Southern Company (SO)

Why Investors Need to Take Advantage of These 2 Utilities Stocks Now

Investors looking for ways to find stocks that are set to beat quarterly earnings estimates should check out the Zacks Earnings ESP.

Southern Co. (SO) Beats Stock Market Upswing: What Investors Need to Know

Southern Co. (SO) reached $95.49 at the closing of the latest trading day, reflecting a +1% change compared to its last close.

Amazon shutters 4 Fresh stores in Southern California as grocery strategy keeps shifting

Amazon is closing some of its Fresh supermarkets, the company confirmed, as its physical store strategy continues to focus more on Whole Foods. The company plans to shutter four Fresh stores in Southern California, and it recently closed four other U.S. locations.

Southern Company Stock Is a Smart Hold in Today's Market

SO's expanding utility investments and demand growth fuel earnings, but execution, data center dependence, gas price swings, regulation and debt costs pose risks.

Southern Company: From Nuclear Risk to AI Reward

The rapid expansion of artificial intelligence (AI) is creating an unprecedented challenge for the U.S. economy: an insatiable demand for electricity. For investors, this challenge presents a clear opportunity.

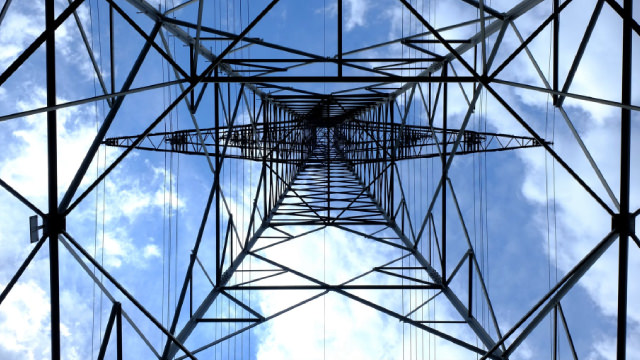

Southern Company Advances Hydro Fleet Modernization for the Future

SO's subsidiary, Georgia Power is upgrading its hydro fleet with major investments to boost efficiency, extend life and support Georgia's energy needs.

Southern's Subsidiary Installs Advanced Turbines at Plant Yates

SO's subsidiary, Georgia Power, teams up with Mitsubishi Power to install new gas turbines at Plant Yates, increasing energy output and providing jobs for locals.

Here is What to Know Beyond Why Southern Company (The) (SO) is a Trending Stock

Southern Co. (SO) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

Southern Company Q2 Earnings Beat as Utility Sales Grow

SO beats Q2 earnings estimates and guided for EPS of $1.50 for the September quarter.

The Southern Company (SO) Q2 2025 Earnings Call Transcript

The Southern Company (NYSE:SO ) Q2 2025 Earnings Conference Call July 31, 2025 1:00 PM ET Company Participants Christopher C. Womack - CEO, President & Chairman Daniel Tucker - Corporate Participant David P.

Compared to Estimates, Southern Co. (SO) Q2 Earnings: A Look at Key Metrics

While the top- and bottom-line numbers for Southern Co. (SO) give a sense of how the business performed in the quarter ended June 2025, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

Southern Co. (SO) Q2 Earnings and Revenues Surpass Estimates

Southern Co. (SO) came out with quarterly earnings of $0.91 per share, beating the Zacks Consensus Estimate of $0.87 per share. This compares to earnings of $1.09 per share a year ago.