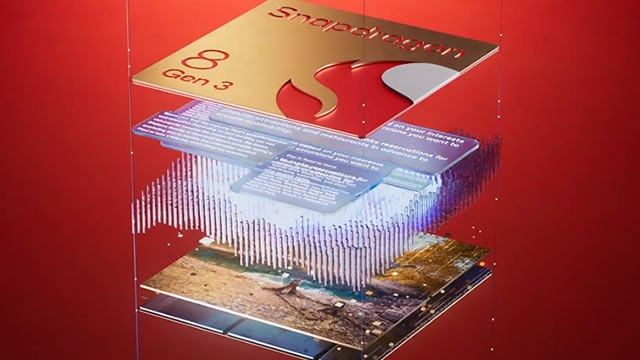

Qualcomm Is Here To Stay

Qualcomm, founded in 1985, is a leading RF chip company specializing in phone technology. The company's growth is driven by its QCT and QTL business segments, focusing on RF chip design and IP licensing. There are some concerns with both businesses, and a potential bear case.

3 Wireless Stocks Likely to Gain Despite Near-Term Headwinds

Solid demand for advanced networking architecture for increased broadband usage despite intense market volatility is driving the Zacks Wireless Equipment industry. QCOM, UI and VSAT are well-positioned to thrive despite the near-term challenges.

Huge News for Qualcomm Stock Investors

Qualcomm is expecting to open exciting new market opportunities ahead.