Super Micro Computer, Inc. (SMCI)

Why Super Micro Computer (SMCI) stock price is surging

Super Micro Computer was poised to be one of the better-performing semiconductor plays of last year. Then, in August, now-defunct short-selling activist group Hindenburg Research released a scathing report, which alleged widespread accounting malpractice at the company.

Super Micro Computer: Timely 10-K Release Is An Inflection Point

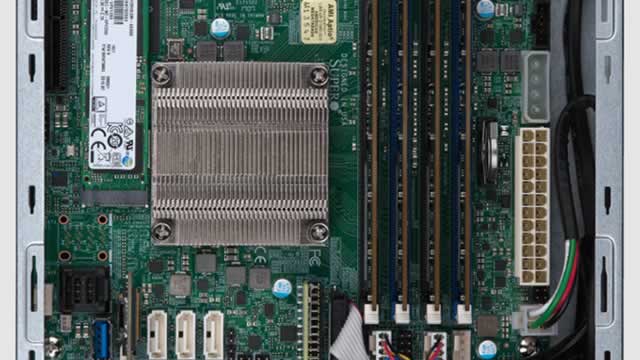

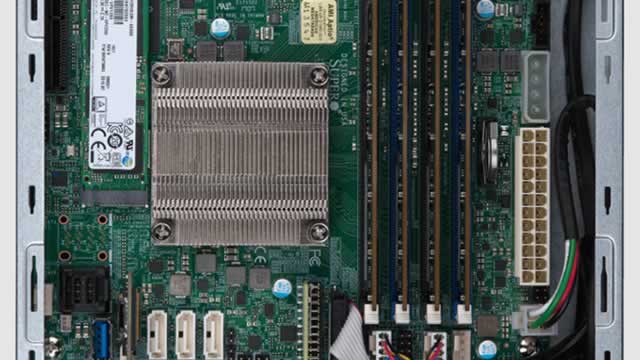

Yesterday's 10-K release acted as an inflection point for Super Micro Computer, dismissing the many fears that had been factored into its stock valuation. Valuation is extremely attractive with a significant upside potential, supported by low P/E and forward P/S ratios and optimistic free cash flow growth assumptions. SMCI's innovative server and storage solutions, strong partnerships with Nvidia, AMD, Intel, and Broadcom, and aggressive revenue growth highlight its competitive edge.

Super Micro Stock Soars 26% After Finally Filing Financials. Why Questions Remain.

The AI server maker filed its long-awaited financial accounts late Tuesday, removing the threat of delisting from the Nasdaq.

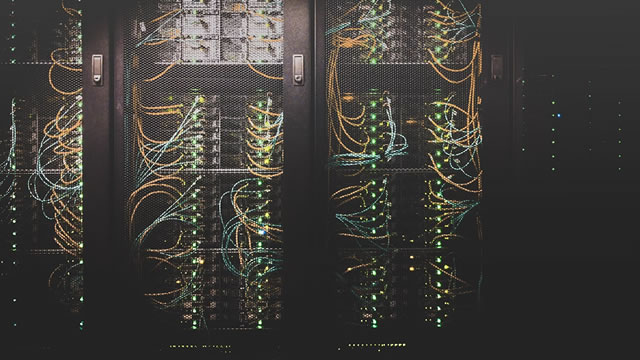

Data centers, bitcoin's stumble, Super Micro: Asking for a Trend

Josh Lipton dives deeper into the stories investors need to know on Asking for a Trend. Turner Construction Company chairman and CEO Peter Davoren discusses the data center market's rapid growth and his expectations for the sector going forward.

Super Micro files 10-K for FY ending June 30

CNBC's Kristina Partsinevelos joins 'Fast Money' with the latest on Super Micro Computer's 10-K filing.

Supermicro Stock Soars in Extended Trading as Server Maker Meets Filing Deadline

Super Micro Computer (SMCI) shares rocketed higher after the company submitted its delayed financial reports late Tuesday, just beating its deadline to avoid being delisted by the Nasdaq.

Super Micro submits its overdue filings. What's next for the server maker?

Super Micro shares are surging in Tuesday's late trading, though they fell sharply in the regular session.

Super Micro Computer stock update: Will SMCI be delisted from Nasdaq after SEC deadline?

Today, February 25, is a make-or-break day for Super Micro Computer (aka Supermicro) and its stock, which trades on the Nasdaq under the SMCI ticker. That's because by the end of today, the beleaguered server company needs to file its delinquent Form 10-K with the U.S. Securities and Exchange Commission (SEC).

Super Micro shares fall ahead of filing deadline

Super Micro Computer shares fell as much as 10% during trading on Tuesday as the company nears a deadline to file audited financial reports or be delisted from the Nasdaq exchange. Earlier this month, Super Micro CEO Charles Liang told investors that he was "confident" that the company could file those reports by Feb. 25, a deadline set by Nasdaq.

Why Super Micro Computer Stock Is Plummeting Today

Super Micro Computer (SMCI -9.89%) stock is getting hit with big sell-offs in Tuesday's trading. The server specialist's share price was down 7.6% as of 1:30 p.m.

Super Micro Computer Approaches Filing Deadline Tuesday to Avoid Delisting

Super Micro Computer (SMCI) faces its next obstacle on Tuesday, with the server maker facing the Nasdaq's filing deadline to avoid being delisted from the exchange.

Does Philippe Laffont Know Something That Wall Street Doesn't? The Billionaire Investor Is Piling Into an AI Stock-Split That Certain Analysts Recommend Selling.

While he may not enjoy the same name recognition as Warren Buffett, Philippe Laffont has an impressive track record. The multibillionaire investor grew up in France, attended the Massachusetts Institute of Technology, and is what the investing community refers to as a Tiger Cub -- someone who worked for Julian Robertson's Tiger Management hedge fund in the 1990s.