Snap-on Inc. (SNA)

Summary

Will SNA's Operational Agility, RCI Plan & Innovations Fuel Growth?

Snap-on's growth strategy, innovation push and expanding product lineup signal resilient operations and potential progress ahead.

Snap-on Incorporated (SNA) Presents at Baird 55th Annual Global Industrial Conference Transcript

Snap-on Incorporated ( SNA ) Baird 55th Annual Global Industrial Conference November 12, 2025 10:40 AM EST Company Participants Nicholas Pinchuk - Chairman, CEO & President Conference Call Participants Luke Junk - Robert W. Baird & Co. Incorporated, Research Division Presentation Luke Junk Robert W.

Snap-on Incorporated: Snap It Up Quick, New Highs Will Come Soon

Snap-on Incorporated NYSE: SNA stock trades near the high end of its historical range in 2025, but it can go higher because this premium is well deserved. The high-quality industrial business is well-supported by global demand, generates ample cash flow, and pays a healthy capital return, including dividends, distribution growth, a market-beating yield, and share-reducing buybacks.

Snap-on Inc. (SNA) FAQ

What is the stock price today?

On which exchange is it traded?

What is its stock symbol?

Does it pay dividends? What is the current yield?

What is its market cap?

What is the earnings per share?

When is the next earnings date?

Has Snap-on Inc. ever had a stock split?

Snap-on Inc. Profile

| Life Sciences Tools & Services Industry | Healthcare Sector | Nicholas T. Pinchuk CEO | NYSE Exchange | 833034101 CUSIP |

| US Country | 13,000 Employees | 21 Nov 2025 Last Dividend | 11 Sep 1996 Last Split | 1 Jul 1985 IPO Date |

Overview

Snap-on Incorporated is a leading global provider, manufacturing, and marketing a wide range of products for professional use. Established in 1920 and headquartered in Kenosha, Wisconsin, it serves various industries including aviation, aerospace, agriculture, construction, government, military, mining, natural resources, power generation, and technical education through its four operating segments: the Commercial & Industrial Group, Snap-on Tools Group, Repair Systems & Information Group, and Financial Services segments. The company is renowned for its commitment to quality, innovation, and providing comprehensive solutions that cater to the professional needs of its global clientele.

Products and Services

Snap-on Incorporated offers a diverse array of products and services tailored for professional users worldwide. These include:

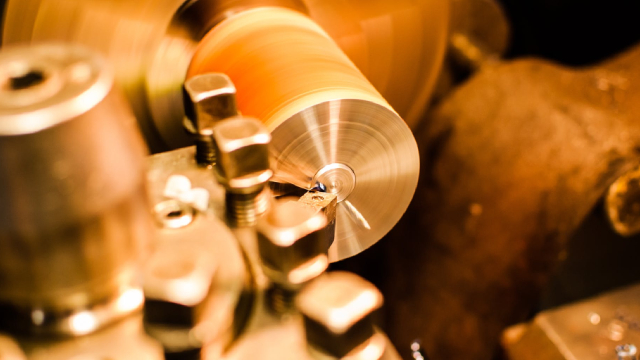

- Hand Tools: This category includes wrenches, sockets, ratchet wrenches, pliers, screwdrivers, punches, chisels, saws, cutting tools, pruning tools, torque measuring instruments, and other related products. Each tool is designed to offer precision, durability, and ease of use for professionals.

- Power Tools: The power tools range comprises cordless, pneumatic, hydraulic, and corded tools. These tools are engineered for performance and reliability to meet the rigorous demands of professional use.

- Tool Storage Products: Snap-on provides robust tool chests, roll cabinets, and other storage solutions to help professionals organize and protect their investments in hand and power tools.

- Diagnostic Products: The company offers handheld and computer-based diagnostic products, service and repair information products, diagnostic software solutions, and electronic parts catalogs. These products are crucial for today’s complex vehicle diagnostics and repairs.

- Business Management Solutions: Snap-on delivers comprehensive business management systems and services, including point-of-sale systems, integrated systems for vehicle service shops, original equipment manufacturer purchasing facilitation services, warranty management systems, and analytics to help businesses operate more efficiently.

- Engineered Solutions: It offers a wide range of equipment solutions for vehicle and industrial equipment service, such as wheel alignment equipment, vehicle lifts, collision repair equipment, and safety testing equipment. Snap-on also provides after-sales support and training programs.

- Financial Services: Snap-on Incorporated facilitates the sales of its products and supports its franchise business through various financing programs, making it easier for professionals to acquire the tools and solutions they need.

Through these products and services, Snap-on caters to a wide spectrum of professional needs, enhancing the efficiency and effectiveness of the industries it serves.