Super Micro Computer, Inc. (SMCI)

Supermicro Shares Plunge on Outlook. Is This a Red Flag or a Buying Opportunity?

Super Micro Computer (SMCI -4.34%) shares plunged following the release of its fiscal 2025 fourth-quarter results, reinforcing its status as one of the more volatile stocks in the market. The stock now trades down around 25% over the past year, but it is still up nearly 50% year to date, as of this writing.

Should You Buy Super Micro Stock After Its 20% Post-Earnings Drop? Wall Street Says This Will Happen Next.

Super Micro Computer (SMCI -0.39%) shares tumbled nearly 20% on Aug. 6, because of disappointing financial results. But most Wall Street analysts think the selling was slightly overdone.

Super Micro: Buy The Fear

Super Micro's stock is under pressure due to missed earnings as a realist of the prior delayed 10-K. The company faced capital constraints and customer order delays hurting FQ4 results, but a $2.3B debt raise addressed the funding issue. Super Micro guided to FY26 revenue of at least $33B, with potential for the original $40B target, offering significant EPS upside versus consensus.

Super Micro Computer: I Am Buying The Dip On The Earnings "Miss" That Wasn't One

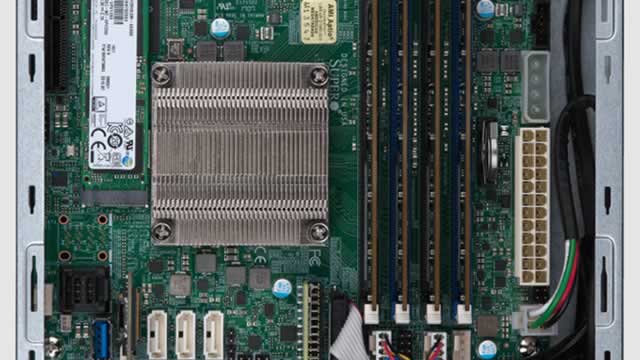

SMCI's 20% post-earnings drop is a buying opportunity; the market misreads a timing-related revenue miss as a business weakness. SMCI is transforming into a full-stack AI infrastructure leader with DCBBS and DLC-2 liquid cooling, far outpacing traditional server vendors. International growth, sovereign AI projects, and rapid data center deployments position SMCI for outsized revenue and margin expansion.

Super Micro Computer: Expectations Reset, Upside If Execution Follows (Upgrade)

Upgrading Super Micro Computer to Buy as market expectations have reset, de-risking the stock after a messy quarter and cautious guidance. Despite margin pressure and missed earnings, strong operating cash flow and resolved capital constraints support the SMCI investment case. Management's ambitious $33B revenue target offers upside if achieved, while current valuation already reflects skepticism about execution.

Super Micro Computer: Let's Not Make Another Mistake Again (Downgrade)

Time to downgrade Super Micro Computer, Inc. stock, as I now realize my previous bullish rating may have overstated my confidence in SMCI's recovery. Ongoing intense competition from Dell and HPE, plus supply chain constraints around Nvidia's GB300, are weighing on SMCI's growth and margins. Management's rather aggressive revenue target for FY2026 seems increasingly challenging to achieve, likely requiring margin sacrifices to achieve competitive pricing.

SMCI stock just collapsed; Here's why

Super Micro Computer (NASDAQ: SMCI) shares plunged on Wednesday, trading at $46.88 at press time, down 18% on the day and at one point sliding as much as 20%.

Super Micro Computer Q4 Earnings Miss Estimates, Revenues Rise Y/Y

SMCI's fourth-quarter fiscal 2025 results reflect an unfavorable product mix, like low margin hyperscale and GPU rack shipments contracting the bottom line.

Super Micro Computer: Earnings Aren't As Bad As Everyone Thinks (Upgrade)

Super Micro Computer, Inc.'s Q4 earnings disappointed on EPS and guidance, triggering a 16% stock drop, but revenue growth and FY26 targets remain robust. Despite margin pressure and high expectations, I see the current selloff as a buying opportunity given strong AI-driven demand and undervalued valuation multiples. SMCI's DCBBS platform and rapid deployment capabilities position it as a top AI infrastructure partner, supporting long-term margin expansion.

Super Micro Computer Stock Plummets After Q4 Results

Super Micro Computer Inc (NASDAQ:SMCI) stock was last seen down 20.7% at $45.43 today, after the server maker's fiscal fourth-quarter earnings and revenue miss.

Why Supermicro Stock Is Plunging Today

Super Micro Computer (SMCI), shares plunged Wednesday after the server maker reported weaker-than-expected results, as it faced higher costs from tariffs and changes required by a major customer.

Super Micro's Q4 Drop Is Just Another Round In The Same Routine

Super Micro Computer delivered strong revenue and cash flow, but declining margins and rising inventory signal underlying risks that haven't improved. Super Micro's gross margin fell below 10% despite the AI boom, highlighting intense competition and eroding pricing power, which is a major red flag for long-term investors. Management's aggressive FY26 revenue guidance requires flawless execution, but inventory build and lack of margin improvement increase the risk of future disappointments.