Rigetti Computing, Inc. (RGTI)

Rigetti Computing, Inc. (RGTI) is Attracting Investor Attention: Here is What You Should Know

Rigetti Computing (RGTI) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

Is Rigetti Computing Stock a Buy Now?

Rigetti Computing (RGTI -8.34%) has been a tough stock to hold over the past three years. The quantum computing company, which went public by merging with a special purpose acquisition company (SPAC) on March 2, 2022, started trading at $9.75, but eventually closed at a record low of $0.38 per share on May 3, 2023.

Rigetti Computing (RGTI), IonQ (IONQ) and Quantum Computing (QUBT) Stocks Look Like Screaming Buys Right Now

The quantum computing sector is one which has seen its fair share of turmoil over the past year.

Rigetti Computing Has Room to Grow. Why the CEO Is Tempering Expectations.

Rigetti Computing takes a more conservative stance when it comes to timelines for quantum development.

How Much Upside is Left in Rigetti Computing (RGTI)? Wall Street Analysts Think 50.71%

The mean of analysts' price targets for Rigetti Computing (RGTI) points to a 50.7% upside in the stock. While this highly sought-after metric has not proven reasonably effective, strong agreement among analysts in raising earnings estimates does indicate an upside in the stock.

Where Will Rigetti Computing Stock Be in 1 Year?

It's usually a bad idea to invest in booming, hype-based stocks because they will probably fall back down to earth unless their rally is based on sustainable fundamentals. With shares down by 41% since the start of 2025, Rigetti Computing (RGTI 0.36%) is an excellent example of this phenomenon.

Is Rigetti Computing a Buy?

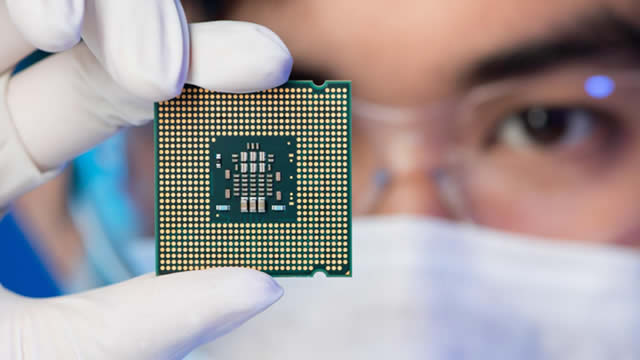

Quantum computing could solve humankind's most challenging problems and someday create countless new technologies and markets. It uses physics to take computing technology to new heights -- levels that, frankly, are difficult to comprehend.

Brokers Suggest Investing in Rigetti Computing (RGTI): Read This Before Placing a Bet

Investors often turn to recommendations made by Wall Street analysts before making a Buy, Sell, or Hold decision about a stock. While media reports about rating changes by these brokerage-firm employed (or sell-side) analysts often affect a stock's price, do they really matter?

Rigetti Computing, Inc. (RGTI) Stock Declines While Market Improves: Some Information for Investors

Rigetti Computing, Inc. (RGTI) concluded the recent trading session at $11.16, signifying a -0.53% move from its prior day's close.

Every Rigetti Computing Investor Should Keep an Eye on This Number

Rigetti Computing (RGTI 20.51%) captured Wall Street's attention by advancing the rapidly evolving field of quantum computing.

Deep Analysis Shows Rigetti's High-Risk Growth Horizon (Rating Upgrade)

Rigetti Computing, Inc.'s multi-chip scaling and in-house Fab-1 aim to catch IBM and IonQ, but quantum advantage remains unproven. Intense R&D drives heavy losses. Revenue growth is sluggish, with 2024 down to $10.8M. Annual burn of $60M drains $190M liquidity; watch for equity dilution. Valuation is lofty, but potential alpha justifies a tiny allocation. Cautious macro stance: hold 20–30% in cash equivalents.

Rigetti Computing Up 14% Post Q4 Earnings: Is the Stock a Buy?

RGTI's strong growth potential and expanding presence in the quantum computing market make it a compelling investment despite market challenges.