Taiwan Semiconductor Manufacturing Co. Ltd. ADR (TSM)

Bull of the Day: Taiwan Semi (TSM)

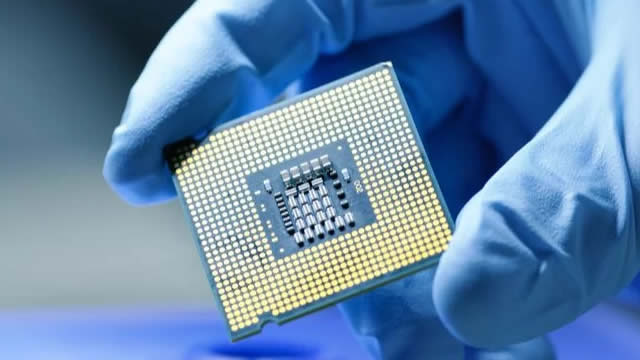

Taiwan Semiconductor ( TSM ) is the premier chip fabrication company for the world's most advanced digital technologies, from Apple smartphones to NVIDIA GPUs. In less than five years, TSMC's trailing 12-month revenue has more than doubled to hit $95 billion as of the March quarter.

TSMC's Dominance Is Intact, And The Valuation Still Works

Taiwan Semiconductor Manufacturing Company Limited remains a Buy as AI-driven demand accelerates, with Big Tech capex and sovereign AI investments supporting a bullish multi-year cycle. Tariff risks have faded, and 2026 growth visibility is improving, pushing out concerns of a semiconductor downcycle. Key risks include Taiwan's geopolitical tensions and currency headwinds.

TSMC (TSM) Registers a Bigger Fall Than the Market: Important Facts to Note

TSMC (TSM) reached $229.17 at the closing of the latest trading day, reflecting a -2.4% change compared to its last close.

TSMC to delay Japan chip plant and prioritize US to avoid tariffs: report

TSMC says its investment plans in the US would not impact existing investment plans in other regions

TSMC Is Making a Huge Investment in the U.S. Why That Could Be a Problem.

Taiwan Semiconductor Manufacturing could find it difficult to balance its commitments to the Trump administration and other national governments.

TSMC to Delay Japan Chip Plant and Prioritize U.S. to Avoid Trump Tariffs

The Taiwanese semiconductor maker is pouring funds more quickly into U.S. expansion.

TSM Stock Hits 52-Week High: Is It Time to Book Profits or Buy More?

Taiwan Semiconductor hits a 52-week high as AI chip demand surges, earnings soar, and valuation still leaves room for upside.

Why Taiwan Semiconductor (NYSE: TSM) Is Poised to Smash Earnings Expectations

Taiwan Semiconductor (NYSE: TSM) reported May revenue up 40% year-over-year, beating expectations despite macro concerns, pointing to continued AI-driven demand.

TSM: Why I Added To My Biggest Position

TSMC is poised to benefit significantly from the ongoing AI boom due to its dominant foundry market share. TSMC may be seen as lagging behind the broader AI market and be seen as undervalued from its low P/E and high CAGR. TSMC manufactures the world's most advanced chips, especially those smaller than 5nm, positioning it as a leader in the industry.

Taiwan Semi's AI Chip Revenue Will Soar for Years, Says Analyst

Needham's Charles Shi doesn't expect TSMC to have any real competition for several years.

Here is What to Know Beyond Why Taiwan Semiconductor Manufacturing Company Ltd. (TSM) is a Trending Stock

TSMC (TSM) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

All You Need to Know About TSMC (TSM) Rating Upgrade to Buy

TSMC (TSM) might move higher on growing optimism about its earnings prospects, which is reflected by its upgrade to a Zacks Rank #2 (Buy).