Super Micro Computer, Inc. (SMCI)

Super Micro Stock's Comeback Has Been Impressive. Why the Market Is Still Nervous About SMCI.

While the share price is almost back to where it was before its recent troubles began, it's still far off the year high of $109 in March.

Important News for Super Micro Computer Stock Investors

In today's video, I will discuss recent updates regarding Super Micro Computer (SMCI 0.52%). Watch the short video to learn more, consider subscribing, and click the special offer link below.

Super Micro Computer Has Multiple Positive Catalysts Ahead

Super Micro Computer faces compliance risks and potential Nasdaq delisting due to delayed financial reports; an independent review found no compliance risks related to the Ernst & Young letter. SMCI has multiple catalysts that can improve the stock price, including the release of its FY24 10-K, Q1'25 10-Q, and sales of its Blackwell rack system. The Company may be overbuilding with its Silicon Valley expansion and new Malaysia facility, given the current utilization rate of 50%. This could potentially create a margin headwind.

Is Super Micro Computer Set for a Comeback in 2025?

Few stocks have taken investors on more of a roller-coaster ride in a single year than Super Micro Computer (SMCI 0.52%). At one point, the stock was up by as much as 318% from where it began 2024.

This AI Stock Has Quietly Doubled in Value

A widely popular stock caught in the middle of the AI frenzy, Super Micro Computer, has seen its shares melt higher over the last month following favorable news surrounding its accounting troubles.

Super Micro's stock still faces accounting overhang despite delisting reprieve

Super Micro's stock rallies after Nasdaq extends the deadline for financial filings, but the stock is still being weighed down by an accounting overhang.

These are SMCI's top shareholders as of December 2024

Super Micro Computer Inc. (NASDAQ: SMCI), a key player in artificial intelligence (AI) server solutions, has been navigating turbulent waters in recent months.

AI sets date when SCMI stock will hit $100 as comeback continues

Super Micro Computer (NASDAQ: SMCI) stock price is showing signs of sustaining its recent positive run as the company continues its governance overhaul.

Super Micro Stock Jumps. Why Delisting Is Now Unlikely.

The AI server maker had some positive news for investors.

Super Micro Computer: Continues Surging Higher (Technical Analysis)

I am raising my outlook for Super Micro Computer, Inc. (SMCI) to a "strong buy" due to improved stability and attractive valuation prospects. Despite recent turmoil and the resignation of Ernst & Young, SMCI avoided delisting and now has a clearer path forward with NASDAQ's extension. SMCI's forward PE ratio of 15.54x is cheaper than most competitors, suggesting significant upside potential as we move into 2025.

Super Micro Computer Sank Amid Financial Reporting Troubles in Recent Months. Could the Stock Become the Biggest Recovery Story of 2025?

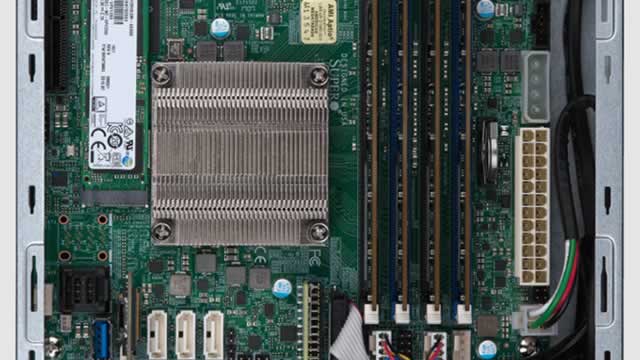

Super Micro Computer (SMCI 6.78%) roared into the year with strength as a leader in the high-growth area of artificial intelligence (AI). The company makes a variety of equipment, such as servers and full-rack scale solutions, crucial to AI data centers, and this has helped revenue soar in the triple digits in recent quarters.

Super Micro Computer Granted Exceptional Extension to Publish Delayed Annual Report

Super Micro Computer said it has been granted an exceptional extension from Nasdaq that would allow it to file its latest annual report through Feb. 25, 2025.