Siemens Healthineers AG Unsponsored ADR (SMMNY)

Siemens Healthineers posts revenue beat, but lowers floor of profit outlook

German medical technology group Siemens Healthineers posted second quarter revenue slightly above market expectations on Wednesday, but brought down the lower end of its annual earnings forecast due to trade barriers and increased tariffs.

Siemens sells 2% stake in Siemens Healthineers

German engineering company Siemens announced late on Wednesday it launched a sale of a 2% stake in healthcare subsidiary Siemens Healthineers.

Siemens Healthineers says it would welcome stake reduction by Siemens

Siemens Healthineers' CEO said on Thursday that the medical-technology company had a "very positive" view on considerations by parent Siemens to reduce its stake.

Siemens Healthineers reports Q1 revenue slightly above consensus

German medical technology company Siemens Healthineers on Thursday reported first quarter revenue slightly above consensus, as its U.S. revenues increased by 16% while those from China declined 6% due to "continued delays in customer orders."

Kromek to swing into profit after winning Siemens Healthineers deal for CZT detection

Kromek Group PLC said it has signed a non-exclusive deal with Siemens Healthineers that should lead it to become profitable this year and slash debt. The radiation and bio-detection detection specialist signed a set of agreements with Siemens Medical Solutions USA, known as Siemens Healthineers, for a total of $37.5 million (£30.2m) in cash, including a first instalment of $25 million to be paid this year.

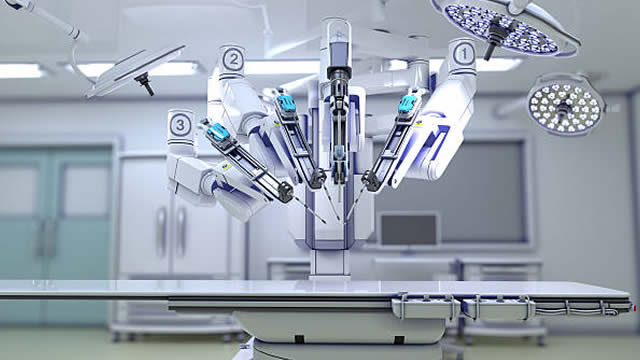

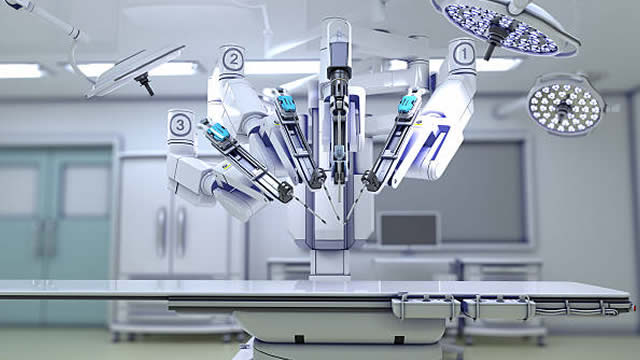

Siemens Healthineers Offers Imaging-Driven Upside For Patient Investors

Recent underperformance is likely due to below-expectations revenue, mixed margins, and lower fiscal 2025 guidance, despite strong imaging and radiation oncology performance. Imaging remains a major growth driver, as new medical interventions and screening programs drive screening demand and tools like AI become increasingly vital. Fiscal 2025 guidance was modestly disappointing, but long-term growth in imaging, oncology, and image-guided therapies supports a positive outlook.

Siemens Healthineers meets full-year earnings forecast

German medical technology company Siemens Healthineers reported a full-year adjusted earnings before interest and taxes (EBIT) and revenue growth in line with analysts' consensus on Wednesday.

Siemens Healthineers: My Current Pick In Medtech Ahead Of Q4 2024

Siemens Healthineers is a company that I have written about a few times in the past, and I already have a bit of a position in SEMHF. My intention, before 4Q24, which is coming out in a few days, is to increase this stake. In this article, I show you why I intend to purchase more in Medtech and why I see a good upside here.

Siemens Healthineers AG (SEMHF) Q3 2024 Earnings Call Transcript

Siemens Healthineers AG (OTCPK:SEMHF) Q3 2024 Earnings Conference Call July 31, 2024 2:30 AM ET Company Participants Marc Koebernick - Head-Investor Relations Bernd Montag - Chief Executive Officer Jochen Schmitz - Chief Financial Officer Conference Call Participants Hassan Al-Wakeel - Barclays Veronika Dubajova - Citi David Adlington - JPMorgan Hugo Solvet - Exane Julien Dormois - Jefferies Julien Ouaddour - Bank of America Robert Davies - Morgan Stanley Sezgi Ozener - HSBC Operator Good morning, ladies and gentlemen, welcome to Siemens Healthineers Conference Call. As a reminder, this conference is being recorded.

Siemens Healthineers: The Upside Is Clear To Me Over The Long Term

Siemens Healthineers reported good revenue growth and margin expansion in Q2 2024, with strong performance in Imaging, Varian, and Advanced Therapies segments. Despite a recent decline in share price, the company maintains a strong balance sheet and confirms full-year outlook for mid-to-high single-digit growth. Analysts have a positive outlook on Healthineers, with price targets ranging from €48 to €75/share and 18 out of 20 analysts recommending a "BUY" or outperform rating.

Siemens Healthineers: Softer Orders A Risk, But The Story Remains Sound

Healthcare capex demand has supported healthy order growth at Siemens Healthineers, as the company leverages new innovative platforms in Imaging (MRI, CT) and radiation oncology (Varian). The Street wants margin leverage and order growth in FQ3'24, and I think there's a good chance of getting both. Diagnostics still needs a lot of work to become more competitive, and a rumored sale/spin may be a better option.