Stanley Black & Decker Inc. (SWK)

Stanley Black & Decker Says Higher Prices Are Coming, Thanks to Trump Tariffs

Stanley Black & Decker (SWK) shares fell Wednesday as the power tool maker anticipates the Trump administration's tariffs negatively affecting its profits this year as it alters its supply chain and raises prices.

Stanley Black & Decker Raising Prices to Offset Tariff Costs

The maker of DeWalt power tools and Craftsman wrenches said that the global tariff war kicked off by President Trump is expected to dent its full-year earnings per share by about 75 cents, based on the timing of its mitigation countermeasures.

Stanley Black Gears Up to Report Q1 Earnings: What's in Store?

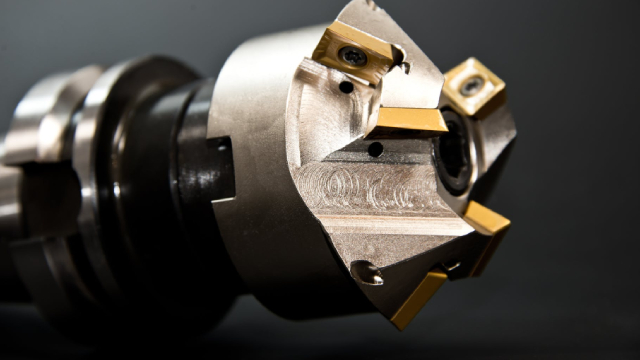

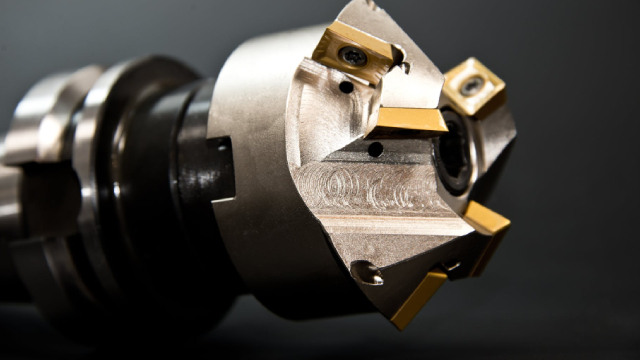

SWK's Q1 2025 results are likely to benefit from strength in the Engineered Fastening business. However, weakness in the Industrial and Tools & Outdoor segments is likely to have weighed on its performance.

Here's Why Hold Strategy is Apt for Stanley Black Stock Right Now

SWK benefits from strength in the Tools & Outdoor unit, cost-saving measures and shareholder-friendly policies. Softness in its Industrial unit and high debt are concerning.

Here's Why Stanley Black & Decker Stock Crashed Today

Stanley Black & Decker (SWK -9.53%) declined by more than 11% in trading at noon ET today. The fall comes as the market sold off after a historic rally yesterday.

Stanley Black & Decker: An Attractive Investment Once Tariff Uncertainty Abates

Stanley Black & Decker's growth is limited in the short term, but its long-term potential remains strong due to its dominant DeWalt and Craftsman brands. A history of acquisitions and poor capital allocation has weakened returns for investors, but the company has a durable competitive moat at its core. Current management is focusing on debt reduction and operational efficiency, aiming to restore margins and refocus on the company's strengths.

Why Shares in Stanley Black & Decker Got Crushed Today

Shares in Stanley Black & Decker (SWK -14.35%) were down by about 12% at noon ET today. The move is in response to the recently announced tariff actions by the Trump administration.

Here's Why Investors Should Retain Stanley Black & Decker in Portfolio

SWK benefits from strength in the Tools & Outdoor segment, cost-saving measures and pro-investor policies. Softness in its Industrial unit and high debt are concerning.

Stanley Black's Q4 Earnings Beat Estimates, Sales Down Y/Y

Weakness in the Industrial segment weighs on SWK's top line in the fourth quarter of 2024.

Stanley Black & Decker sees weak 2025 profit, prepares to blunt tariff impact

Tool maker Stanley Black & Decker on Wednesday forecast annual profit below estimates, hurt by tepid demand for its power tools, and said it was preparing measures to mitigate a hit from the recent tariffs announced by U.S. President Donald Trump.

Stanley Black & Decker Set to Report Q4 Earnings: Is a Beat in Store?

SWK's Q4 2024 results are likely to benefit from strength in the aerospace market. However, weakness in the Industrial and Tools & Outdoor segments is likely to have weighed on its performance.

Stanley Black & Decker Is Too Cheap To Ignore

Stanley Black & Decker's shares have recently dropped over 20% due to tariff fears and rising interest rates, but these risks seem overblown. The company has struggled with bloated inventory and lower gross margins since 2021 but is expected to recover by 2026. Valuation is attractive with a Forward P/E of 16X and a trailing P/S of 0.89.