Reddit, Inc. Class A Common Stock (RDDT)

Reddit Investors Have No Faith in Used Car Stocks | CVNA CARS CARG

Shares of Carvana (NYSE:CVNA) trade near $460 today, and amazing rally from just $309 a share on November 21st.

Got $1,000? 1 Tech Stock to Buy and Hold for Decades

Reddit is becoming a default destination for people to get information on almost anything. Analysts expect its earnings per share to grow at high rates.

Reddit Sues Australian Government Over Social-Media Ban for Under-16s

The company said the law infringes on teenagers' freedom of political discourse, adding any reduction in risk of harm would be minimal at best.

Reddit files legal challenge to Australia social media ban

Online discussion site Reddit launched a legal challenge Friday to Australia's social media ban for under-16s, just days after the landmark law came into effect.

Reddit's Top AI Stocks: Why Traders Are Backing IBM and ASML Over other AI Plays

Shares of ASML (NASDAQ:ASML) and IBM (NYSE:IBM) are riding a wave of retail trader enthusiasm this week, with both stocks showing strong bullish sentiment on Reddit.

Here's How Reddit Gets to $300 Per Share in 2026

Reddit (NYSE: RDDT) has delivered a stunning 2025 performance.

Australia just pulled the trigger on a teen social media ban. Governments worldwide are watching

Australia became the first country to enforce a nationwide under-16 social media ban as global regulators watch closely. Platforms face tough age checks amid privacy fears, unreliable tech, and circumvention by teens.

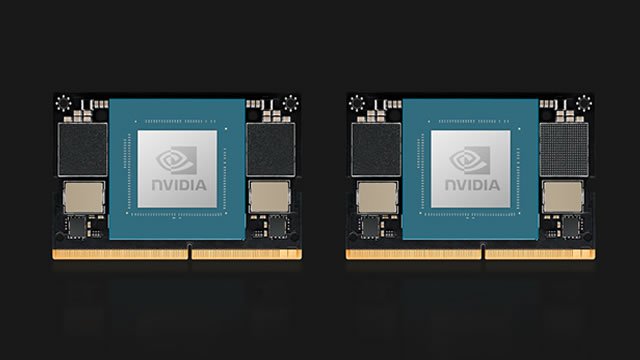

Reddit Traders Cool on NVDA Stock After CEO Huang Warns of China's AI Infrastructure Advantage

Shares of Nvidia (NASDAQ:NVDA) slipped .5% today, coinciding with a noticeable shift in retail investor sentiment on platforms like Reddit and X from bullish to almost perfectly neutral.

Reddit's Most Popular Stock Trades at 19x Sales After 3,568% EBITDA Jump

Shares of IREN (NASDAQ:IREN) are trading at $47.9, extending an impressive 17% gain over the past week.

Aurora Innovation Burns $222 for Every Dollar Earned as Reddit Sentiment Crashes

Shares of Aurora Innovation (NASDAQ:AUR) are trading around $5.21 as retail investor sentiment deteriorates sharply.

Reddit Traders Push AST SpaceMobile Higher Despite Analyst Sell Ratings and Extreme Multiples

AST SpaceMobile (NASDAQ: ASTS) closed Friday at $69.90, up 185% year-to-date despite a volatile November that saw shares briefly touch oversold territory.

I Let Reddit Choose My Wedding Dress — and They Got It Right

Sometimes it's easier to talk to strangers, which might explain why the platform has become an increasingly popular resource for wedding planning.