Super Micro Computer, Inc. (SMCI)

SMCI Earnings Preview & Auditor Concerns

Brian Mulberry (@ZacksInvestmentNews) points to the questionable datakeeping practices plaguing Supermicro (SMCI) as a red flag ahead of earnings. "They need to get their house back in order in terms of accounting," he adds, but notes that the company was seeing tremendous growth, if the data is to be believed.

Super Micro Computer Posts Q1 Earnings: Are Delisting Fears Here To Stay Or Can The Stock Rebound?

Super Micro Computer Inc. SMCI is gearing up for its first-quarter earnings report Tuesday after the market close. Expectations are set for 75 cents in earnings per share (EPS) and revenue of $6.45 billion, according to Benzinga Pro data.

Billionaire Israel Englander Sold 40% of Millennium's Stake in AT&T and Is Piling Into This Troubled Artificial Intelligence (AI) Stock Instead

Englander's Millennium has shed nearly 9 million shares of supercharged income stock AT&T since 2024 began in favor of a controversial artificial intelligence (AI) stock.

Supermicro Shares Plunge Again. Time to Buy the Dip or Stay Away?

The resignation of its auditor sent Supermicro shares plummeting.

Super Micro needs a new CEO before its AI advantage erodes

Super Micro Computer Inc. was an early beneficiary of the artificial-intelligence boom. But with the server maker under an accounting cloud, Super Micro now needs its chief executive to step down so it can fully realize the benefits of that trend.

SMCI's "High Pressure" Earnings Amid Accounting Accusations

Supermicro (SMCI) reports earnings tomorrow after markets close. The company faces a plethora of accusations surrounding its accounting practices.

3 Significant Risks That Market Has Yet To Price In For Super Micro Computer

Following an eye-watering rally earlier this year, the SMCI stock has now flipped to YTD declines as it faces continued implications of ongoing accounting woes. In the latest turn of events, SMCI's auditor, Ernst & Young, has resigned from the engagement. This casts further uncertainties on when investors can expect SMCI's delayed 10-K filing. In the meantime, SMCI bulls continue to believe that the company's accounting problems and delayed 10-K filing are isolated issues from its technological advantage in capturing AI opportunities.

Super Micro Computer faces bigger questions than just earnings expectations, says analyst

Results from Super Micro Computer Inc (NASDAQ:SMCI) are due on Wednesday but the performance of the server manufacturers and Nvidia's third-largest customer is likely to "take a back seat" to other concerns, analysts say. Shares in Super Micro lost over 45% of their value last week after Ernst and Young resigned as its auditor, taking the decline in the shares to almost 70% over six months, following a Wall Street Journal report about the launch of a Department of Justice investigation, a warning in September that it would be late in filing its annual result, and a weaker-than-expected quarterly earnings in August.

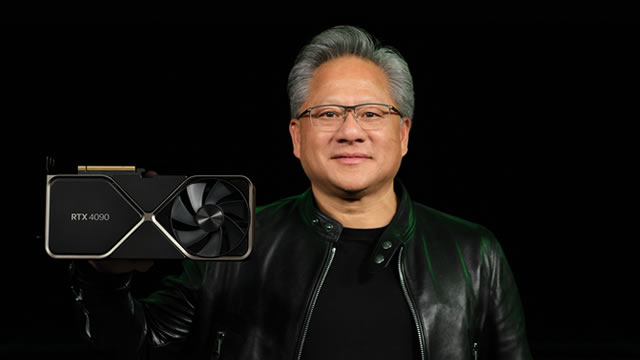

Could Nvidia's stock benefit from shifting SMCI orders?

Semiconductor companies have seen stellar performance over the last two years, owing to the revolutionary potential of widespread AI adoption.

What Is Happening at Super Micro Computer? Here's What Investors Need to Know.

Amid fresh controversies and high-stakes allegations, Supermicro's stock is plummeting.

Super Micro Computer And Forensic Flags To Consider After E&Y Resignation

Amidst the sudden resignation of Ernst & Young as auditors for SMCI this article looks at forensic financial models for any additional insights. Five forensic and two value models are reviewed for any irregularities that could explain potential areas of risk for Super Micro Computer. Investors should always do their own due diligence, and no models are without errors and inconsistencies related to actual events occurring within the business.

AI predicts when SMCI stock will recover after accounting debacle

The share price of Super Micro Computer Inc. (NASDAQ: SMCI) is witnessing a significant sell-off as investors turn bearish on the company following its recent accounting challenges.