Teledyne Technologies Incorporated (TDY)

Teledyne (TDY) Q1 Earnings: How Key Metrics Compare to Wall Street Estimates

While the top- and bottom-line numbers for Teledyne (TDY) give a sense of how the business performed in the quarter ended March 2025, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

Teledyne Technologies (TDY) Q1 Earnings and Revenues Beat Estimates

Teledyne Technologies (TDY) came out with quarterly earnings of $4.95 per share, beating the Zacks Consensus Estimate of $4.92 per share. This compares to earnings of $4.55 per share a year ago.

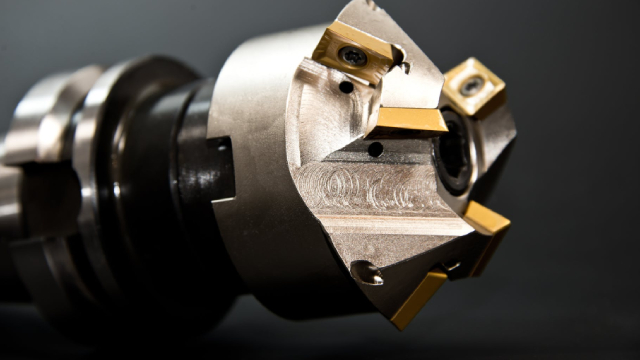

Teledyne tops quarterly results on sustained demand for defense products

U.S. defense firm Teledyne Technologies topped expectations for first-quarter profit and revenue on Wednesday, aided by sustained demand for its target detection sensors and electronic components used in aerospace and defense.

Will Segment Growth Aid Teledyne Technologies' Q1 Earnings?

TDY's Q1 results are expected to reflect robust top-line performance from its business segments.

Gear Up for Teledyne (TDY) Q1 Earnings: Wall Street Estimates for Key Metrics

Beyond analysts' top -and-bottom-line estimates for Teledyne (TDY), evaluate projections for some of its key metrics to gain a better insight into how the business might have performed for the quarter ended March 2025.

Teledyne Technologies (TDY) Reports Next Week: Wall Street Expects Earnings Growth

Teledyne (TDY) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Teledyne Reveals FLIR MIX Multispectral Infrared Imaging Systems

TDY presents FLIR MIX Starter Kits, an enhanced multispectral imaging system intended to increase the precision and detail of infrared imaging.

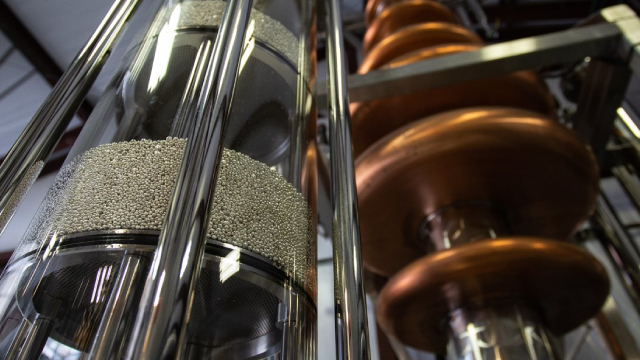

Teledyne Technologies: A Strong Player in the Sensor Market

Explore the exciting world of Teledyne Technologies (TDY -0.80%) with our expert analysts in this Motley Fool Scoreboard episode. Check out the video below to gain valuable insights into market trends and potential investment opportunities!

Teledyne's Unit Signs $15M Deal to Supply Black Hornet 4 Nano-Drones

TDY's business unit, Teledyne FLIR Defense, gets a contract to deliver Black Hornet 4 to the German armed forces.

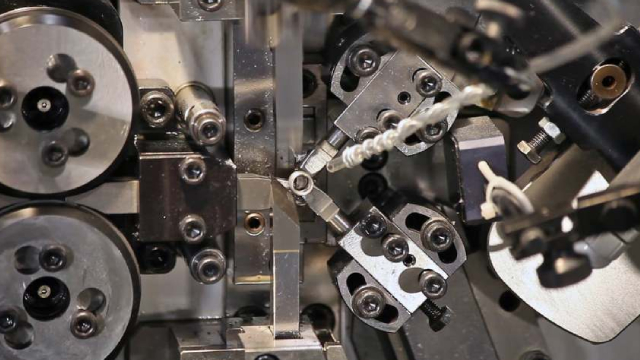

TDY Buys Some of Excelitas' Aerospace & Defense Electronics Assets

TDY completes the acquisition of some assets of Excelitas' aerospace and defense electronics business and further expands its product offering to customers.

Teledyne Technologies: Riding The Global Defense And Unmanned Systems Wave

Teledyne's strong 4Q24 results, with revenue and EPS beating estimates, reflect robust growth in digital imaging, instrumentation, and aerospace and defense electronics segments. I remain bullish on TDY due to its exposure to rising global defense spending, particularly in unmanned systems like the Black Hornet drones. The marine instrumentation segment shows significant growth potential, driven by offshore energy demand and subsea defense applications amid geopolitical tensions.

Teledyne Technologies Incorporated (TDY) Q4 2024 Earnings Call Transcript

Teledyne Technologies Incorporated (NYSE:TDY ) Q4 2024 Earnings Conference Call January 22, 2025 11:00 AM ET Company Participants Jason VanWees - Vice Chairman Robert Mehrabian - Executive Chairman Edwin Roks - Chief Executive Officer George Bobb - President and Chief Operating Officer Stephen Blackwood - Senior Vice President and Chief Financial Officer Conference Call Participants Noah Poponak - Goldman Sachs Greg Konrad - Jefferies Andrew Buscaglia - BNP Damian Karas - UBS Jordan Lyonnais - Bank of America James Ricchiuti - Needham & Company Joseph Giordano - TD Cowen Operator Welcome to Teledyne's Fourth Quarter Earnings Release Conference Call. Here's our first speaker, Mr.