Spire Inc. (SR)

Spire (SR) Q2 Earnings and Revenues Miss Estimates

Spire (SR) came out with quarterly earnings of $3.60 per share, missing the Zacks Consensus Estimate of $3.70 per share. This compares to earnings of $3.45 per share a year ago.

Spire (SR) Earnings Expected to Grow: Should You Buy?

Spire (SR) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Spire Global: Still A Buyer Despite Recent Challenges

Spire Global's stock has dropped over 50% due to setbacks in selling its maritime business, yet I maintain a Buy rating. The sale of the maritime business is crucial for debt retirement and future growth, with management confident the deal will close soon. Despite recent challenges, SPIR achieved positive free cash flow in Q3 and expects significant revenue growth ahead.

Spire Global Earnings Are Imminent; These Most Accurate Analysts Revise Forecasts Ahead Of Earnings Call

Spire Global, Inc. SPIR will release its fourth-quarter financial results, after the closing bell, on Monday, March 31.

Spire Inc: Buy For Income

Spire Inc. offers a 4.11% dividend yield, 22 years of dividend growth, and an 80-year history of paying dividends, making it a stable income investment. The company serves 1.72 million customers across Missouri, Alabama, and Mississippi, and operates three natural gas pipelines and two major storage facilities. Earnings are primarily from regulated utility and midstream activities, with a projected EPS growth from $4.40-$4.60 in FY2025 to $5.01-$5.27 by 2027.

Spire to Benefit From Investments and Expanding Customer Base

SR is expected to benefit from its systematic investments to strengthen infrastructure and expanding natural gas customer base.

With Its Kpler Deal on the Rocks, Can Spire Stock Survive?

Debt is dangerous. Getting out of debt can be tricky.

Why Is Spire (SR) Up 5.1% Since Last Earnings Report?

Spire (SR) reported earnings 30 days ago. What's next for the stock?

Spire Healthcare down 22% after earnings miss

Spire Healthcare Group Plc (LSE:SPI) shares tumbled 22% after the company posted a slight earnings miss and issued a cautious outlook for 2025, revealing a £40 million EBITDA hit from higher employer National Insurance costs starting in April. For 2024, revenue rose 11% to £1.51 billion, while adjusted EBITDA increased 9% to £260 million.

Why Spire Global Stock Just Crashed 50%

Spire Global (SPIR -52.16%) stock crashed 49.7% through 11:11 a.m. ET Wednesday, and a lot of investors are wondering why right now.

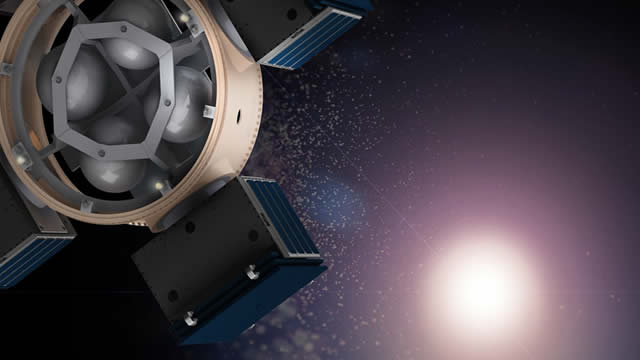

Spire Global Lands ~$50M Contract For Canadian Wildfire Detection; Stock Jumps

Shares of space-to-cloud data and analytics provider Spire Global, Inc. SPIR are surging on Friday.

Spire Inc. (SR) Q1 2025 Earnings Call Transcript

Spire Inc. (NYSE:SR ) Q1 2025 Earnings Conference Call February 5, 2025 10:00 AM ET Company Participants Megan McPhail - MD, IR Scott Doyle - EVP, COO, and Acting CEO Adam Woodard - EVP and CFO Conference Call Participants Gabe Moreen - Mizuho Richard Sunderland - JPMorgan Shar Pourreza - Guggenheim Partners David Arcaro - Morgan Stanley Operator Good morning and welcome to Spire's Fiscal 2025 First Quarter Earnings Call. All participants will be in listen-only mode.