Trimble Inc. (TRMB)

Here's Why Trimble Navigation (TRMB) is a Great Momentum Stock to Buy

Does Trimble Navigation (TRMB) have what it takes to be a top stock pick for momentum investors? Let's find out.

Trimble Q3 Earnings Beat: Can Raised FY24 Guidance Drive Shares?

Trimble's third-quarter 2024 results benefit from strong subscription and services revenues, backed by robust guidance for continued growth.

Trimble Inc. (TRMB) Q3 2024 Earnings Call Transcript

Trimble Inc. (NASDAQ:TRMB ) Q3 2024 Earnings Conference Call November 6, 2024 8:00 AM ET Company Participants Rob Painter - President & Chief Executive Officer Phil Sawarynski - Chief Financial Officer Conference Call Participants Kristen Owen - Oppenheimer Jerry Revich - Goldman Sachs Rob Wertheimer - Melius Research Jerry Revich - Goldman Sachs Jason Celino - KeyBanc Capital Markets Tami Zakaria - JPMorgan Clarke Jeffries - Piper Sandler Chad Dillard - Bernstein Arsenije Matovic - Wolfe Research Operator Thank you for standing by. My name is Novi [ph] and I will be your conference operator today.

Compared to Estimates, Trimble (TRMB) Q3 Earnings: A Look at Key Metrics

While the top- and bottom-line numbers for Trimble (TRMB) give a sense of how the business performed in the quarter ended September 2024, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

Software firm Trimble raises annual forecast again after Q3 beat

Trimble on Wednesday raised its full-year earnings forecast for the second time this year, after higher revenue from its subscriptions and software services helped the GPS navigation maker beat estimates for the third quarter.

Trimble Navigation (TRMB) Surpasses Q3 Earnings and Revenue Estimates

Trimble Navigation (TRMB) came out with quarterly earnings of $0.70 per share, beating the Zacks Consensus Estimate of $0.62 per share. This compares to earnings of $0.68 per share a year ago.

China Stimulus, DET Launch & Trimble JV News Boost CAT: Buy the Stock?

CAT stock gains due to China's stimulus measures and other company-related developments. We analyze whether it is a good time to invest in the stock.

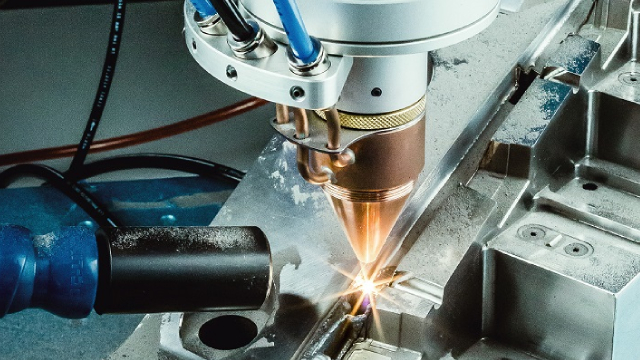

Can Trimble's Partnership With Caterpillar Push the Stock Higher?

TRMB and CAT extend their partnership to enhance grade control solutions and expand access for customers in the construction sector.

Trimble Up 6.2% YTD: Should You Buy, Hold or Sell the TRMB Stock?

TRMB benefits from an expanding clientele. However, sluggish North American transportation mobility business and adverse forex are a headwind.

Why Is Trimble (TRMB) Up 9.7% Since Last Earnings Report?

Trimble (TRMB) reported earnings 30 days ago. What's next for the stock?

Secret's Out: Buy This Hot Technology Stock Before Wall Street Catches On

This technology stock isn't the easiest to understand, but its solutions add real and growing value to its customers. Its headline numbers mask the company's strong underlying growth.

Trimble: Undervalued Amid Strong Q2 Results And FY25 Estimates

TRMB is undervalued due to multiple contractions; expected revenue and EPS growth in FY 2025 support a $68 12-month price target, implying a ~30% price growth. Trimble excels in technological innovation through AI and strategic acquisitions but faces competition from players like Tesla's Optimus in automation. Despite a 12% YoY revenue decline in Q2, TRMB's ARR rose by 12% YoY, indicating resilience and growth in recurring software services.